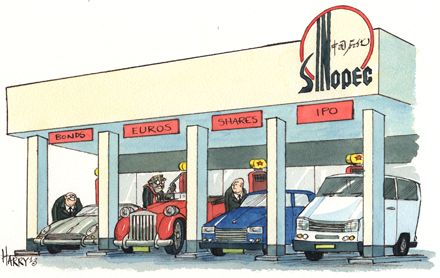

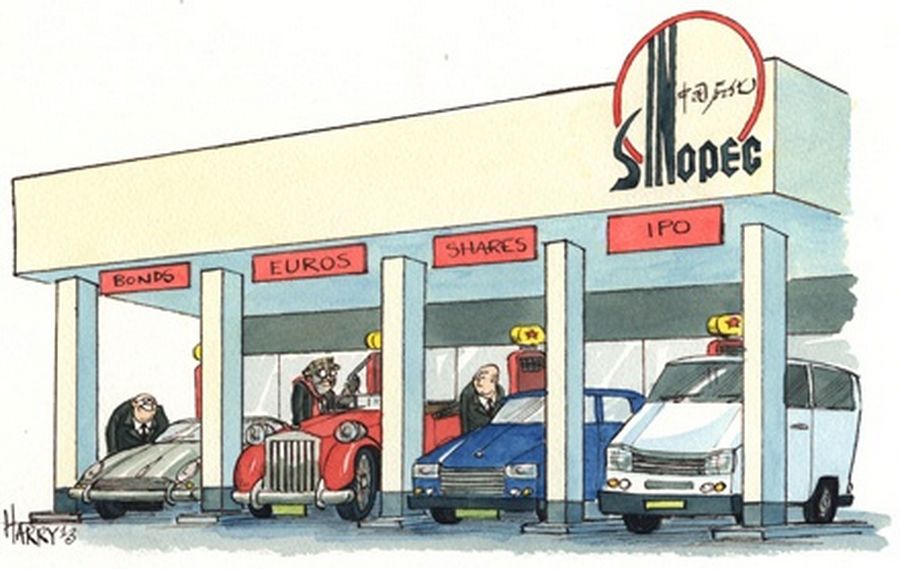

China’s state-owned enterprises were at the forefront of Asian financing in 2013, but one managed to position itself as both a solid credit and a growth proposition. For successfully navigating multiple asset classes, China Petrochemical Corp is IFR Asia’s Issuer of the Year.

Issuer of the year

China Petrochemical Corp, better known as Sinopec Group, raised nearly US$12bn from international investors in 2013, setting the pace among the PRC’s top issuers in both the debt and equity markets.

Sinopec Group and its subsidiaries issued in multiple formats and currencies throughout the year. Its equity issues overcame considerable uncertainty towards China’s economic growth, while its bond offerings set new benchmarks for top Asian issuers.

The PRC growth story was starting to show serious signs of wear during IFR’s review period. The International Monetary Fund lowered its 2013 GDP growth forecast for China to 7.6% from 7.75%, confirming that years of double-digit economic expansion, the last recorded as recently as 2010, were history. Likewise, a liquidity squeeze in China’s banking system in June had raised fears of default in the country’s previously immune money markets.

On top of that, demand for new Greater China equities had almost vanished and mixed signals about the end of the US quantitative-easing programme sent the debt capital markets into panic mode at various times throughout the year.

Asia’s largest oil refiner, however, did not let the fickle equity or debt markets crimp its plans for 2013. Instead, it used the markets to its advantage.

Sinopec had much to accomplish. It was on a mission to restructure its business lines to become more competitive in the offshore markets. China Petroleum & Chemical Corp, or Sinopec Corp, planned to buy overseas exploration and production assets from Sinopec Group, its parent. In the same vein, Sinopec International Petroleum Exploration and Production, another subsidiary, had agreed to buy a one-third stake in Apache’s Egypt oil-and-gas business.

All of that needed financing and, because the assets were offshore, foreign-currency funding was necessary.

Perhaps, the most daunting challenge, however, was the spinoff of Sinopec Engineering through an IPO. At the beginning of the year, a new issue on the Stock Exchange of Hong Kong – even if it was a reliable PRC name – seemed a near-impossible feat.

To complicate things further, Sinopec also had to manage the often conflicting demands of the Chinese Government, existing and potential investors, bankers and regulators. Sinopec executives also did not want to increase leverage very much. None of this would be easy.

Smart execution

The Chinese issuer started working early in the year. For any company looking at the capital markets in January, two things were obvious: bonds were in hot demand and equity markets for Chinese issuers basically were frozen.

Naturally, Sinopec executives decided it would be smart to use the debt markets to fund growth. They could expand their investor base and take advantage of still-low rates. Yet, it was important to the company to keep its gearing under control. For that, it needed equity, as well.

Timing was important. Sinopec Corp wanted the China Securities Regulatory Commission to approve its funding plans – a typically tiresome process – and price a US$3.1bn offering of Hong Kong shares before Chinese New Year.

In the end, the company priced the private placement on the same day the CSRC approved the plans, on February 4. It sold 2.845bn new H shares, about 17% of existing shares, at HK$8.45 apiece to 10 investors.

The regulator, after asking a lot of questions, approved the deal three weeks after the company applied – a short time by local standards.

“Getting US$3.1bn in one day from 10 investors is astonishing,” said Huang Wensheng, secretary of the board of directors at Sinopec Corp.

The company’s next trick was a trip to the bond market. This, again, was no regular fundraising. The issuer sold a US$3.5bn four-tranche bond in April that scored a number of firsts. It was Asia’s largest US dollar bond since Malaysian oil-and-gas giant Petronas raised US$4.5bn in August 2009, and all four tranches printed at the lowest coupons from any Chinese oil major at their respective tenors of three, five, 10 and 30 years.

Timing was important here, too, and Sinopec executives had asked the government to approve the company’s financing plans as soon as possible to get ahead of any announcements from the US Federal Reserve that would impact rates.

“At the time, there was some noise that the Fed was considering withdrawing QE3 and, if that happened, it meant interest rates could soon be higher,” Huang said. “We communicated with the government authorities about trying to do the bond as quickly as possible before rates went up.”

That push paid off, although more than a little luck was involved, too. Timing could hardly have been better. The deal priced on April 18, shortly after the Bank of Japan had announced its own massive quantitative-easing drive and boosted demand for Asian credit. The yield on the 10-year US Treasury benchmark also shrank on the day, to 1.72%, matching the 2013 low.

Win-win situation

At the same time, while Sinopec was working on those two jumbo financings, it was also preparing to reopen the Greater China IPO market. Investors had been expecting the spin-off IPO of Sinopec Engineering since at least January, when it filed an application for the US$1.5bn listing in Hong Kong.

Investors and bankers were watching the progress of the offering closely. With confidence in Chinese growth at a low, the backlog of new equity issues had reached several billion dollars. Sinopec, for its part, had a lot of different interests to consider.

“When we were out on the road with Sinopec Engineering, we were looking for a win-win situation: the company should have the financing for the right price and shareholders should make money,” Huang said. “That put a lot of pressure on us when we were setting the price. Even if the deal is oversubscribed, we still have to ask, ‘What is the real demand?’”

The issuer ended up printing a HK$14bn (US$1.8bn) offering of 1.33bn shares at HK$10.50, above the low point of the HK$9.80–$13.10 range. The new stock began trading on May 23 and, immediately, had to weather a summer selloff in emerging markets, but had climbed to HK$11.84 at the end of the review period.

Sinopec’s talent for fundraising in 2013 went beyond just pricing the deal in a stagnant Hong Kong market. The IPO priced in the same week as that of China Galaxy Securities, which took home HK$8.32bn.

The two trades offer a telling comparison of fees and the size of bank groups. Sinopec paid a base fee of 1% and an incentive fee of 0.8%, unusually low remuneration for an H-share IPO, sources said. Galaxy’s trade, meanwhile, cost 2% with a 1% incentive.

The issuer also managed to price with a smaller bank group than some of its peers. Sinopec hired 13 banks for its underwriter group versus Galaxy’s 21.

Sinopec was also quick to take advantage of a new market after a September offering from China National Offshore Oil Corp showed that there was demand for top PRC credits in euros.

Even with a precedent in place, Sinopec’s euro debut was far from a guaranteed success. Investors had other things on their minds in October, when Sinopec was sounding out demand. The prospect of the Fed withdrawing from QE resurfaced as Sinopec prepared to sell the nearly US$3.5bn deal, which included a US$2.75bn three-tranche bond and a €550m (US$753.7m) seven-year tranche, its first euro foray.

“In October, people were again talking about the Fed quitting QE and the market had been expecting it soon,” Huang said.

However, on October 9, when the bonds were priced, President Barack Obama nominated Janet Yellen to be the new Fed chairman. Investors interpreted her speech that day as proof the withdrawal of QE would not occur as soon as the market feared.

Once again, Sinopec was able to read the market accurately.

“So, we thought this might be a good time to issue the bond, after the market reaction,” he said. “At the same time, the cost of funding in the euro market was looking good and we took advantage of it to expand our investor base.”

To see the digital version of this report, please click here.