With bonds of more than US$120bn due to mature this year, refinancing pressure is likely to ensure another busy year for Asian issuers in the international markets.

Driver of growth

Source: REUTERS

Employees work inside a milk factory in Beijing.

Offshore issuance of dollar- and euro-denominated bonds from Asia ex-Japan is set for another banner year, with most shops predicting that the standing mark of US$120bn will be breached yet again. If that does happen, it will be the third straight year that Asian issuers have raised more than US$100bn in the international bond markets.

That is no small feat for a market, which, until 2010, had never breached US$80bn, but bankers in the region believe the surge in offshore issuance has given Asia the critical mass to guarantee that activity will remain strong.

Bankers estimate about US$120bn in bonds will be called or refinanced this year in the Asia Pacific region, with Asia ex-Japan and Australia as the origin of at least US$80bn of the total. Even if new issues only replace maturing bonds, it will be an active year.

“With a backdrop of over US$120bn of Asia-Pacific bond redemptions in 2014, we expect another strong year for bond issuance, with the potential to exceed last year’s volume,” said Duncan Phillips, head of debt syndicate for Asia at Citigroup.

Add to that the almost US$25bn that has already been issued so far this year, and the US$120bn target both Credit Agricole-CIB and Deutsche Bank have predicted for 2014 looks easy to achieve.

In their outlook for the year, published in early January, Deutsche Bank credit analysts forecast 2014 supply to be slightly lower than 2013’s US$133bn. The analysts noted, though, that redemptions this year would be materially higher than 2013, implying that net issuance in 2014 could be much lower.

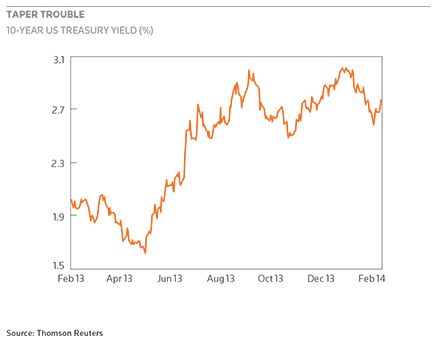

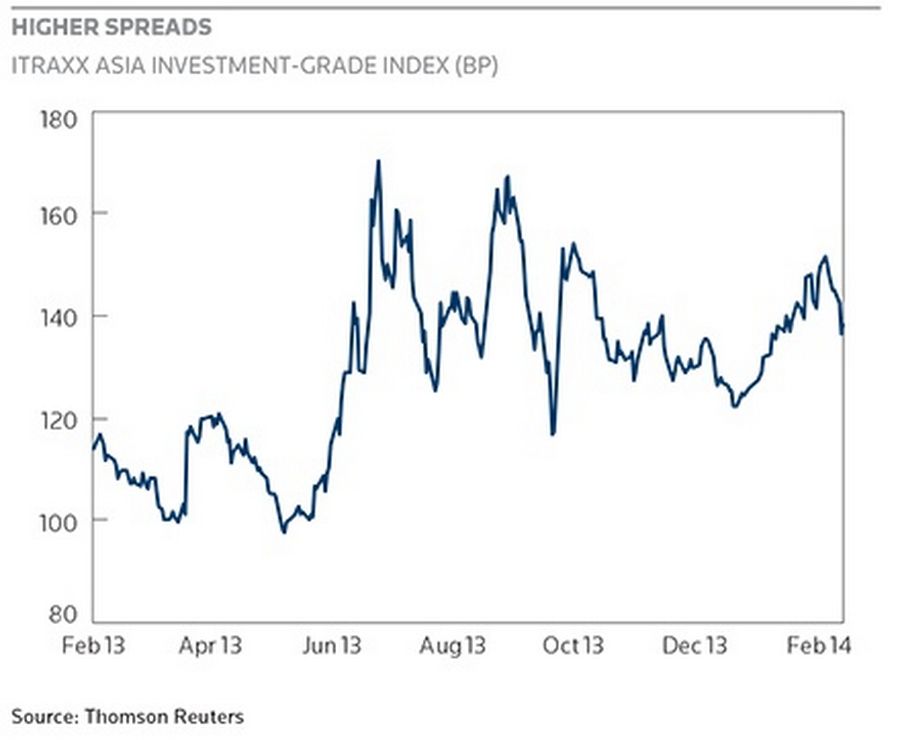

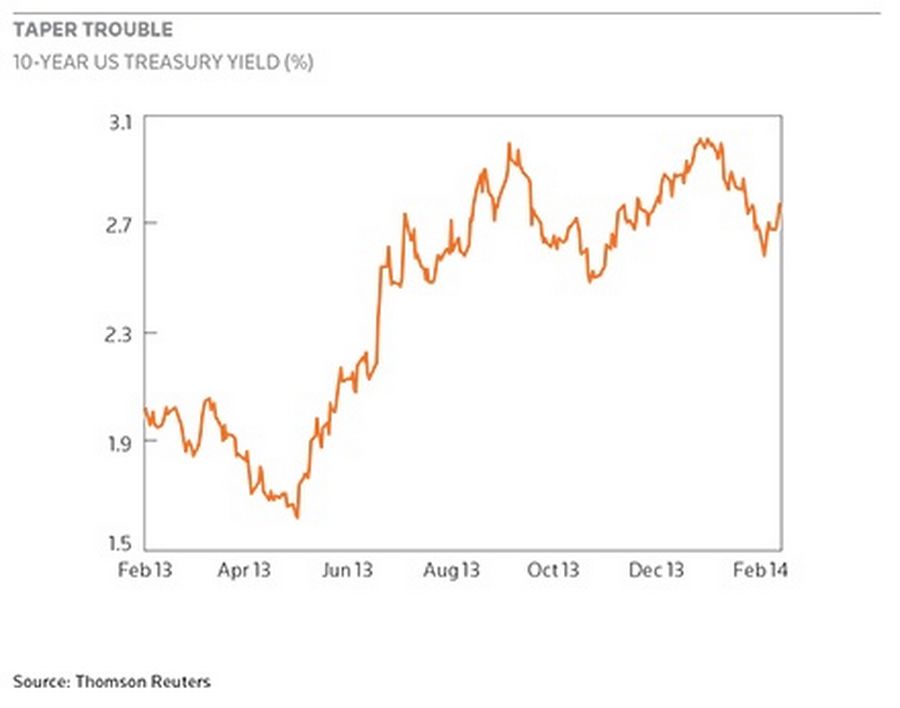

The lower net issuance may be a positive in a year when rising rates are expected to add volatility to the asset class. Citigroup analysts estimated that the yield on the 10-year US Treasury could end the year at 3.6%, 60bp up from the end of 2013 and 180bp higher than the end of 2012.

The higher rates will be challenging to issuers and they may have to pay up to refinance, but will be attractive to fund managers who will be drawn to reinvesting the proceeds of redemptions into new bonds in the region.

Diversifying the menu

One sign of Asia’s development as a key destination for some of the world’s most important funding portfolios is the broader diversification in issuance that bankers and analysts are projecting for this year.

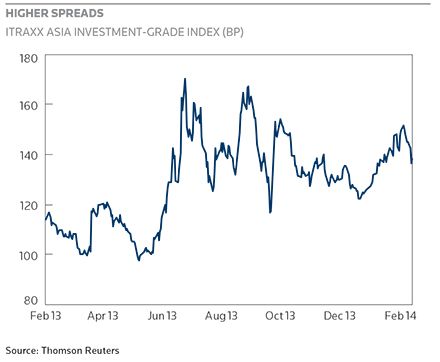

Higher spreads

Sovereign issuance, for instance, is expected to rise, largely because governments need to refinance large dollar redemptions. Before the global financial crisis, sovereigns and financial institutions were responsible for the vast majority of overseas bonds out of the region.

However, their contribution to overall volume has dropped significantly in the past few years. Analysts and bankers expect volume from sovereign states will return closer to the norm this year, with sovereign offshore debt nearly doubling from 2013. Only the Republic of Indonesia and the Republic of Korea put out bonds last year after issuing totals of US$9.2bn in 2012 and US$8.3bn in 2011.

“We expect up to US$8bn–$12bn of sovereign issuance in 2014, up from US$6.5bn this year,” said Avanti Save, Asia sovereign credit analyst at Barclays, who expected most of that total to come at the beginning of the year.

Analysts at Deutsche Bank, meanwhile, also estimated that sovereign issuance might reach US$13bn this year.

Those predictions found early confirmation in January deals from the Republic of the Philippines, the Republic of Indonesia and the Democratic Republic of Sri Lanka, which together sold US$6.5bn, or half the total sovereign bonds that most sell-side shops had estimated for the year as of December.

Taper trouble

“The increase in issuance partly stems from the need to finance upcoming maturities and fiscal or current-account financing needs, but the inclination to avoid supply pressures in local markets also plays a part,” Save said.

Bankers expected the Kingdom of Thailand to be among those that turned to the overseas market in 2014, although recent political turmoil in the nation had put those plans on hold.

Still, there are plenty of candidates to make up for that absence. Among them are the Socialist Republic of Vietnam and Korea, which priced a 10-year sovereign issue last year, marking its return to the dollar bond market after four years. This time, though, bankers expect Korea to return as early as in the first quarter.

“There will be a good mix of repeat issuers and new credits, and we may find a continued focus on bank capital and liability management projects.”

“Korea has a US$1.5bn maturity in April. So, it makes sense for them to refinance that in the market,” said a Hong Kong-based origination banker. “They should either do a new 10-year or create a full curve by printing a 30-year, which would be a blockbuster.”

Bangladesh has expressed interest in selling bonds in the international market to fund infrastructure projects, but no deal is imminent. The Islamic Republic of Pakistan also issued a request for proposals in October and has appointed advisers on a US dollar offering.

Another batch of bonds could come from banks. Deutsche Bank predicted bank bond issuance would increase 10% this year versus the roughly US$20bn printed last year in the region.

“There will be a good mix of repeat issuers and new credits, and we may find a continued focus on bank capital and liability management projects,” said Phillips at Citigroup.

Mergers and acquisitions are also gathering pace, particularly as Chinese companies look to make their mark overseas, and the resulting financing requirements should also add some momentum.

“Transformational M&A activity by local corporate champions may also help drive the need for bond financing,” Phillips said.

China domination

In terms of geographical origin, bankers expect Chinese issuers to continue to lead the primary market. Perhaps, the most important driver for the foreign issuance is the tight liquidity that Chinese banks have experienced onshore this year.

Higher money market rates, which reached 30% at one point last year, increased onshore funding costs for Chinese banks. The yield on five-year government debt is about 4.28%, a significant spread over US yields.

Banks are also looking at China to boost issuance in the euro-denominated market. After several state-owned blue chips in the country tapped the European asset pool last year, bankers expect even more this year.

Spurring issuance will be Asian corporations looking to finance acquisitions in the eurozone, as well as a favourable basis swap that makes repatriating the funds more cost-effective, according to Benjamin Lamberg, head of Asian syndicate at Credit Agricole-CIB.

Also, European investors like the diversification benefits they get from investing in Asian credits denominated in euros, according to Lamberg.

“Now that Chinese and Asian issuers have beefed up their euro issuance, this will definitely be an area of growth for the Asian primary pipeline,” he said.

To see the digital version of this report, please click here.