Kazakhstan and the other Central Asian Republics play a key role in connecting East and West, and promoting regional development. In the aftermath of a severe banking crisis, however, investors still need some convincing.

Astana 2014

Source: REUTERS/Shamil Zhumatov

Participants practice Tai Chi during the FourE open air festival outside Almaty.

Kazakhstan, the host of this year’s Asian Development Bank annual meeting, acts as a giant land bridge between China and the Middle East. The world’s ninth-largest country is an integral part of the Central Asian Regional Economic Cooperation, or CAREC, and the site of several important transport projects aimed at improving regional connectivity.

The Kazakh Government wants to increase its international profile, having led CAREC in 2013, and to diversify its economy beyond oil. However, the nation faces numerous challenges, including a banking sector with a non-performing loan ratio of 32%.

“Kazakhstan is focusing on diversification away from the oil sector to the industrial sector, to higher value-added trade and knowledge services,” said Klaus Gerhauesser, director general of the ADB’s Central and West Asia operations. “It is also part of the customs union with Russia and Belarus, and there are some issues in expanding that union.”

Most custom duties and economic restrictions are lifted between countries in the union, which also share a common customs tariff.

The ADB expects the Kazakh economy to expand 6.0% in 2014, matching last year’s growth rate, according to the latest Asian Development Outlook report. The bank warned, however, that reversing massive losses in the banking sector was a key policy challenge, since risk-averse lenders had hindered investment.

“The financial sector ran into difficulty in the 2008 crisis,” said Gerhaeusser. “The problem was they borrowed in foreign currency – everybody lent to them. Interest rates domestically were higher, so that encouraged a currency mismatch and led to a real estate and credit bubble. When things turned sour, a number of banks needed to be restructured.”

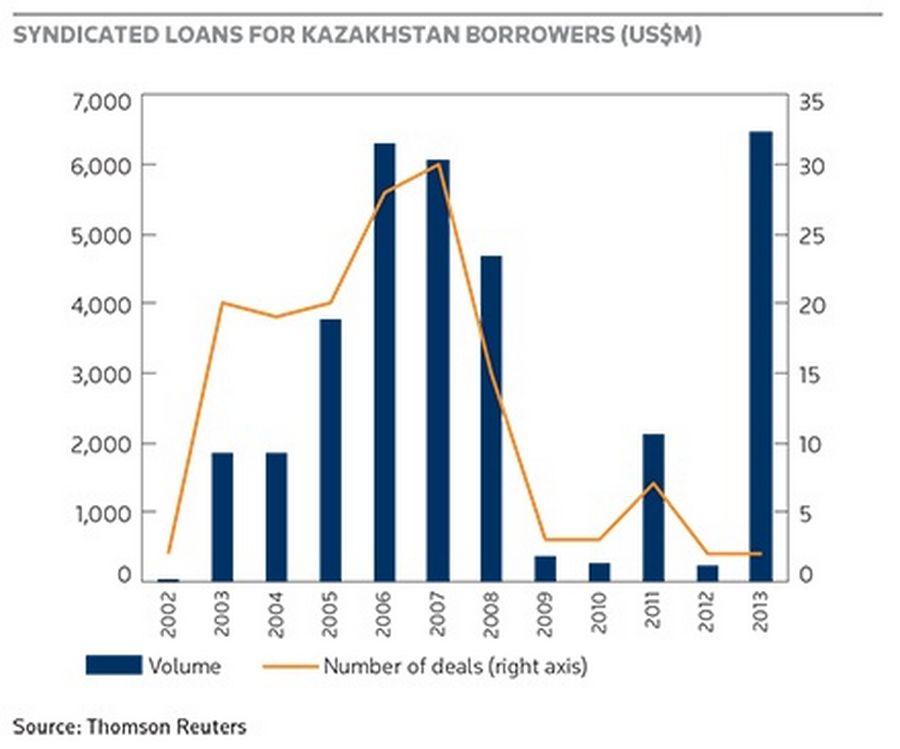

Syndicated loans for Kazakhstan borrowers

Non-performing loans made up 32% of gross lending in 2012, the worst ratio in the world, according to the World Bank’s financial stability report. The alarming number is the result of the 2008-09 crisis as asset prices collapsed and the government was forced to nationalise Alliance Bank, Temirbank and BTA Bank.

The restructuring that ensued has yet to be fully completed. BTA, the country’s biggest overseas borrower before the crisis, has already been through two rounds of debt restructuring, but remains stressed, with bad debts accounting for almost half of the national total. Still, progress is being made.

“NPLs are still very high, but the financial sector is doing much better overall,” said Gerhauesser. “The sector went through some major reforms, and credit to the private sector is growing again, especially from some of the smaller banks.”

If a recovery is gaining pace in the local credit markets, however, the impact has yet to filter through to international lenders.

While there was a significant rebound last year in international syndicated lending to Kazakhstan, only two loans closed – both for jumbo energy-related financings: the US$1.8bn Beineu-Shymkent Gas and US$4.7bn Asia Gas Pipeline projects.

In other sectors, there is a clear need for multilateral support.

ADB has provided almost US$4bn of financing to Kazakhstan since 1994, with projects concentrated in the transport sector. The bank now intends to support the government’s diversification push under a five-year plan sealed in 2012, providing knowledge and technical expertise, alongside financing.

“We are involved in several studies on specific topics and sectors that can be beneficial to Kazakhstan, and can be shared with the rest of CAREC,” said Gerhauesser.

A particular focus for the region are policies to open up new trade corridors, such as a major knowledge-sharing initiative focused on preparing CAREC nations for accession to the WTO, with support from the ADB, the IMF and other multilateral development banks.

CAREC nations agreed to expand the Transport and Trade Facilitation Programme last year to include Pakistan and Turkmenistan, potentially allowing a big improvement in trade and energy flows by giving easier access to important ports, such as Gwadar in Pakistan – where China is providing most of the funding for a major construction project.

Risks, however, remain significant.

China accounts for 16% of all CAREC exports and has been the major driver of export growth in recent years, especially following the construction of oil and gas pipelines connecting Kazakhstan and Western China. A slowing Chinese economy presents challenges for Kazakhstan and the region.

Years after the dismantling of the Soviet Union, Russia remains critical to many of the Central Asian economies. For instance, remittances from Russia account for about 40% of GDP in Tajikistan and the region will be watching closely for any sign of worsening political tensions following the Russian annexation of Crimea and US sanctions on certain Russian individuals and institutions.

“Any disruption to consumption demand would have a significant impact,” said Gerhauesser, pointing specifically to trade flows with Kyrgyz, Tajikistan and Armenia. “The regional customs union means the effects are spread beyond Russia.”

Capital flows out of Russia are also a threat to countries that compete with Russia for exports, such as Kazakhstan and Belarus. The ruble makes up 10% of the currency basket in Kazakhstan – alongside the US dollar (70%) and the euro – and the depreciation of the Russian currency since the start of 2014 has already triggered a policy response. The National Bank of Kazakhstan devalued the Kazakh tenge by 16% in February to boost competition for exports.

Given Kazakhstan’s strategic importance in feeding Asia’s energy needs, any hint of further disruption has to be taken seriously.

To see the digital version of this report, please click here.