Asian bond issues surpassed all expectations in 2014, but it was the secondary markets that offered the best indication of the stresses that are lurking on the horizon.

Unexpected harvest

It was supposed to be the year in which the long-awaited reversal of US Treasury yields forced a rethink on bond investors and cooled the breakneck growth of Asia’s G3 bond markets. As we now know, that didn’t happen, and 2014 instead turned out to be yet another showstopper for Asia’s new issue market.

No, 2014 produced more of the same in Asia G3 – only much more so, with annual volume records again exceeding even the wildest dreams of a sell-side debt banker.

All the boxes were ticked in primary: sovereign, investment grade, high-yield, financials, the whole spectrum of regulatory capital, and all with the frisson bankers love to get breathless about. Debut issuers were there, and so was size and complexity.

But, putting breathlessness aside, it was the secondary Asian market which provided the real excitement in 2014. Tellingly, for those who see the Asian offshore debt market as a hugely inflated bubble, the region’s high-yield sector experienced a mini meltdown in August where prices in some counters including the Republic of Indonesia fell by as much as four cash points.

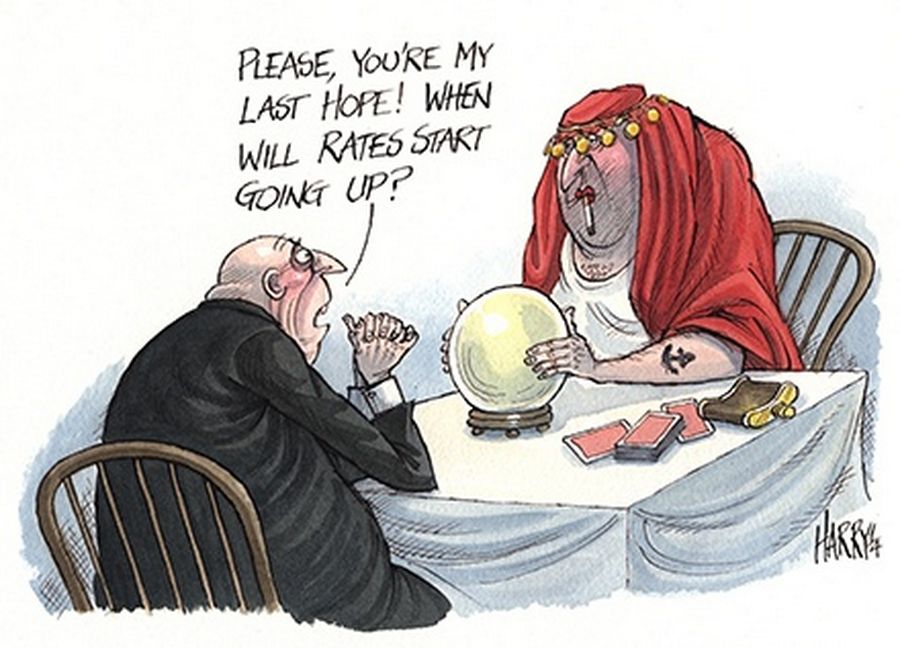

Was that correction a warning, perhaps, of further meltdowns as the Fed’s rate normalisation triggers an even greater unwind? Only time will tell.

If there was anything that stood out in Asia’s primary markets, it was the FIG onslaught from China, together with a showstopping jumbo from China tech giant Alibaba.

Issuance in Asia, excluding Japan and Australasia, came in at US$192.6bn for the IFR review period, an increase of 33% over the US$144.9bn which printed over the same period in 2013. In the more conventional calendar, the US$200bn landmark would be a distant memory by the end of the year.

The markets managed to avoid a rerun of May 2013’s “taper tantrum” when the withdrawal of the Federal Reserve’s stimulus was first mooted and the actual event went off with barely a ripple.

Still, in certain quarters the sharp reversal in Treasury yields in October might be regarded as ominous – at least among those who, like myself, are expecting a secular reversal of the 30 year-odd Treasury bull market.

“There have been some discrete elements in various Asia countries that have helped drive issuance, most obviously in India and Indonesia with the election of Modi and Jokowi.”

“I think everyone has been surprised by the path interest rates took in 2014 and you would have to say that at the beginning of the year the market consensus for long term rates was off the mark. Certainly I don’t think many players expected the 10-year Treasury to end up at 2.3%,” said Herman Van Den Wall Bake, head of debt capital markets for Asia Pacific at Deutsche Bank in Singapore.

“And Asian primary wildly exceeded expectations. Most of us thought that 2014 would equal or slightly better last year’s print, but again I don’t think anyone expected it would exceed by such a high margin, of more than 30%.”

New catalysts

There were some specific elements in Asia which powered the new issue accelerator in 2014. New leaders in India and Indonesia in the shape of Prime Minister Narendra Modi and President Joko “Jokowi” Widodo, and tight liquidity onshore in China, have pushed more issuers from those countries offshore.

“There have been some discrete elements in various Asia countries that have helped drive issuance, most obviously in India and Indonesia with the election of Modi and Jokowi,” said Deutsche’s Bake. “That has convinced the market that the drag on efficiency of bureaucracy will be cut, and that infrastructure will become the core focus. It has created a strong tailwind for issuance.”

The issuance effect in India was especially pronounced following Modi’s May election victory. A signal effort was the opening up of the India high-yield space, thanks to a reduction in withholding tax for Indian issuers bringing offshore deals from 20% to 5%. High-yield deals were brought in October for Indiabulls and JSW Steel with an India high-yield pipeline said to be building steadily.

It might just be that this long-awaited opening up of India high-yield is the “jewel in the crown” of the Modi victory, but I remain sceptical of the asset class, mainly because the capricious nature of India’s regulatory and judicial system casts a dark shadow, despite the hype that offshore paper will rank pari passu with local debt, and the decent yields on offer.

Clarification in Indonesia last August that Jokowi had won the election in the face of a legal challenge provoked a US$2.3bn print in September and according to Asia-based DCM bankers, the Indonesia pipeline is full.

Sentiment is gaining traction from a variety of economic reforms proposed by Jokowi, with the most recent – a hike in fuel prices as the country’s fuel subsidy is gradually removed – getting pushed through with the minimum of opposition. You would have to hope that Jokowi’s election might provide a level playing field if you find yourself caught up in yet another Indonesian debt restructuring, but somehow I doubt it.

As has been the case in recent years, China has dominated the public G3 primary markets, with US$54bn-equivalent having printed in 2014 off 72 issues, versus a US$39.2bn tally for the same period last year. Of this total, however, a relatively modest US$7.3bn has emerged from the property sector, down from US$11.7bn for the same period last year, and the shine has faded from many of the debt-laden developers.

This was hardly surprising given the cooling seen in China’s property market last year and the general sense that there is now investor fatigue towards a sector that has generated more high-yield issuance than any other in Asia primary since the financial crisis. The China FIG space, however, more than took up the slack, producing an eye-watering US$26bn of deals.

China issuance led the market’s show-stoppers in 2014. E-commerce giant Alibaba produced in late November a US$8bn jumbo which represented the biggest offshore bond from any Asian company, and perhaps more significantly, at tighter pricing than global technology peers such as Oracle, Amazon and eBay.

The six-tranche deal pulled in US$55bn of mainly high-quality orders and cemented Asia’s growing status in the global bond markets, representing as it did one of the biggest high-grade deals to emerge anywhere in 2014, and one that, all things considered, priced without an iota of Asia risk premium. China issuance generally emerges at a 20bp–50bp premium to like-sector US names, not through the curve, as was achieved by Alibaba.

Capital ideas

Meanwhile, Bank of China in October blew the doors off with a bank capital debut.

The US$6.5bn Additional Tier 1 deal represented the world’s biggest preference share exercise and went out to just 120 investors in Reg S format. Moreover, the trade featured a somewhat challenging point of non-viability clause such that the entire paper will convert from US dollar-settled debt into renminbi equity should the bank be deemed by the authorities to be financially unsound. A Tier 2 deal from BOC in November then showed that broader distribution was indeed possible.

“There’s a massive Basel III capital need for China’s banks and you have to applaud the results of the initial fundraisings in compliant format in 2014,” said a Hong Kong-based asset manager.

Despite the BOC and Alibaba standout trades, observers are mindful of China’s alarming ratio of non-financial corporate debt to GDP – it stands at around 150%, versus 100% seven years ago. With economic growth slowing, investors may well become increasingly wary of embracing offshore debt issuance from the country.

This has become a familiar refrain since the financial crisis, but with China showing the most palpable signs of a slowdown – third-quarter growth of 7.3% was the lowest for five years – debt service strains look to me a certainty.

The hybrid format gained more traction in 2014, as low absolute yields made issuance attractive. Thailand’s PTT Exploration and Production managed to price a US$1bn corporate hybrid just three weeks after the government of Yingluck Shinawatra was ousted in a military coup.

Will 2015 be yet another record breaker for Asia primary debt, and is it really “different this time?” It might be that the region has found a debt printing press that would be the envy of Croesus himself, but October’s stunning rebound in the US 10-year Treasury – from 2% to 2.3% inside a month – might very well be the harbinger of a longer-term trend.

As always, only time will tell. But it’s difficult to conceive another gangbusters year for new issues should there be a bearish Treasury backdrop, however decent the credit conditions in Asia might be.

To see the digital version of this report, please click here.