Investors expect Asian bonds to overcome concerns over Chinese high-yield credits, paving the way for more first-time issuers to access the international markets.

In search of stability

Source: REUTERS/Jason Lee

Students hold a piece of paper between their legs as they balance a book on their heads during etiquette training at a vocational school in Beijing.

Investors expect Asian bonds to overcome concerns over Chinese high-yield credits, paving the way for more first-time issuers to access the international markets.

An ongoing slump in oil prices and concerns over default risk in the Chinese property sector roiled credit markets at the start of the year and these factors, as well as new threats, are likely to continue to have an adverse impact.

High-yield Chinese developer Kaisa Group has been battling against default since the start of January, dampening appetite for similar credits, and making investors realise they need to put more work into examining corporate governance risks related to some Asian high-yield names.

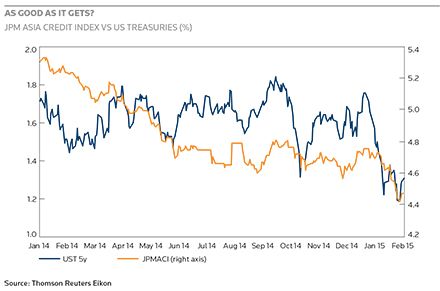

As Good as it Get

“The reality is there are things going on that are not necessarily visible to the market. The bigger picture that concerns us more is the cost of transparency,” said Jamie Grant, head of Asian fixed income at First State Investments.

“Some good-quality Chinese property companies have found their cost of funding has had a premium put on it, arguably through no fault of their own. There are still some worthy names to invest in from that sector.”

Credit spreads for Double B Chinese property issuers have widened to 700bp–750bp, from around 580bp six months ago, and the spread for Single B names has neared 1,000bp, almost 200bp wider.

“That does not create a very negative environment for Asia in my view. If the US rate hike comes alongside stronger US growth, Asia is normally a beneficiary. I’m not worried about a significant shake-up for Asia in this tightening cycle.”

Grant said he expected uncertainty around the Chinese property sector to drive spreads in this quarter, but not in the long term.

Still, concerns over high yield, plus general market volatility, may prompt some investors to move to higher-grade credits.

“Asset managers account for the largest share of demand, and volumes are sensitive to AUM (assets under management) trends, which are sensitive to performance trends,” wrote Victor Hjort, head of Asia fixed-income research and credit strategy at Morgan Stanley.

“Funds have mostly been overweight high yield and may need to re-allocate towards higher quality should volatility persist.”

In the medium term, though, Asia’s high-yield sector is expected to sustain its strong growth.

“We still believe there is tremendous growth for that market,” said Olivier Szwarcberg, head of Asian fixed income at Fidelity Worldwide Investment. “There’s probably potential for the Asian high-yield market to be four times its current size in value and three times in number of issuers over the next five to seven years.”

The low oil price, meanwhile, has been positive for almost all Asian sovereigns, as they are net importers, but could weigh on some exporters like Malaysia’s state-owned refiner Petronas, as the price of a barrel of crude has halved in the past six months.

“Petronas indicated that it might decrease dividends to the state,” said Brayan Lai, portfolio manager at One Asia Investment Partners. “That tells me they feel the vulnerabilities. Malaysia is vulnerable and so is the ringgit.”

Meanwhile, Standard & Poor’s warned that Thailand’s PTT would need to raise more debt unless it cut its spending plans.

“Oil is less problematic in Asia,” said Neeraj Seth, head of Asian credit at BlackRock. “It accounts for only around 15% of Asian credit and most is quasi-sovereign or very high-quality corporate credit. A low oil price is very positive for most sovereigns in Asia, and significantly benefits their external balance position.”

“When you see widening, it’s a buying opportunity, not a reason for panicking.”

Commodities, though, could create problems, as most bond issuers in the sector are private corporations and high-yield credits, although this accounts for only around 3% of the Asian credit market.

The impending US rate increase, after years of close-to-zero benchmark rates, could create another external shock. Seth sees the US raising rates gradually from around June, causing the Treasury curve to flatten as short-dated yields rise, but foresees little risk to Asia.

“That does not create a very negative environment for Asia in my view,” he said. “If the US rate hike comes alongside stronger US growth, Asia is normally a beneficiary. I’m not worried about a significant shake-up for Asia in this tightening cycle.”

Chinese issuers are expected to continue to dominate the Asian bond market, but some investors are hoping for more diversity, following a start to the year which has seen issuers from the Philippines and India make their mark.

“I would like to see better-quality Indian names coming to market. It would be nice to see better-quality sovereign and quasi-sovereigns like Psalm, National Power Corp and Pertamina returning,” said Lai. He is of the opinion that investors generally have a neutral view of Korea, but tend to be underweight China.

First State’s Grant said that, after two years of record issuance, Asian bonds were becoming more viable as an asset class to investors from outside the region.

“One of the long-held concerns about Asian fixed income is liquidity, but, when you have year-on-year issuance like this, that’s a step in the right direction,” he said.

To view all special report articles please click here and to see the digital version of this report please click here .

To purchase printed copies or a PDF of this report, please email gloria.balbastro@thomsonreuters.com .