US Fed rules on foreign firms

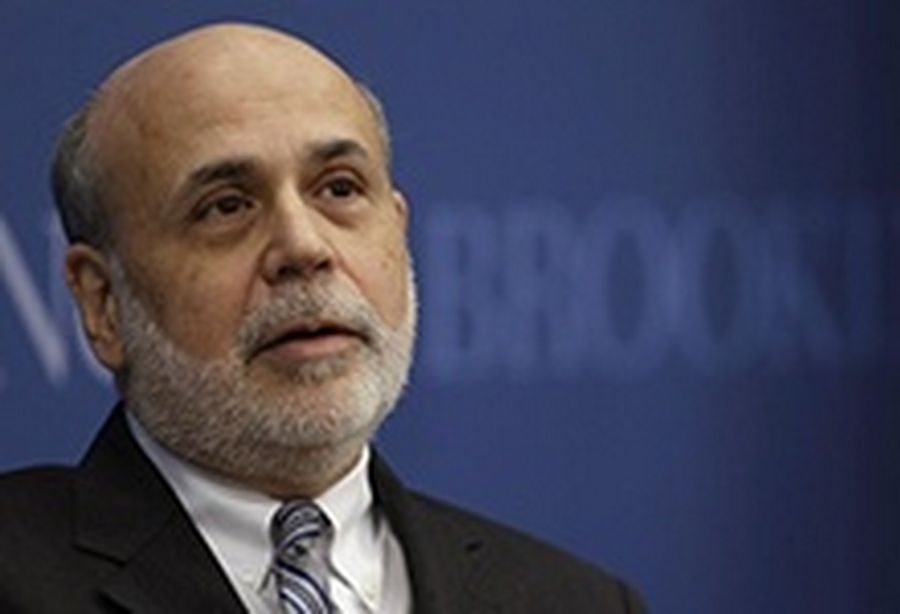

Source: REUTERS/Gary Cameron

Outgoing U.S. Federal Reserve Board Chairman Ben Bernanke participates in a discussion at the Brookings Institution in Washington.

The US Federal Reserve Board’s final rule on the regulation of foreign banks with operations in the US could affect the way Asia firms do business in the world’s largest economy.

The new Fed rules, published last Tuesday, cover the supervision and regulation of large US bank holding companies and foreign banking businesses. The requirements aim to ensure the financial health of the US divisions of foreign banking enterprises meets US standards, rather than the many other rules in place in the international banking market.

The rules could affect plans Asian firms may have had to expand in the US, although initially the rules are likely to affect the larger European firms most.

Foreign banks that have US non-branch assets of US$50bn or more have to create an intermediate holding company for their US subsidiaries. Those holding companies will have roughly the same risk and leverage limits as holding companies of US-headquartered firms. The Fed will also require them to provide capital plans and to undergo stress tests.

Overseas firms with assets of US$50bn or more will also have to have a US risk committee and US chief risk officer to ensure compliance, the Fed said.

Foreign banking organisations with consolidated assets of more than US$10bn will have to meet certain “stress testing requirements”, the Fed said in a release. Foreign banks have until July 1 2016 to comply with the rules, a year later than the central bank had initially proposed. US banks need to comply by January 1 2015.

Japanese, Australian and Chinese banks have the largest exposure to the US market, based on US office assets, according to the Fed’s quarterly report of foreign banking. Japanese banks have US$569bn, led by Bank of Tokyo-Mitsubishi UFJ’s US$239bn, as of June 30, the most recent report.

Australian banks have US assets totalling US$96bn, led by National Australia Bank with US$35bn. Chinese banks control US$52bn of assets in the US. Bank of China, with the largest PRC exposure, has US assets of US$28bn.

Still, the US exposure of firms from Asia-Pacific (excluding Japan) is generally smaller than European exposure. Deutsche Bank, for example, has US$206bn.

Meanwhile, ICBC, the world’s largest bank, has nearly US$8bn. ICBC, like other Chinese firms, have been slowly increasing its exposure to the US market. The lenders bought an 80% stake in Bank of East Asia’s US business in 2012.