Indian firms are preparing to rush to the offshore bond markets to take advantage of international enthusiasm for the country’s new pro-business government.

Picking up steam

Source: REUTERS/Jayanta Dey

Labourers work inside a steel factory on the outskirts of Agartala, capital of India’s northeastern state of Tripura.

Encouraging Indian companies to sell bonds in the offshore debt markets is among the less direct, but nonetheless critical, moves India’s new Narenda Modi-led pro-business government is taking to revive the nation’s economy.

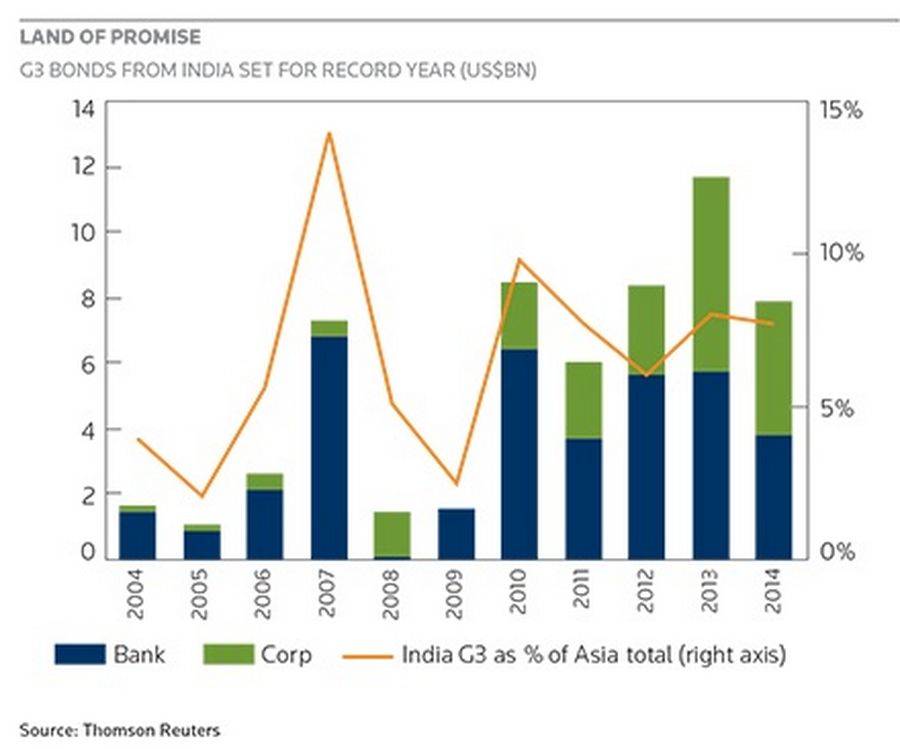

India is on track to sell more debt offshore than last year’s record US$11.7bn. Indian issuers have printed about US$8bn of offshore bonds so far this year, and bankers say a flood of additional offerings is expected in the next 12 to 18 months from both large and mid-sized companies, as well as banks. (See Chart.)

Initially, the rush is expected from firms involved in desperately needed infrastructure projects, although DCM bankers also expect several companies to replace existing overseas debt with new bonds.

Indian issuers have US$3.2bn of US dollar-denominated bonds and convertible bonds falling due in the second half of 2014, according to Thomson Reuters Eikon. Another US$405m of offshore loans are also due this year, Thomson Reuters data shows.

The flood of Indian debt is expected to find a receptive audience among overseas investors.

“Since the Modi-led government came to power, India has again become the sweet spot for investors,” a Delhi-based banker said, adding that he expected both offshore bond and equity offerings to pick up in the next six months.

High-yield stakes

One move the government is likely to make to spur offshore financing is the relaxation of withholding taxes on external commercial borrowings, or ECBs. The government may either remove or substantially lower the tax, which is now at 5% for infrastructure financings and as high as 20% for all others, depending on where a company raises these funds outside India.

Bankers also are hoping the government will review margin limits on ECBs to allow companies to sell high-yield bonds.

The Reserve Bank of India does not allow Indian borrowers to pay an all-in cost of more than 500bp over six-month Libor for ECBs of more than five years. For ECBs of three to five years, the all-in cap is 350bp over Libor. The caps do not apply to offshore arms of Indian companies.

Market participants are already betting big that India’s high-yield corporate bond sales will surge. IT software-company Rolta India is one of only a few high-yield Indian borrowers to tap the offshore market so far and, at BB–/BB–, it is among the lowest-rated to do so.

In fact, Rolta is in the market now, meeting fixed-income investors in Asia, Europe and US for a potential US dollar offering, just over a year after selling a debut US$200m 10.75% five-year bond to offshore investors.

Picking up steam_Chart

Car-parts supplier Samvardhana Motherson Automotive was talking to investors in late June for a potential €500m (US$679m) debut in the euro bond market. The high-yield offering is expected to be a seven-year non-call three secured bond.

High-yield offerings from Mytrah Energy, Shree Renuka Sugars, Reliance Communications’s Global Cloud Xchange, Bhushan Steel and Jindal Steel and Power are also in the pipeline.

Currency flows

One concern with boosting offshore debt volume is the potential effect of aggressive foreign-currency borrowings, and the subsequent build-up in foreign-exchange liabilities, on the Indian rupee.

To protect the rupee from any shocks, India is taking steps to strengthen its forex reserves. One of these is to encourage long-term investors to buy Indian assets.

Canada’s biggest pension fund, Canada Pension Plan Investment Board, recently announced plans to invest US$166m for a stake in a unit of Larsen & Toubro, India’s largest engineering company.

The Canadian fund has said it is committed to investing an equal amount for an additional stake in L&T Infrastructure Development Project 12 months down the road.

Fuelling growth

Before Modi took over as prime minister, India’s GDP growth had slowed to 5.3% from an average 8.5% the previous eight years. Fiscal deficits, at both the state and national levels, rose to an average 7.6% of GDP in the last three years from 4.0% of GDP in 2008.

Bankers expect the Modi government to turn these figures around as it takes steps to deliver on its promise of pro-business reforms and fiscal discipline.

Doing so will be critical to investors. Currently, India’s Baa3 sovereign rating faced risks from the high fiscal deficit, which exposed the country’s economy to many external shocks, Moody’s said in a report earlier this month. It would be critical for India at this juncture to shore up its revenue base, and cut costs, Moody’s added.

“Whether the new government’s FY2015 deficit estimate is above or below the previous government’s estimate of 4.1% of GDP is not the key determinant of India’s credit outlook,” the agency’s analysts said in the report.

“More relevant to the sovereign credit outlook will be whether the budget includes measures that address the government’s low revenue base, high current expenditures, and exposure to commodity prices.”

“More relevant to the sovereign credit outlook will be whether the budget includes measures that address the government’s low revenue base, high current expenditures, and exposure to commodity prices.”

The previous government had forecast that the fiscal deficit would narrow to 4.1% of GDP by March 2015 from the current 4.5%.

After only a month in office, the Modi government has already taken steps to strengthen its finances. For instance, it has raised rail fares by 14.2% for passengers and 6.5% for freight, a move that should bring in income of Rs80bn (US$1.33bn), giving the government room to cut subsidies on passenger tariffs that have increased to Rs260bn a year.

To generate revenue, the new government is also expected to move aggressively to sell stakes in state-owned companies. The outgoing government had a patchy track record in this area, having revised down to Rs160.27bn from Rs400bn its disinvestment target for 2013–14.

“The government is working overtime to manage its fiscal position. It will take a year or two to streamline things, but corrective actions are already being taken,” said a source in touch with finance ministry officials.

However, hopes that the new government will finally set a benchmark in the international debt markets appear to be falling flat. While the government is encouraging companies to borrow offshore, it has no plans to issue a sovereign bond, sources aware of the matter have said.

While it is early days for Modi, and details of the government’s priorities are yet to emerge, there are already signs of a renewed sense of urgency at the highest levels.

“For the first time, I was given an appointment in the finance ministry at 7.30pm and asked to follow up on the meeting the next morning,” one source said. “The government is moving really fast.”

To see the digital version of this report, please click here.