Divyang Shah

IFR Senior Strategist

The market is searching for clues as to the outlook for ECB policy but they are finding little answers from either ECB speakers or informed source based articles. We are likely to see the uncertainty persist into the December ECB meeting next week where the outcome is as predictable as what was seen in November.

The fact is that the ECB itself does not know and while the latest source story suggests that there is no consensus this could change once the ECB members gather around the table. This is what happened in November and the same risks are in play for the December meeting where we reiterate the propensity of the ECB under Draghi to surprise and further measures at the December meeting should not be ruled out.

We get the latest update on inflation this Friday with the flash release for November and next week we will get updated ECB staff projections for growth and inflation. Neither are likely to change the ECB view on inflation and it might be that they decide to keep the prospect of a negative deposit rate and a further refi rate cut in play even if we are talking about a further 10bp reduction.

More of a pressing matter is whether the ECB wants to strike early with regards to excess liquidity. We are already seeing a jittery market with regards to EONIA and the inability to fully sterilise the SMP only adds to concerns over the liquidity environment; even if such concerns are unfounded and likely related to month/year end considerations (see below).

We would still assign a significant probability (30%) of action at the December ECB meeting but at this stage it is difficult to say whether the ECB will favour a negative deposit rate or liquidity boosting measures should it choose to act. The central scenario is for the ECB to be on hold but we are cognisant that at the November meeting the consensus (including ourselves) got it wrong as we underestimated the ECB’s reaction function and propensity to act as it looks to fulfil its inflation mandate.

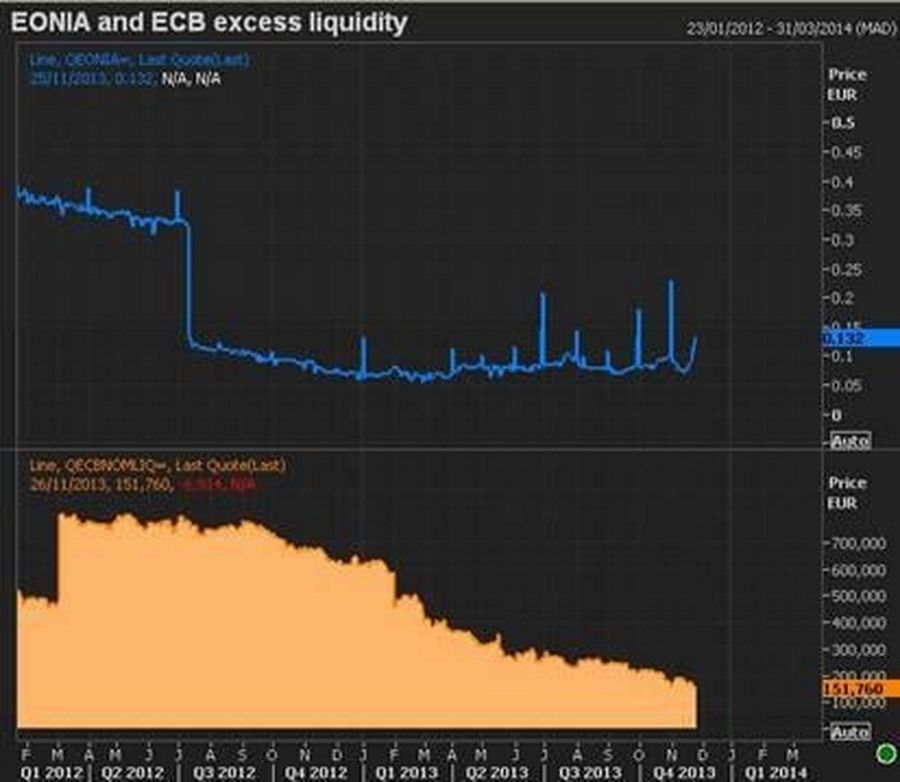

EONIA markets jittery on another YTD low on excess liquidity

EONIA and ECB Excess Liquidity

Financial markets are becoming a little edgy as o/n EONIA averaged 13.2bp on Monday, while at the same time, excess liquidity declined to another YTD low of €151.6bn (after hitting €158.7bn on Friday).

The fact that the EONIA curve is inverted suggests that the movement on EONIA is seasonal and not related to the movement on excess liquidity. We still believe that a more significant impact will not be seen on EONIA until excess liquidity falls below €100bn.

The current reserve maintenance period does not end until Dec 10 but we are already starting to see much higher prints on o/n EONIA. EONIA’s move higher seems a little over done at the current level of excess liquidity, really we would have expected higher prints on a move below €100bn.

The EONIA curve’s inversion, at the very short-end, seems to also reflect concerns over the potential for accelerated repayments. The ECB announced last week that early repayments of 3-year LTRO loans would be suspended from Dec 23 (Monday) until Jan 15 (Weds) (Full Story).

Month/year-end is around the corner and this is likely to be a more important factor in the higher EONIA fixings. EONIA’s move higher highlights the ECB need to eventually act on the decline in excess liquidity. It could either cut the deposit rate, provide a modified VLTRO in the new year or leave the SMP programme unsterilised.

Such easing is likely during Q1 2014 but we must not forget the propensity of the ECB under Draghi to surprise and further measures at the December meeting should not be ruled out.