IFR ASIA: Welcome to this annual discussion on RMB bond markets. Ricco, what has changed since we met last year?

RICCO ZHANG, ICMA: There’s a lot to mention over the last year. The first one is the Panda bond guidelines, which were finally released last month. People have been expecting that for at least two, three years, so this is quite encouraging. The guidelines definitely give a lot of clarification on the Panda bond issuance process, as well as the different regulatory requirements for issuers, particularly around which regulator oversees which type of issuer. Except for financial institutions, which now belong to the PBoC, all other issuers will need to file applications to NAFMII, which is easier.

That sends a very positive signal that onshore regulators want to make life easier for foreign participants, even with the background of the trade war and a cooling economy. The regulators want to attract more foreign participation for the onshore market.

That’s linked to the second big change this year. We’re also seeing different financial institutions and rating agencies allowed to own subsidiaries or joint ventures in China. Basically the Chinese authorities have opened the gates. HSBC is a very typical example, with the securities licence in Qianhai allowing them to expand in onshore China. We also expect more participation from the international big three rating agencies. There’s a commitment from the Chinese authorities to open the market to international participants.

I also want to mention Bond Connect. Last year, we were still arguing about whether it would work or not, compared to different access channels. So far, we have seen very positive feedback from the international community, and investors will see that this is quite convenient. Also, on the Bond Connect anniversary in July, the PBoC announced quite a few further reforms, including DVP [delivery versus payment] and tax issues. They’re all resolved already, so I think the route to the onshore market is just much more open than before.

IFR ASIA: Ko-Wei, so what does this mean then for your issuer clients? Has it opened new avenues for them?

KO-WEI HSIUNG, HSBC: Definitely. We work with a lot of international clients that are looking to fund themselves in RMB. Before, there were only selective options for international issuers. The onshore market, which is the third largest bond market in the world, just opens up an entire new avenue for them to look for RMB funding.

The Chinese regulators have also sent a very strong signal for issuers that were looking to tap the onshore market, including clarifications on the process, making the access much easier, linking onshore requirements with the offshore practices, rating reforms, and so on. All those make access to the onshore markets much easier than before, which is very, very welcome to the international issuer base.

IFR ASIA: Paula, what have you seen in terms of how investors access the RMB bond markets now? What’s changed over the last year or so?

PAULA CHAN, MANULIFE: It’s actually quite interesting, as Ko-Wei said. We have heard from European investors, especially pension investors, that they are keen to look at the Bond Connect route. They were already quite interested in the logistics of it, now, with the so-called Bond Connect enhancement, they are actually looking to invest. I’ve just been to Europe in June and received some positive feedback from investors who are looking for managers specifically for onshore bond investments. Having said that, they’re still quite sceptical about the credit market, so the mandate is more on the high-grade side, like the CGBs and the policy bank issuers. For the Chinese state-owned enterprises, a lot of investors are more comfortable with the US dollar market, because of the documentation and the legal framework that comes with an offshore issue. So that’s the recap.

IFR ASIA: Are investors suddenly looking because they are now able to invest? Or is there a more fundamental reason why RMB markets might be more attractive?

PAULA CHAN, MANULIFE: It’s definitely the index inclusion story. It’s structural. They’re all quite familiar with the story and they have been doing a lot of work about the potential inflows once RMB bonds are included in global indexes. The numbers really vary, depending on how we look at passive or active flows. Based on our research, we’re looking at about US$600bn coming into the onshore market, eventually.

IFR ASIA: Once all the indexes are aligned.

PAULA CHAN, MANULIFE: Yes, correct. So that’s just passive. The active flow is usually much more aggressive. So it’s definitely a structural change. Whether we expect the RMB to depreciate, appreciate or whatever, the inflow has to be there. We are looking at about a 5% weighting on the main indexes; that’s a lot of money going into China.

IFR ASIA: We mentioned credit ratings a couple of times already. Tony, tell us what’s changed on that front.

TONY TANG, PENGYUAN: Yes. Ricco mentioned the Chinese authorities have opened up the credit rating industry. So far, no licences have been granted for international participants. All the submissions were due by the end of September, so the reviewing process is underway.

The China ratings market has been running for more than two decades, so the rules are well established. Personally, I think it would be hard for big players to come in and change the whole market practice. I think they will add value, but they’re not going to shake up the entire industry. Based on the documents submitted to NAFMII so far, S&P is planning to create a new set of criteria for the onshore market, which means they will not be in line with the current practice in global markets. Moody’s has not made it clear, but I heard that they’re probably going to use their existing criteria.

There is certainly more competition coming to the domestic market from outside China. I think that would help the industry to improve in terms of fundamental analysis and rating quality, as well as the quality of the analysts. It is a big industry, so it will be small changes each year for a long period time.

On the other hand, we also see Chinese ratings agencies are coming outside of China, so there is another side to the story. We are establishing our practice in Hong Kong, and there are a few other agencies also practising in Hong Kong now. I think this will also provide a different voice to this line of work.

IFR ASIA: Ricco, just on the rating point. On the new Panda guidelines, there is no rating requirement anymore, is that right?

RICCO ZHANG, ICMA: It’s not a regulatory requirement anymore, it’s up to the market. In the onshore market, every bond issuance must have a domestic rating from a Chinese agency. The Panda market is the exception. It’s not a regulatory requirement anymore, it’s just for the market to decide if a rating is necessary or not. That will depend on investor feedback.

This will give more flexibility for issuers that already have a very high rating in the international market. If the onshore investor feels comfortable investing in such bonds without a domestic rating, that’s fine. If it’s, say, a less well-known corporate and the rating is not that high, the investor may feel different.

Now, as Tony said, the gate is open for the international players, but it’s not easy. Don’t forget, foreign participation in the onshore market is still less than 2%; the vast majority is onshore investors. The first question there is do they trust these international players? Second, what will issuers pay for? When you imagine an international rating agency giving BB, and Chinese rating agencies give AAA, what will issuers choose? I will say that there will be changes over the years, because we all know that it’s hard to differentiate between Triple A issuers in the domestic market. Triple A in the onshore market may mean investment-grade in the offshore market.

We will have to see what further reforms the regulators will put in place. One option is to change the whole rating system to make it more consistent with the international one, but that’s only one option. Over the coming years we will see how the market responds and which way the rating regime will go.

IFR ASIA: Steve, credit risk, is one of the most interesting topics at the moment in China. Do you think ratings reforms would make a difference?

STEVE WANG, CITIC CLSA: At the end of the day, there’s no replacement for doing good credit analysis yourself. My colleagues and I have to put ourselves in the shoes of investors and think about whether we are comfortable taking on a particular credit or not. We go to visit companies and talk to people onshore. We are also very fortunate to have a very large team of onshore credit analysts at Citic Securities, so we get a download on what is happening onshore.

We do look at the onshore credit rating when we do our research. I recognise there are a lot of challenges there but the rating services they provide are very valuable. They provide a lot of detail and a lot of background on the issuer and some rating reports are very long and detailed. I actually find onshore rating reports very useful as a starting point but to get deeper you need to do your own research.

IFR ASIA: Have you changed the way you approach that analysis, now that default rates are rising?

STEVE WANG, CITIC CLSA: I started to look at this market in depth about a year or so ago, and at that point people were already well aware of the deleveraging campaign, and the squeeze on liquidity. It’s quite obvious that we can’t just rely on simple rating brackets to decide relative value, or even gauge the risk of default.

There are some sectors that require a different approach to credit analysis, such as LGFVs [local government financing vehicles]. This year, at the CLSA Investors’ Forum, we explained our methodology to investors. We look at the fiscal strength at each government level to help identify how strong each LGFV issuer might be, or might not be.

IFR ASIA: It’s not just the support that you expect them to get from the top.

STEVE WANG, CITIC CLSA: That is still very important, as we have seen in some recent cases, but we have to also look at why do they deserve to be supported? I think that’s the most important question.

IFR ASIA: I’m interested if this rise in defaults is a major hurdle now. Paula, have you had to change the kind of securities you buy as a result?

PAULA CHAN, MANULIFE: Yes, we have been staying away from the LGFVs for some time, simply because we think the issuers are a bit challenging to understand, and getting the information is another hurdle. We know we will probably miss some great opportunities, but we think that we can catch up by investing in other asset classes.

On that note, I would say we’re quite balanced. For the onshore market we’re more focused on government bonds, and government issuers, simply because we think the credit cycle in the onshore market is still at an early stage of correction. Also, credit spreads are trading homogenously, so even if we step down the credit curve, we don’t get enough compensation.

For the same type of credit risk, we would be happier to get ourselves involved in the offshore credit space. We don’t necessarily compare the same credit in different markets, because we can’t hedge it, but we think that taking outright credit risk would be much more meaningful in the offshore market, at this stage.

IFR ASIA: So it’s not that credit risk has suddenly come up, it’s more about getting paid for the risks involved.

PAULA CHAN, MANULIFE: Correct. We still run valuations every day; where we get the most alpha, that’s what we are looking at.

IFR ASIA: Is this something you’ve noticed, Ko-Wei? How do you explain to issuers that there might be no pricing benefit from an RMB bond?

KO-WEI HSIUNG, HSBC: There are a few ways to really look at this. First of all, I have to agree that some issuers do look at this market hoping to get some sort of arbitrage over their funding curve. While other issuers will look at this market as a way to fund a business onshore.

There are also other reasons for going into the market. Some issuers are purely looking to build stronger ties with China; that’s also a possibility. While I agree that trying to get the best pricing outcome is perhaps the common goal for a lot of issuers, we cannot overlook the other reasons why they may consider this market.

IFR ASIA: Do you see people issuing onshore RMB bonds instead of Dim Sum, even if they have to pay a little bit more?

KO-WEI HSIUNG, HSBC: Certainly. For example, if you have operations in China, if you were to issue a Dim Sum bond offshore and apply the funds onshore, it will take up your onshore foreign debt quota. But if you satisfy certain criteria and issue a Panda bond onshore to fund your onshore operations, it actually allows you to keep your foreign debt quota for other uses.

That makes a very big difference for some issuers when they are looking to decide which funding routes they’ll be using. Essentially what you’ll be comparing is the cost of an issuer funding itself onshore, rather than comparing the Panda pricings versus Dim Sum pricings, which could be affected by market conditions from time to time.

RICCO ZHANG, ICMA: That’s definitely one of the biggest incentives in the new Panda bond guidelines. If such issuers want to fund their onshore projects, their life will definitely be easier – although it’s subject to further detailed rules from SAFE, and it also depends on the issuer’s corporate structure.

Two years ago, we rana survey, co-organised with NAFMII, asking different issuers if they were interested in issuing Panda bonds, and why. We found that their treasury structure made a difference. For some treasuries, when they get funds, they are required to get the funds back to head office, either in the region or to their global headquarters. Then they need to allocate those funds back to China. In that case, it’s way more complicated, and then a Panda bond is probably not an option. If they’re allowed to leave the money in China to fund their onshore business, then it’s definitely attractive.

IFR ASIA: So, in the new rules, is it easier to get approvals for a Panda bond if you’re keeping the money onshore?

RICCO ZHANG, ICMA: Exactly, yes.

KO-WEI HSIUNG, HSBC: Just to make one clarification here. The rule itself doesn’t explicitly differentiate the process based on the use of proceeds. It does mention that issuers should follow the applicable regulations published by the various regulators in China related to account opening, fund remittances and cross-border settlements.

IFR ASIA: I see. On the investor side, Paula, you talked a bit about the Bond Connect enhancement. Does that basically mean that international investors are comfortable coming into the onshore market?

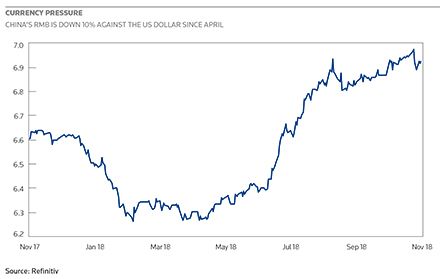

PAULA CHAN, MANULIFE: The currencies definitely still play a big part. We talk about diversification benefit, tracking error, Sharpe ratio – whatever numbers you plug into your model the outcome is very one-sided. We have to include China, no matter how you slice and dice it, China is the most attractive market right now. Having said all that, to be very honest, the RMB performance against the dollar is a problem. A lot of people are still stuck on that, even if they can hedge it in the offshore market, the CNH market.

Pension investors will normally swap it back to, say, euros or Swiss francs. To them, they are looking at negative rates, so anything above zero is great, but it still doesn’t work for them. Deep down, they’re still looking at the currency performance.

IFR ASIA: Are there still any concerns about China’s capital controls? Can investors move their money around freely now?

PAULA CHAN, MANULIFE: They can, but these pension investors are looking at three, five years investment horizon. They are not a hedge fund or a normal asset manager like us, where it is all about whether we beat the benchmark or not. If they are really going into the market, they want to stick around. Bond Connect definitely is a good thing, and we like it. We like the transparency, we like that we can hedge. Whether other global funds really want to get involved, that is a separate question.

RICCO ZHANG, ICMA: Well, the Chinese market is a very unique market. It’s a developing market and it’s quite closed. On the other hand, it’s one of the biggest bond markets in the world. There are two perspectives now for investors looking at the Chinese market. One is economics. The RMB is now in the SDR basket and bond index inclusion is coming. A passive investor will definitely look at accessing the RMB, through onshore or offshore options. You can see this year the RMB is still depreciating against the dollar but we’ve seen net inflows into China, particularly from central banks, big pension funds and asset managers. That shows the commitment of the offshore investors to the onshore market. That’s not something the Chinese authorities can control, but they can make the market more accessible.

The other view is the technical perspective. We now have Bond Connect, direct access, RQFII. It’s all about making the process simpler, and that is opening up new opportunities. Under Bond Connect, the DVP improvement is quite important, because previously some big investors say they cannot get through their internal compliance without true DVP. The feedback actually is well received by the Chinese government, and that is already quite a change from the past. They are very interested in feedback around international market practice and how to help get RMB bonds into global indexes.

IFR ASIA: The Bloomberg Barclays index announcement about including RMB bonds came with a list of conditions. After the last enhancements to Bond Connect, is that all done?

RICCO ZHANG, ICMA: Well, technically there are still some hurdles. The onshore market does not use the same repo agreements as the international market, where market participants value the Global Master Repo Agreement, which ICMA manages. That’s one further technical issue.

Economically, the currency, trade war, the impact on the Chinese economy, the way people see Chinese credit risk – all of those are hurdles. That’s why some investors still want to wait and see. But the investors who are getting into the market now will definitely encourage others to follow.

IFR ASIA: Steve, are your clients concerned about change to indices?

STEVE WANG, CITIC CLSA: Absolutely. And echoing Paula’s point, it’s all about currency. The RMB is in a very interesting situation right now. Earlier this year, when the policy situation was less certain, there was a lot of speculation that the yuan could weaken past 7 to a dollar. By now the Premier and state council has drawn a line in the sand and the in-flows that we’ve seen this year have continued to be pretty good through the Bond Connect.

There is a very valuable window of opportunity for global investors to take a closer look at the RMB bond market. Right now, the currency is inexpensive after coming down substantially from the beginning of the year. A little bit of weakness is also good to stimulate the economy, and the RMB has definitely outperformed against its Asian peers. I’ve looked at China for a good part of my career, in rates, economics and credit, and it always comes down to currency.

What the central bank is doing is really important. Lo and behold, right after the Golden Week holiday they cut 100bp from the reserve ratio requirement, which will help stabilise liquidity. They’re still saying that they’re not loosening the monetary side, but there’s a number of things they can do to smooth out market liquidity. This has been very well-orchestrated. With the global market struggling a little during the past few weeks, it’s actually quite a big confidence booster from the PBoC.

IFR ASIA: It seems to me that China is saying that its deleveraging campaign is not going to get out of hand – especially after a bit of a blip earlier in the year.

STEVE WANG, CITIC CLSA: May 2018 was the toughest time for all of us in the market, and it was a turning point. Into the summer we saw infrastructure spending start to contract. That was really the warning bell and triggered the turn in policy stance. That’s very positive. Of course, we’re still dealing with a rising default rate, but the overall default rate in China is very low by global standards, and the bond default rate is still much lower than the bank NPL rate. From a credit investor’s perspective it’s still a very attractive proposition to look into the RMB onshore market, as Paula mentioned. My only advice is do your homework and identify the best performers.

I think the LGFV sector deserves a lot more attention because it has the real potential to grow into a major asset class, like the property sector over the last decade. It’s in a state of transformation. People running LGFVs are trying very hard to make their business more sustainable, either from a cash flow perspective or from actually cementing closer ties with the city’s development.

IFR ASIA: Tony, what do you think? How does policy affect credit risk?

TONY TANG, PENGYUAN: I’ll just add two things first on why people invest in RMB bonds. The onshore bond market represents the true China, with a much more diversified range of asset classes and different issuers. That is a big opportunity, whether you’re a hedge fund investor or pension manager, because you can still find the assets you want. It’s a much better representation of China than the offshore dollar bond market or Dim Sum market.

Secondly, the onshore RMB bond market also has a very low correlation with the other major global asset classes. You can see the contrast in recent years with quantitative easing in the US and Europe. China offers great diversification benefits to the offshore investor, and of course index inclusion will help that to accelerate the process. Eventually, I believe the onshore RMB bond market will be one of the most important asset classes in the world.

Policy this year is still focused on deleveraging. If you recall, at the end of last year in the Central Committee Economic Work Conference, the central government set one of its three main work priorities over 2018-2020 as preventing and controlling the financial systemic risk. They will have to continue deleveraging, because they know China cannot continue the current path forever, but they also don’t want to cause a bubble to burst. It’s a very delicate dance they have to do.

Given the backdrop of the trade tensions between the US and China, they’re probably going to relax a little bit, I would say, just to avoid a sudden drop in economic growth or jump in credit events, particularly in the property market. Even though this year property sales have been good, we do see a lot of property companies, whether it’s Vanke, Country Garden or even Evergrande, they are all coming out with pretty conservative comments going forward. Actually, we’re in the process of reviewing the entire sector right now. I would say that sector remains one of the biggest risks for China. A trade war with the US may be an external shock that is hard to model, but I think its impact is still manageable for China at this moment; I believe the real risks are still very much originating from the domestic economy.

IFR ASIA: Is the risk to the property sector about companies accessing finance, or is it more about house prices?

TONY TANG, PENGYUAN: There are multiple fronts. On the policy front, the tone from the top leadership has clearly changed. Before, policymakers always said they want to have slower price growth, but now they don’t want any price increases at all!

Even though the economy has faced so many obstacles, we haven’t seen a massive relaxation on a policy side because it’s a worry about the money continuing to go to the property sector, further blowing up the bubbles. Price definitely will be another big factor, because that has a big psychological impact on the buyer’s side. We are already observing some protests in Guangdong and even in Shanghai, after people bought apartments and then the property developers cut the price 30% or 40%. All the property developers are rushing to get their cash back. The Vanke chairman said in the annual meeting that he just wanted to survive. The whole thing has changed.

IFR ASIA: While we’re talking about policy, does anyone have a view on the way the trade war will play out for the RMB markets?

STEVE WANG, CITIC CLSA: The trade war was probably the most important topic of conversation at the CLSA Investors’ Forum this year, and it will not go away any time soon. What we’re seeing right now is probably a little more ideological than anything else. Depending on President Trump’s results in the mid-term elections, it is unlikely that he will turn down his tone with China unless China meets his demands.

I’m quite cautious about what the US and China might bring about in the short term. Right now, China is not in a great spot but it does have sufficient policy levers to pull to defend growth. It’s going to be a good lesson for everybody.

On Tony’s section about the property sector, that has been such a major driver for China’s growth. This is happening at a very important moment in history and I’m happy to see China putting the brakes on housing prices. I don’t think they can see housing prices go lower either and we can’t afford to see protests popping up everywhere, but they are serious about it this time.

China has to build a market-based economy, meaning that there’s a chance that you will lose money on your investments. It’s a learning curve and it’s a good time to change. China still has a lot of energy. Just as an anecdotal example, you saw how crowded Nathan Road was during this year’s Golden Week holiday? That’s very much due to the opening of the high-speed rail station. This is China in its finest moment: it is building infrastructure and bringing people to new places.

TONY TANG, PENGYUAN: Just to echo what Steve says, China still has huge potential. Even though we have seen more than 30 years of rapid growth, the GDP per capita is still less than US$10,000. China has a huge population that is underserved and underdeveloped, and if their needs are met it’ll create so much value for the economy.

Also on the trade war, I don’t think the trade war will have an out-of-control economic impact on China. Yes, the headline numbers around the tariffs and the US trade deficit of US$375bn are very big. But compare that with a US$12tn-$13tn economy and it’s still a small percentage. We still expect China to have an overall trade surplus over the next few years. China is also pretty agile at dealing with situations like this. If the policy responses are quick and proper, they can minimise the impact. Some short-term pain may be felt, but China’s long-term economic outlook is still determined by its structural reforms and R&D investments.

IFR ASIA: We talked a bit about what might be holding investors back. Ko-Wei, what about the issuers? How do your issuer clients decide whether to fund in China, Hong Kong, Taiwan or wherever else they can find RMB?

KO-WEI HSIUNG, HSBC: It’s part of the learning curve. If you look at the Chinese market, for example, HSBC is the first foreign bank to have a majority owned entity to operate in the Exchange Market. We also have the banking entity that operates in the Interbank Market. You really have to understand how the local market works, how the different regulators are responsible for different markets and the relevant regulations. This all takes time, especially for someone who doesn’t speak Mandarin to really understand the details.

The regulators have so far been very helpful in terms of helping offshore issuers understand how it works, and changing some of the local ways of doing things to match international market standards.

IFR ASIA: What sort of global standards are you talking about there? Is that the ratings?

KO-WEI HSIUNG, HSBC: It could be the ratings; it could be the application process itself. Those are all relevant for offshore issuers looking at this market.

The offshore RMB market, meanwhile, is much more similar to what we’re doing in the G3 market which makes it easier for issuers to understand. Even on the Formosa Bond side in Taiwan, there is no specific requirement on governing laws or languages. That makes a difference why people take less time to adjust to the Dim Sum market or the Formosa market, versus the onshore Panda market.

IFR ASIA: Paula, is there still a lot of interest in the offshore CNH markets?

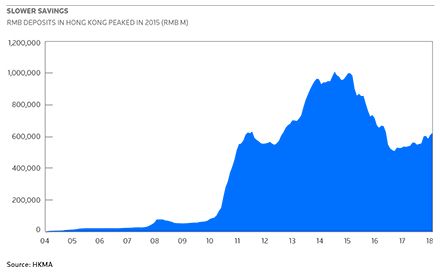

PAULA CHAN, MANULIFE: No, there’s not. It’s coming down quite quickly. I think the key reason is that the duration of the market is too short, compared to the onshore market. So if I’m a duration player on the bond side, it’s very hard to express a view. It’s more about benefiting from the sporadic opportunities in the market. As we speak the CNH short-term interest rate (HIBOR) is squeezing very hard, and that creates some opportunities for investors.

For us, if we want to play the yield curve, we would definitely play the onshore yield curve, because its monetary policy cycle is clear. Policy divergence versus the US is something we can play. In the primary market, the longest you can get in the onshore market is 50 years – there are not a lot of markets that can give you that kind of duration.

Investors will have their own focus and their own mandates, but even for our third-party mandates where we have flexibility, we like the onshore yield curve. The offshore market is more interesting for the derivatives markets, e.g. forward speculation, FX hedging and so on. For underlying bond investments, I would probably recommend the onshore market. I know that the Panda market is still young, but we are seeing more issuers tapping that market and hopefully we can have more selections there. For now, definitely the flow is all onshore. We are actually revamping a lot of our existing products to include Bond Connect, and one new product we are developing will be much more dynamic, allowing us to go onshore, offshore to give ourselves more leverage and extend the long-term shelf life of the product. In our 10-year vision, it’s all about the onshore market, for sure.

KO-WEI HSIUNG, HSBC: From what we’re seeing, the offshore market is an opportunistic market. A lot depends on the depth of offshore RMB deposits. Definitely there are some investors who will swap their home currencies into CNH to invest, but again that would depend on the derivative market, liquidity, and how it fits into their overall investment strategy.

A lot of it still boils down to the pool of offshore RMB savings. That has not really been growing over the past few years, so it creates a phenomenon where you only see new issues coming in when there have been redemptions in the market. You’re not going to see a big growth in the market, unlike how it was many years ago.

IFR ASIA: Where do you see that ending up? If you go forward five, 10 years, will there still be a deep and liquid offshore market?

PAULA CHAN, MANULIFE: No.

KO-WEI HSIUNG, HSBC: There will still be an offshore market; it’s not going to go away. Then I would say it really depends on the progress of RMB internationalisation. One possibility is that the offshore RMB takes the same path as the US dollar market, for example, where you have both an onshore US dollar market and an offshore US dollar market. On the other hand, given the correlation between the onshore and the offshore RMB market, the growth of onshore market will have an impact on how the offshore RMB market will look in the future.

IFR ASIA: Any views on Taiwan? There used to be a fairly active Formosa market in Taiwan.

KO-WEI HSIUNG, HSBC: There still is. But I would say it’s very regulation-driven again. There have been a lot of new regulations introduced in the local Taiwanese market this year, and that has had an impact on the appetite for various instruments. Having said that, Taiwan is still the second-largest offshore RMB market, in terms of RMB reserves held by corporations and the banking sector. It’s still a market that you cannot just ignore, but would depend on the level of reserves and whether there are sufficient funds to support transactions.

IFR ASIA: Ricco, we’ve talked about the idea of RMB internationalisation through Silk Road bonds. Did we ever get anywhere with those?

RICCO ZHANG, ICMA: One angle is to basically combine the Belt and Road Initiative with the Panda bond. The Chinese authorities have made it clear that any Belt and Road issuers are welcome to tap the Panda bond market - that applies to both the interbank market and the exchange market. I expect Panda bond guidelines for the exchange market will follow by the end of this year, and the two exchanges will compete with each other to attract issuers. We all know the Belt and Road initiative is about infrastructure financing, and the biggest players are Chinese corporates. RMB would be the ideal currency for them when they consider funding such projects, and I expect you will see more of them issuing bonds as a result.

I would also echo what has already been said that the onshore market would be better than the offshore market. Offshore liquidity is definitely not doing great. When people talk about RMB internationalisation, they used to expect a lot of Dim Sum bonds, but that has shifted. First it is again about the currency. We’ve moved from appreciation to depreciation. Second is a very substantial change in regulations. The Keepwell structure is one example. The format has been widely used by Chinese issuers in Hong Kong as an alternative to a guarantee structure, because if the bonds are guaranteed by the onshore parent company the money cannot go back to China. The Keepwell allowed the funds to be repatriated back to China. Now, the regulatory requirements are gone, so you can just put the guarantee on the table and the money is free to go.

Ask anyone to predict the next five or six years and the answer will always be “We don’t know”, because it’s always shifted so quickly.

TONY TANG, PENGYUAN: Also on the Belt and Road initiative and Panda bonds, I think Chinese investors are so used to investing in their domestic market. Understanding the credit risks in all these Belt and Road countries is a challenging task for onshore investors. So for the Belt Road credits to take off in the Panda bond market, I think that the onshore investors have to be comfortable first.

That goes back to the first topic we talked about. The rating agencies going into China can provide a rating service from an international perspective, and then hopefully onshore investors will also get used to those risks. At the same time, I think it is also important that the onshore agencies provide more credit opinions outside of China for the Belt and Road projects. That is also a challenging task. You need to have a criteria system and a model that works. You also have to have an analyst who’s actually experienced in covering those countries. Yes, it’s easier for a Belt and Road company to decide whether to come to Chinese onshore market and issue bonds, but it will take some time for a young market to understand the outside world. To get a proper understanding on the credit risks of that particular company, you probably need to have an understanding of that sovereign first. All these things will take time to develop.

IFR ASIA: Do we think that RMB bonds will play a big part in the Belt and Road?

KO-WEI HSIUNG, HSBC: I am very assured that it’s going to play a big part in what we’re going to see going forward. We’ve been talking to many different issuers in Belt and Road countries, and a lot of them have expressed very strong interest in what the RMB market would be able to bring to them.

I think some of the issues that they face - whether it’s understanding the foreign exchange regulation or about the market itself - those are obstacles that will eventually fall away, and then we will see a very strong participation from the Belt and Road countries in the onshore market. We are already starting to see that now, actually.

IFR ASIA: Is it true that a Belt and Road issue has a chance of getting a much quicker approval?

KO-WEI HSIUNG, HSBC: Yes. There’s actually a fast track channel for the Exchange Market.

IFR ASIA: Do you see any possibility that an onshore credit enhancement agency will get involved in some of these Belt and Road bonds?

TONY TANG, PENGYUAN: The credit enhancement agencies themselves are going through a change in China right now. The regulations around the financial guaranty companies are still not fully settled. A lot of those credit enhancement providers were actually called financial guarantors in the onshore market, but they’re not true guarantors in some cases. There have been many cases that these financial guarantors refused to fulfil their payment responsibilities in the event of default. The legal system around this industry needs a lot of improvement, I must say. For them to expand offshore is a much bigger challenge. To provide a professional service they’ll need to take a fee, like 1% or 2% on the issuance, and if they don’t understand the credit risks of an issuer then they probably will charge more. And even if they do provide some kind of credit guarantee, how can they enforce the repayment and model the recovery to protect themselves? That will be difficult.

Chinese investors don’t really have a lot of experience with the global capital markets. In the domestic market they are very direct. For example, if they are investing in the pharmaceutical sector, they probably will buy funds, patents, shares, bonds – that’s all fine. When it comes to cross-border activities, it’s still very much limited to that direct style. I don’t really think they have the confidence and experience in more sophisticated financial services. Maybe the policy banks can provide some credit enhancement mechanisms, but for the regular commercial financial services companies to do that it’s very difficult now, in my opinion.

IFR ASIA: What do you worry about between now and the end of the year?

STEVE WANG, CITIC CLSA: The biggest risk towards the year-end is refinancing. We are facing some significant maturity schedules against a backdrop of policy changes and trade tensions. The refinancing pressure for property developers is quite severe and we still haven’t seen the biggest player come into the market so there’s a constant fear around the trading floor.

The market doesn’t have a lot of risk appetite at the moment and it’s the same for any trader providing liquidity. We have had multiple years of a strong bull market and this year is very different. It’s still going to be very challenging in the fourth quarter and into 2019.

My analysis shows that the refinancing schedule really picks up into the second quarter of 2019, so the market needs to sort itself out, stabilise, and work its way through some of the refinancing challenges. If not, then we may see some more blood on the table towards the year end. That being said, we are still optimistic that policies will shift and things will stabilise in the fourth quarter, but I would say refinancing is the major risk.

IFR ASIA: Is that the same for you, Paula? Is that (refinancing risk) what you worry about?

PAULA CHAN, MANULIFE: For us, we are more concerned about secondary market liquidity, even in the IG space. Bank balance sheets have been strengthened, but their staying power is not as great as before, from our observation. If we want to exit the market in a block trade it is just very, very difficult. So we protect ourselves by staying in benchmark names, and we’re very nimble. We’re doing a lot of work on position sizing, making sure that we can exit if we want to. The market is going to be very nervous into the year-end, because the mid-term presidential election is due.

The dollar strengthening story is bothering me. I think the central banks here in Asia have been proactive with rate hikes. They are doing their jobs much better compared to 1997 and the global financial crisis, so I give them credit for that. The problem will come if markets start to get crazy and feel that the Fed is behind the curve. We’re seeing wages picking up in the US with some feel-good factors. Friends of mine are looking at what to do with their tax rebate. They are spending. Mercedes Benz just said they are building their new SUV in the US. So if the capex is also starting to work, it will be a powerful engine in the US.

I’m not sure how Asia is going to play out if we head into an inverted curve in 2019. At the moment, not a lot of people are talking about it but that’s something I’m looking at. On the rate side, I can use the Treasury market to do hedging. For credit, especially in Asia, I don’t think we have had to deal with an inverted curve for a long time, so that’s something I’m thinking about.

IFR ASIA: Well, the RMB is the answer then!

PAULA CHAN, MANULIFE: Of course, yes. It’s still a work-in-progress, but this is something I’m looking at.

RICCO ZHANG, ICMA: I also want to respond to the point about liquidity and refinancing. 2018 and 2019 are big years in the capital markets for refinancing, so it’s quite critical. In the short-term or maybe in the next two or three years, the trade war may actually be expanded. Geopolitical factors will affect the market.

Liquidity has been a concern for at least the last three or four years. We publish a liquidity report every two years globally, and now we have extended the study to Asia. Because of Basel III, the banks that were supposed to be the dealers and market makers are not allowed to provide so much liquidity any more. That’s been really a big issue for the debt capital market.

IFR ASIA: Ricco, how does the RMB fit into the growth of the Green bond market?

RICCO ZHANG, ICMA: The green market in Asia is driven more by issuers and government policies. In 2016 the Chinese market was already the biggest in the world for Green bond issuance. Last year, it was second behind the US, but the difference is not that substantial. This year the market has continued to grow, and different countries have schemes and incentives to encourage more issuers.

The Hong Kong government is really committed to building Hong Kong into a green finance hub. They have put two schemes on the table. The first is a grant, covering the cost of verification, and a separate incentive for first-time issuers in the Hong Kong market, basically to cover 50% of their issuance costs with a cap. That’s all relevant to encourage more Green bond issuance in Hong Kong.

Second, last month the Hong Kong Green Finance Association was launched. I will be co-chair for the Green Bond Working Group. green finance also covers green insurance, green investments - everything. The Hong Kong government has also committed to more Green bond issuance to raise awareness in the community.

IFR ASIA: Just thinking about what we’re talking about today, will you get an easier approval route perhaps for a Green bond in the RMB markets – say a Green Panda bond?

RICCO ZHANG, ICMA: Well, exactly. One thing people worry about is that there may be too much labelling. Actually, the first Green Panda bonds were issued two years ago by the New Development Bank. Definitely if Belt and Road issuers tap the market they could do a Belt and Road Green Panda bond. I would say actually it’s a good thing. And as Ko-Wei said, there’s a fast-track to make the approval process faster than a conventional bond. I wouldn’t expect that to last forever, but at least for the next one or two years, being green will help.

KO-WEI HSIUNG, HSBC: From what we’re seeing, the Chinese regulators are definitely very welcoming for issuers considering something in the Belt and Road format or in the green format. I think those are the two priorities for the market. Also from HSBC’s perspective, the growth of Green bonds and Social bonds is definitely one of the big themes of the past year. Traditionally, this has been much focussed around some of the very large corporates or financial institutions trying to “green” their transactions, but now we’re seeing a broader issuer base.

It’s very difficult to quantify the benefit to an issuer on day one, but we are seeing that access to the Green bond market has a positive impact for issuers across the entire curve. As well as other intangible benefits, that’s a very strong argument to look at this market - no matter in China or elsewhere.

IFR ASIA: Is this something that Chinese rating agencies are aware of, Tony?

TONY TANG, PENGYUAN: Yes, you know, we will be publishing very soon our green evaluation criteria in Hong Kong. It’s not really about credit risks, that’s the first point, but credit agencies can rate how green the issuance is, and help assess the use of proceeds. The governance factors, reporting and disclosure are all part of it. The second point is that it’s a ‘point-in-time’ assessment, not like a credit rating, where we have ongoing surveillance.

IFR ASIA: Do you think that the typical Chinese investor looks at those as part of their investment decision?

TONY TANG, PENGYUAN: I think it was a big thing a few years back because the government was pushing it. Environmental protection has become a big topic for the government and also for society. From my observations, China’s investors are, I would say, less environmentally aware than, say, European investors. Green issuers in China are more about a policy incentive or aligning themselves purely for the policy benefits. I don’t think at this point it’s a nationwide social awareness and conscience yet.

IFR ASIA: I wonder if industries that are actually getting government subsidies for being “green” are going to be better credit risks in the future.

TONY TANG, PENGYUAN: Not necessarily. The credit risks are about financial performance and the ability to compete in terms of business, which in turn translate into the issuer’s willingness and capacity to meet its financial obligations. It’s separate.

RICCO ZHANG, ICMA: Actually, from the investor side, I think being green does make a difference. The policy alignment is there. If you have two identical issues in the market, would you choose the green one or the not green one? I guess the answer is probably quite straightforward. We think the green market is going to continue growing.

IFR ASIA: Ladies and gentlemen, thank you very much for your time.

To see the digital version of this roundtable, please click here

To purchase printed copies or a PDF of this report, please email gloria.balbastro@refinitiv.com