Australian dollar funding has caught up to 2015 levels after a jump in issuance from banks and local governments, while Kangaroos and securitizations have contracted.

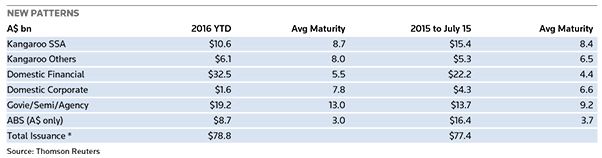

After a slow start to 2016 the Australian dollar primary market has recovered to such an extent that issuance has now overtaken year-ago levels with A$79bn (US$59bn) raised up to July 15 versus the A$77.5bn total in the same period of 2015.

But while overall totals are similar there have been substantial shifts among asset classes with domestic financial and Commonwealth/state government supply soaring while the sovereign, supranational and agency Kangaroo, domestic corporate and securitisation sectors have all declined.

Domestic banks have dominated supply Down Under even more so than normal, printing A$32.5bn for a 41.3% market share, well up on their A$12.2bn and 28.7% share a year earlier.

Commonwealth government and state government supply has expanded to A$19.2bn from A$13.7bn while non-SSA Kangaroos have increased to A$6.1bn from A$5.3bn, boosted by the A$2.45bn raised by global corporate giants Apple and Coca-Cola.

The success of these jumbo corporate Kangaroos was assisted by a slump in domestic corporate financings to A$1.6bn from A$4.3bn, as competitive domestic bank lending levels and deep offshore markets lured borrowers elsewhere.

Securitisations have almost halved to A$8.7bn from A$16.4bn a year ago with fewer and smaller deals printed, largely a reflection of elevated margins which made it uneconomic for regional lenders and other smaller institutions to tap the RMBS market.

NEW PATTERNS

Waning interest from bank treasuries has also weighed on RMBS as it has on SSA Kangaroos, where issuance has dropped to A$10.6bn from A$15.4bn.

The Reserve Bank of Australia and Australian Prudential Regulatory Authorities have steered banks towards holding a smaller committed liquidity facility, required to meet the shortfall in high-quality liquid assets, which banks must hold to meet short-term liquidity coverage ratios under Basel III regulations.

Last December, Assistant RBA Governor Guy Debelle said the overall size of the 2016 CLF, made up of less liquid assets including Triple A rated SSA Kangaroos and ABS would decline from A$275bn to A$245bn due to increased government supply and lower projected net cash.

Reduced Asian and Japanese demand has also been cited to explain the decline in SSA Kangaroos sales, thanks to a shift in focus towards US assets with Treasuries becoming a preferred port of call ever since the Fed began to first discuss, and then deliver, rate rises.

The RBA meanwhile is continuing with its easing cycle with May’s 25bp cut in the official cash rate to a record low of 1.75% expected to be followed by one or more quarter point reductions by year end.

However, Sydney syndicate managers report steady non-Japan Asian demand alongside increased interest from Japanese investors attracted by the yield pick-up as well as the Australian dollar’s slide against the Japanese yen, which has created an attractive entry level for Australian investments.

Yields on 10-year Australian Commonwealth government bonds hit several record lows in July 2016 and were quoted down at 1.93% on July 21, but this still represents the highest yields available from the exclusive club of 10 countries currently rated AAA by the three main agencies.

Despite their different monetary cycles 10-year ACGB yields still return 35bp more in absolute terms than the 1.58% on US Treasuries.

Ten-year Canadian, UK and German yields were quoted at 1.12%, 0.83% and minus 0.1% on July 21 while among Asian peers, Singapore, Hong Kong and Japanese 10-year government yields were seen at 0.86%, 1.04% and minus 0.23%, respectively.

Australia’s Triple A sovereign ratings are at risk after a closely fought federal election on July 2 failed to produce a commanding majority for the ruling coalition.

Standard & Poor’s promptly lowered the country’s AAA rating outlook to negative from stable, citing reduced expectations of fiscal reforms. The negative outlook means there is a one-in-three chance of a rating downgrade within the next two years.

Despite fiscal slippage in recent years, Australia still enjoys a relatively low net debt of under 20% of GDP, around half the Triple A average. Furthermore, as the long rallies in US Treasuries and UK Gilts have shown, losing Triple A status is no barrier to bond-market strength.

S&P followed its sovereign move by putting the AA– ratings of Australia’s Big Four lenders – ANZ Banking Group, Commonwealth Bank of Australia, National Australia Bank and Westpac – on negative outlook, but this did not damage ANZ’s subsequent visit to the US dollar bond market.

ANZ raised US$1.5bn from three and five-year senior unsecured bond on July 11. The bank attracted orders of around US$4bn and priced tighter than National Australia Bank’s exiting 2019 and 2021 lines as market sources emphasized that Australian banks remained attractive relative to their peers in other jurisdictions that had bigger structural problems to address.

To view all special report articles please click here and to see the digital version of this report please click here.

To purchase printed copies or a PDF of this report, please email gloria.balbastro@thomsonreuters.com.