Dilip Parameswaran_web

Dilip Parameswaran

In the past year, India has transformed from an ugly duckling to a beautiful swan with amazing speed. Little more than 12 months ago, foreign investors were busy pulling out of India on doubts about the country’s balance of payments position, sending the rupee and the stock market crashing, and bond spreads soaring. But today, India is on the buy list of every major equity and fixed-income investor worldwide.

There are two significant drivers for this turnaround. The first came when India managed to quell fears of a balance of payments crisis through a combination of import controls on gold, raising dollars from non-residents and demonstrating a commitment to contain its fiscal deficit. The second was May’s election of a pro-reform government led by Narendra Modi, which bolstered confidence that India would undertake fundamental structural reforms and turn itself around.

India is now on the cusp of a positive confluence of factors. Although economic growth has partly revived to 5.7% for the second quarter of 2014, it remains far below the highs of 9% seen in 2010. But inflation has fallen from 11.2% last November to 6.5% in September; hopes are high that this will soon allow the Reserve Bank of India to cut interest rates to trigger a pick-up in growth. The recent fall in global oil and gold prices is also fortuitous for India, as it will not only help lower inflation but also help eliminate the current-account deficit.

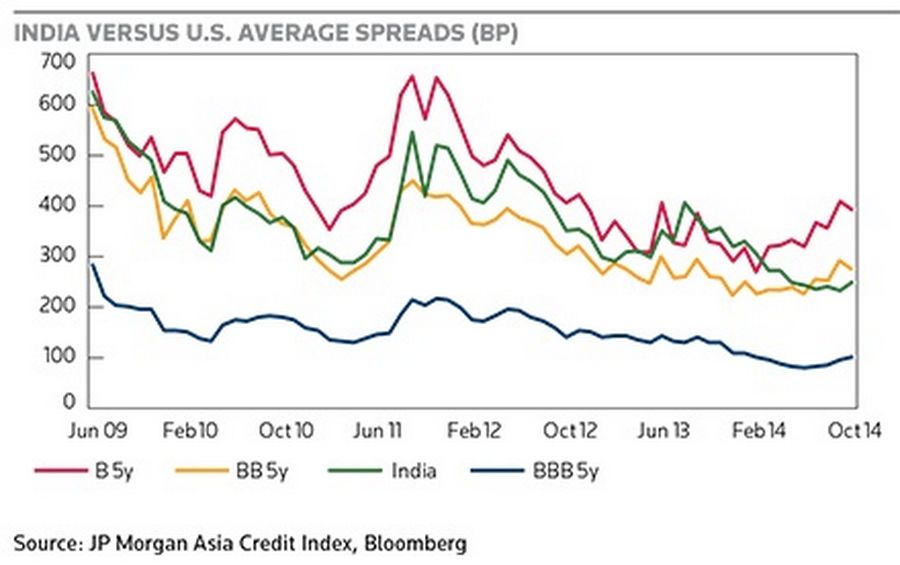

INDIA VERSUS U.S. AVERAGE SPREADS (BP)

Structurally too, Modi is moving towards implementing important economic reforms; he has started with freeing the diesel prices and has moved to permit commercial coal mining; many of the infrastructure projects are moving ahead again; several small steps have been taken to ease the regulatory burden on businesses. However, many major reforms are still awaited, including implementation of a national goods and services tax, easier land acquisition, and relaxation of labor laws. Based largely on the expectation of further reforms, S&P changed the outlook on its BBB– rating from negative to stable.

Global investors have reacted positively. The Indian rupee has been the world’s best-performing emerging-market currency, staying flat during 2014 while the ruble has lost 30% and the Brazilian real 9%. The Indian stock market has risen 36% this year. Foreign portfolio inflows have picked up, reaching US$16bn in equities and US$24bn in domestic bonds.

In the Asian US dollar bond market too, Indian bonds have been among the best performers, rising 10.7% this year and outperforming the overall return of 8.1% for JP Morgan Asia Credit Index. The average credit spread on dollar bonds from India has compressed from 337bp at the beginning of the year to 249bp.

The key question for bond investors at this stage is whether Indian spreads can tighten further. To answer it, investors can compare Indian spreads with typical US spreads. At the height of the crisis last year, Indian spreads had widened to levels equivalent to Single B rated US bonds, on average. Since then, they have compressed back to levels somewhat tighter than Double B rated US bonds. (See Chart.) In fact, current average spreads for India are the tightest, relative to US bonds, in the last five years.

For all the positive attention that India is receiving from global investors, India makes up only 9% of the Asian US dollar bond market. While new issues from India this year have exceeded US$15bn, up from US$13bn for the whole of last year, dollar bonds remain a small segment relative to the size and potential of the Indian economy. Of the US$47bn of bonds outstanding, 50% are from Indian banks, which regularly access dollar bond markets to raise senior debt and subordinated capital. Another 8% has come from quasi-sovereign entities, and the rest from companies in different sectors. That again indicates the limited range of Indian issuers.

Part of the reason for India’s diminished share of Asia’s US dollar bond market lies in regulations on offshore borrowings. By specifying the maximum spreads that borrowers can pay for a given tenor (currently 500bp over Libor for over five years), the authorities have tried to encourage equity portfolio investments rather than debt. Besides, the Indian government itself has shied away from offshore commercial borrowings, and only 6% of the national debt is borrowed offshore. While this policy has protected India from the sudden loss of confidence of global lenders, it has also limited the amount of capital available for growth companies.

If India uses the tailwinds of falling oil and gold prices, stays resolute in its fight against inflation and implements difficult structural reforms, it will surely turn more global investors into enthusiastic supporters. Current credit spreads show fixed-income investors are already convinced. This is India’s time!

*Dilip Parameswaran is the founder and head of Asia Investment Advisors, an investment advisory firm specialising in Asian fixed-income markets.