IFR: The government is trying hard to promote FDI. Thomas, do you think this is an initiative that’s going to be successful?

Thomas Meow, CIMB: Well, it’s early days. On the ETP, the plan is basically for foreign investment to support something like 25% of the RM1.3trn cost of the programme. That’s quite a bit of FDI. Whether we are able to do that is perhaps beyond the scope of our discussion today. The other problem is even if we are able to attract FDI of that size, there is another probably close to RM1trn to be financed by the capital and banking markets. That’s a huge size.

Of course not everything will be in the form of infrastructure financing. From the capital markets perspective, we also need to attract foreign issuers into Malaysia. I think the example of Korean issuers tapping the Malaysian market has to be developed on a more widespread basis. Maybe the ASEAN region (or ASEAN Plus Three - APT) should come up with a platform to allow issuers within the group to issue bonds into each other’s countries. Korean issuers tapping Malaysian investors is the first step, but it should not stop there. If you look at the period since the previous Asian crisis, a lot of ASEAN savings that were built up have been invested in the West. It’s time to channel those savings back into this region.

Malaysia being a small country it’s difficult to get that done but APT could be an important platform to attract FDI flows as well as capital

flows back into this region by coming out with a framework that is similar to Reg S or 144a. I think it’s important to come up with a platform that is compatible, so that issuers in this region that are thinking about issuing Reg S or 144a bonds should also think about issuing local currency bonds in the region. That would not just be a case of Malaysian liquidity supporting Korean issuers, but maybe some foreign investment coming in to support the local market.

Abdul Farid, Malayan Banking: Asian countries are growing at different rates and some countries are more developed than others. But what is certain right now, take Indonesia as an example. Indonesia is a fast-growing economy right now. Over the past four years, the administration has been trying to expand infrastructure spending, talking about power, toll roads, utilities, airports, seaports, everything. They’re talking about infrastructure spending of some US$150bn.

A lot of these projects have failed to take off because the rupiah market is not deep enough to support long-term funding for any of these projects. Malaysia, by contrast, has a lot of liquidity and the market is deep enough. There’s a good match there. But we need a push from governments and - specifically in this case - securities regulators, to try and harmonise the regulatory framework, and working together to get issuers tapping tap each other’s market.

Whether it’s deliberate or not, Malaysia has a high savings rate. We have a mandatory savings system: the Employees Provident Fund now manages more than US$100bn We have a very business-friendly government, our common-law legal framework is very familiar to a lot of investors, we have been privatising state companies since the mid-80s, and in infrastructure, the Malaysian government was open enough to have consultants and advisors to put the right documentation in place for project finance.

IFR: Beyond APT, could the Malaysian market eventually support issuance by Gulf issuers, US issuers, Australian issuers, as has been mooted? Or is this just hype?

Maimoonah Hussain, Affin Investment Bank: If you look at the timing of foreign issuers tapping the Malaysian market, they were basically getting a good pricing arbitrage. That was the key to the whole thing. If there is a pricing advantage, issuers will move. If you look at the Koreans who issued in ringgit and swapped into dollars, the pricing they got was nowhere near their dollar pricing at that point in time. Honestly if our investors had been smart enough, they should have simply bought that same credit risk in the US dollar market and swapped it back into ringgit. They’d have got far better pricing.

Ai Chin Tan, OCBC: I agree. Foreign issuers took advantage of a market anomaly in ringgit and got a good pricing arbitrage. It’s not that investors here don’t know how to price risk, it’s just that in the beginning there was a first-mover advantage for some of the foreign issuers. But if you look at the market today, the swap rate has corrected itself to the extent that if you swap it back the pricing is no longer that much different for foreign issuers.

So to that extent, I don’t think we should be insulated and keep the local market liquidity only to Malaysian issuers. Singapore moved quite fast through the crisis by attracting a lot of foreign issuers into its market, including Malaysian state agency Khazanah which issued a S$1.5bn Sukuk. Even Russia’s VTB Bank sold a S$400m bond offering.

For the Malaysian market to develop, we need to have a very open perspective towards foreign issuers in the market, and I’m definitely a proponent of setting up an ASEAN capital market because with that then we would have better chance of tapping into the huge savings pool in Asia. And for it to work, besides the regulatory framework I think the key is really how to harmonise and set up a standardised clearing system as well as ratings to a certain extent. I think those will be key for us to actually develop the market into an international financial market.

Promod Dass, RAM Ratings: Can I just add onto that? Taking it from a different perspective, one man’s meat is another man’s poison, so to speak. When we had the global crisis, foreign issuers came here in search of our liquidity and yes, they were all arbritrage issues initially. But I think the important point now is that Malaysia is on the map. We are part of the circuit and from a distinctive competence perspective, we also have a very strong Sukuk market.

So some of the Korean issuers that tapped once are now coming back. We’ve seen Middle Eastern issuers as well. So the important thing now is that Malaysia is on the landscape. And when you talk about globalisation, perhaps this is the future scope for the Malaysian bond market. You have foreign issuers and Malaysian investors who are able take foreign credit in ringgit because there’s a developed swap market. And at the end of the day the Asian bond market can be in Malaysia, can be in Kuala Lumpur. We are proof of the pudding.

IFR: What role does Cagamas have in promoting Malaysia as an international bond hub?

Angus Salim Amran, Cagamas: From the perspective of the role Cagamas can play in attracting foreign investors into our market, obviously being the largest issuer of private debt securities does play a big role. We offer debt from one to 20 years so we cater to the whole spectrum of the investor base. We also are a very prolific Sukuk issuer. To that end actually, we’ve come up with different structures. One of our key initiatives is to try and get some form of harmonisation between Malaysian Sharia perspectives with that of the GCC. We recently issued a Sukuk ALim, a three year bond, which was actually taken up by a lot of GCC investors. In fact the GCC investors that came onto the book were investors who had never bought a Sukuk from Malaysia before.

IFR: 40% of that went to the Gulf, right?

Angus Salim Amran, Cagamas: That’s right, 40% went to the Gulf. And so that really is just proof of how we can play a very important role in trying to attract foreign investors into our marketplace. Another way of us promoting Malaysia is looking at the offshore markets ourselves.

We’ve toyed with the idea of looking at foreign issuance and looked at what it means to us if we were to go offshore. There are a few things that we consider. Obviously number one is: is it economically viable? At the moment, everything we acquire is ringgit based. So if we were to go offshore and swap back into ringgit, from a spread perspective it still has to make sense.

But having said that, we are also very mindful of the role we play in developing the bond markets, and one of those roles, in my personal opinion, should be to try and promote the Malaysian bond markets from an issuer’s perspective offshore. And then, while there may have to be a pay-up in terms of yield in the short term, I think longer-term it gets our name out there, it sets up our stall offshore and allows us to capitalise on opportunities a lot more profitably moving forward. So there are two ways we can play a role, domestically and internationally.

IFR: Absolutely. You can write off the excess spread as corporate marketing, right?

Angus Salim Amran, Cagamas: Yes and maybe the investment bankers won’t charge anything for arranging it either!

IFR: We haven’t talked much about equities. Of course there are a couple of issues out there, one of which (Malaysia Marine and Heavy Engineering - MMHE) just launched and another (Petronas Chemical) is pricing in mid-November. If Petronas prices at the top of the range, the resulting US$4.6bn deal will be the largest-ever primary offering from South-East Asia. Is the equity market stealing the bond market’s thunder?

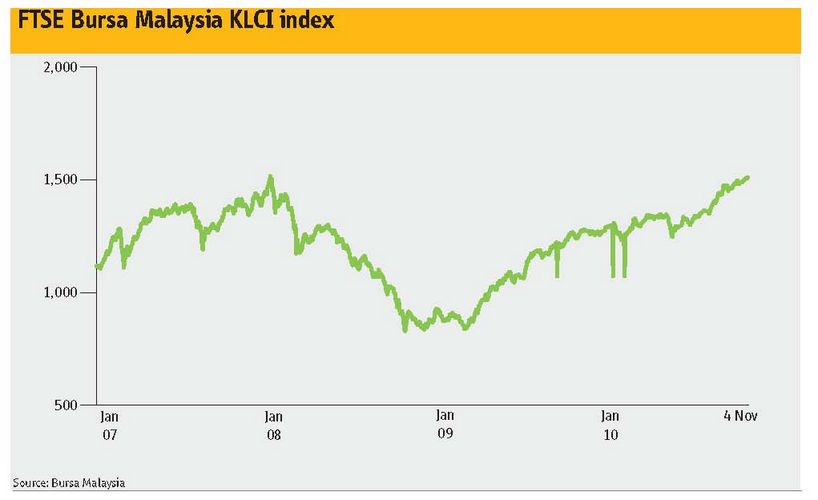

Abdul Farid, Malayan Banking: I think it’s true to a certain extent that the equity market is stealing the thunder from the bond market. But not because of the IPO market; It’s mostly because of what’s happening in the secondary market right now. In all the markets, not just in Malaysia but across Asia, the markets are reaching new highs every day. We have gone back up to where we were back in 2008. Investors are generating such good returns from equities. Bond yields are much less interesting.

What’s happening on the secondary market is flowing into the primary market. MMHE was oversubscribed multiples times right from launch. And the deal was over subscribed multiple times by local funds. I believe the same thing will happen with the Petronas Chemical as well.

[The roundtable was held prior to MMHE pricing. The US$692m deal was 27 times covered at the top of the range in the institutional tranche and six times covered in the tranche reserved for Bumiputra investors.]

Thomas Meow, CIMB: The run-up in the equity market is good in the sense that it has created a bit of opportunity from an M&A perspective as well. I agree the focus is not so much on IPOs. When there’s a run-up in the equity market, it gives rise to M&A activity, which could involve bond market funding, so in a way I think the run-up in equities could be good for the bond market.

IFR: Does anyone else have M&A on their radar screens?

Maimoonah Hussain, Affin Investment Bank: I think the M&A pipeline is quite strong generally; I’m sure most of the investment banks are working on deals. Some of these will spill over into the funding side of the business.

Yeo Teik Leng, Standard Chartered Bank: There are opportunities out there and we’ve seen some substantial transactions being done. M&A activity is not yet widespread across sectors and not all deals work out. But I think the bond market can play a part. I mean who would have thought at that point in time [2007] that Maxis could have been taken private and its Malaysian assets IPO’d [in 2009]? Clearly the fact that it could be done shows that you can take a very large equity market play, morph it into a debt play and switch it back up into the equity capital markets again.

So I agree with what Thomas and Maimoonah have been alluding to that there is an interplay between bond and equity markets. The good thing about Malaysia is that we now have both markets now which are capable of picking up the slack from each other.

IFR: That’s a good point to end our conversation. Ladies and gentlemen, thank you very much for your comments.