Asia’s local currency debt markets are vulnerable to local factors and global fund flows, but the Thai baht market’s resilience after a military coup gives reason for optimism elsewhere.

Strength in adversity

Source: REUTERS/Chaiwat Subprasom

A woman holds an umbrella as she walks during heavy rain in Bangkok.

After the tapering scare in Asia last summer, it had looked like the region’s local currency bond markets were in for a difficult 2014. However, rates have yet to move higher in developed economies, and Asian issuers have continued to take advantage of attractive local funding costs to deepen the domestic markets.

The resilience of Asia’s economies and markets – most remarkably in the face of a military coup in Thailand – has amazed many. Although at various stages of growth, Asia’s local debt markets have become sustainable financing alternatives for the region’s borrowers.

“While local currency markets are smaller, they have shown themselves, at times, to be insulated from external shocks in the global financial markets,” said Tan Kee Phong, OCBC’s head of capital markets. “Asian economies, generally, have high national savings rates – in excess of 30% – and that provides a huge investable pool for the local currency markets.”

Asia’s markets have been attractive this year because smart policy making in countries like India and Indonesia has helped restore investors’ confidence in the outlooks for their economies. Both countries took aggressive action to rein in inflation and introduce fiscal reforms after severe drops in their currencies last year.

In fact, since the Asian Financial Crisis of the late 1990s many of Asia’s economies have strengthened, allowing them to deepen their respective local currency bond markets and reduce the region’s reliance on offshore debt.

Nonetheless, at the beginning of the year there were concerns that the markets would grind to a halt. The worry was that, not only would investors flee to equities and developed-market debt, the supply of new issues would dry up. Many corporations already refinanced debt over the last two years to lock in low rates before US yields return to normal.

Money flowed into developed market equity funds and out of US and emerging-market bond funds in early January, according to EPFR Global, which tracks global fund flows.

But as the timetable for rate hikes was extended and US Treasury yields had retreated, many investors returned, bringing down Asian bond yields and bringing borrowers back to the market.

Meanwhile, Asian equity markets became rocky due to headlines of China’s wobbling economy, making it challenging for funds to gain steady returns. In April, overseas investors returned to Asian bonds. EPFR data posted eight consecutive weeks of gains in EM bond funds as of late May.

More local bonds

With rates lower, corporations in Singapore, Malaysia, the Philippines and Thailand picked up the pace of local bond issuances.

The Asian Development Bank’s June 2014 Asian Bond Monitor report shows the total of outstanding local currency bonds in the region rose to US$7.6trn for the quarter ending in March, up 2.1% from the same period last year. The corporate bond market in Asia grew to US$3.1trn, up 1.9% on a quarterly basis and 11.7% on a yearly basis.

The Philippine peso market has been one of the region’s busiest, with companies having sold Ps123.5bn (US$2.8bn) so far this year, up sharply from only Ps14.5bn in the same period last year, according to Thomson Reuters data.

Major corporate issuers were out in force in the past few months, trying to beat expected hikes in benchmark interest rates later this year. The Bangko Sentral ng Pilipinas has already started to tighten monetary policy.

Strength in adversity_Chart

Philippines conglomerate JG Summit Holdings sold the largest issue of the year so far with a jumbo Ps30bn three-tranche bond in February. Other large conglomerates, such as San Miguel Brewery and SM Investments Corp, tapped the market with issues of Ps15bn each in March and April, respectively.

Another significant development this year has been the emergence of more Philippine lenders to raise Basel III-compliant Tier 2 bank capital as both institutional and retail investors proved willing to bear the additional risks inherent in the new-style, loss-absorbing bonds.

Indeed, Basel III bank capital has become the focus throughout Asia’s local bond markets. Islamic banks, for instance, have been on a funding spree in Malaysia in recent months, in tandem with their conventional counterparts, to raise Basel III capital. Maybank Islamic Bank sold a 4.75% M$1.5bn (US$460m) Basel III-compliant Tier 2 bond in April.

Thai surprise

In Thailand, banks were worried that there would not be enough demand for Basel III bank capital issues as the country’s Securities and Exchange Commission had banned retail investors from buying them. Typically, retail investors account for as much as half of the investor base for Thai bonds.

Nevertheless, Thanachart Bank easily sold Thailand’s first baht-denominated Basel III Tier 2 bond in June. Institutional and high-net-worth investors subscribed to more than twice the size of the offering, prompting Thanachart to increase the size to Bt13bn from Bt10bn. The performance is likely to pave the way for other Thai banks to sell the new-style bonds locally instead of in the US dollar markets, which they had been exploring.

Getting the Thanachart Tier 2 issue across the line was significant. It proved investors could accept political and regulatory risks.

Indeed, the most surprising story out of Asia’s bond markets may be that of Thailand, which has been under military rule since late May after months of street protests and political unrest. Despite the turmoil, the baht debt market has actually grown this year, with corporate bond sales amounting to Bt247.2bn (US$7.2bn) year to date, up from Bt234bn in the same period in 2013.

Global investors have even snapped up the riskiest types of bonds, including PTT Exploration and Production’s US$1bn non-dated hybrid, sold in early June.

Thailand has endured eight years of political turmoil since former prime minister Thaksin Shinawatra fled the country after being ousted in a 2006 military coup. Over the years, the business and financial communities have built a tolerance for Thailand’s political instability.

“It is the Thai way,” said a local debt syndicate banker, a refrain echoed across the banking sector a day after the military junta took over the government. Many investors view the military’s move as necessary and are optimistic about the outcome.

“We expect them eventually to set up an effective government that will be acceptable to all and help push the economy forward, and that will benefit the bond market,” said a Thai mutual fund investor.

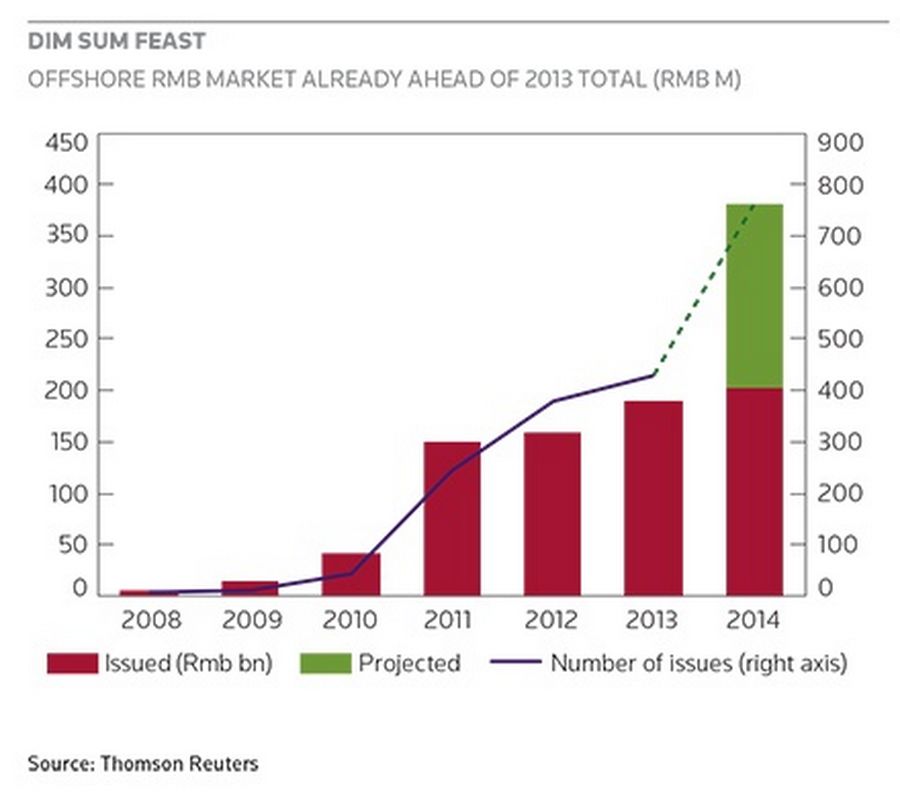

Dim Sum matures

The brightest spot is the offshore renminbi market, which has grown more than 10-fold in the last four years on the back of an expanding array of issuers and investors.

Issuance in the market soared to more than Rmb400bn (US$64bn) in 2013 from about Rmb40bn in 2010, with already more than Rmb400bn printed as of May 28 this year, according to Thomson Reuters. Many market participants are beginning to view the maturing market as a potential regional alternative to the Eurobond market.

“The renminbi is an increasingly relevant currency and this forms the basis for the huge demand for offshore renminbi bonds,” said Clifford Lee, head of fixed income, treasury and markets at DBS Bank in Singapore.

For instance, the market has lured issuers like China Construction Bank Asia, which printed the largest Dim Sum paper from a non-sovereign issuer in March with a Rmb4bn two-year Reg S senior bond.

The Singapore dollar market also has been a popular choice for foreign issuers. This year alone, a dozen foreign companies tapped the market for close to S$3.2bn, including China’s Ping An Insurance, which raised S$370m (US$292m) through a 4.125% 5.5-year senior bond in March.

“The renminbi and the Sing dollar markets are open with minimal regulatory barriers and no withholding taxes for issuers to deal with and, as a result, they have become more relevant,” said Lee at DBS. “When we take clients to look at funding options, we are increasingly asked to quote pricing in US dollars, renminbi and Sing dollars.”

“Issuers can compare and see which post-swap pricing is cheaper. The Asian markets have become a large area of options for issuers,” he said.

“The renminbi and the Sing dollar markets are open with minimal regulatory barriers and no withholding taxes for issuers to deal with and, as a result, they have become more relevant. When we take clients to look at funding options, we are increasingly asked to quote pricing in US dollars, renminbi and Sing dollars.”

Elsewhere in Asia, bank capital and government-guaranteed deals this year have dominated Malaysia’s ringgit bond market, boosting volumes to M$37.1bn (US$11.5bn) so far this year from M$20bn in the same period in 2013.

However, activities have been more subdued in India and Indonesia, with general elections in both countries. Only Rs680bn (US$11.3bn) was issued in India, half the volume of the previous year, while Indonesia’s local issuance tumbled to Rp16trn (US$1.35bn) this year from Rp22.8trn in the same period in 2013.

While many of Asia’s local currency markets are maturing, there are plenty of risks ahead. Another crisis in emerging markets, as seen when money fled in the third quarter of last year, has the potential to spread rapidly throughout the region.

Thiam Hee Ng, senior economist at the ADB, notes that inflationary pressures are taking root in some regional economies, which always worry bond investors, who do not like the values of their investments to erode. The rising yields that accompany inflation also may discourage issuers from coming to market.

At the same time, more Asian companies are looking to the US dollar markets, where a deeper investor base allows them to sell larger issues at lower rates. That trend makes their home countries more vulnerable should currencies begin to depreciate.

Asia’s local markets also are sensitive to news from the US and China. The Chinese Government has so far been able to stem a worrying economic slowdown to a moderate pace, but there is still a risk that rebalancing will cause large declines in certain sectors, particularly property and heavy industry.

While Asian markets have priced in the US Fed’s tapering moves, a rise in short-term rates could spark another round of market turmoil. Local markets have withstood the vagaries of foreign fund outflows and tapering moves so far, but investors know they cannot afford to ignore external factors.

To see the digital version of this report, please click here.