IFR Asia: Welcome to the IFR roundtable. We have for you a discussion on the internationalisation of the Asian capital markets, and a wide range of views represented on the panel.

The first question to kick things off is why are we here to talk about Asia? In my mind, it’s because of a few recent major developments in Asia’s biggest capital markets, China and India, but I’m going to ask Alexi for your view on how significant the Asian emerging markets are and what internationalisation really means.

ALEXI CHAN, HSBC: Thank you, Steve, and thank you IFR for sponsoring this important event. I’m delighted to be here with this distinguished group of fellow panellists.

I think it’s a very exciting time to be talking about Asia’s capital markets. We’re more than 20 years now since the Asian financial crisis. At that time, people were talking about Asia’s over-dependence on the bank lending market and the importance of developing a capital market that could sustain the needs of corporates – in both local currency as well as other G3 currencies – and take advantage of what the capital markets can offer in terms of scale and tenor.

I’m pleased to say that we’ve reached a position in the last few years where Asia has become the largest capital market among the global emerging markets. In hard currency, we’ve now got a regional G3 bond market expected to print well north of US$250bn this year. That has provided a very significant source of financing for governments in the region, for financial institutions as well as corporates.

So, the development of an Asian dollar bond market, with a significant number of investors in the region as well as globally, I think has been a pretty unique feature of the international financial system, and one that we’ve strongly encouraged.

If we look on the local currency side, we’ve also seen good progress in Asia’s local currency markets right across the region. I think the most significant development is how the RMB market is opening up. We’ve had a number of offshore local currency markets, including the Dim Sum market in RMB, and that has extended to other major markets like India, which has developed the Masala bond market. The offshore markets have given international investors a way to provide financing to Asian and other issuers, while taking on the foreign exchange risk themselves, and that’s been an important development.

Clearly, one of the goals that we’re working towards is a greater opening up of the domestic markets themselves. Onshore China represents a very major opportunity. We’ve brought a number of global issuers to the Chinese market in the sovereign space, including European sovereigns like Poland and Hungary, and a number of the supranational issuers have also tapped these markets and helped to develop these markets in terms of both access and the curve.

These are exciting developments in terms of both hard currency and local currency, which really makes the Asian capital markets a pretty exciting place to be right now.

IFR Asia: There is a good talking point around Asia’s exposure - or the emerging markets’ exposure - to what happens here in the US as well. Arnab, when US rates go up, emerging markets tend to underperform. What’s your take on where Asia fits into in that picture?

ARNAB DAS, INVESCO: Yes, it’s certainly generally been the case, that when US interest rates go up and the US yield curve rises or steepens, and in particular the dollar strengthens, then you usually have some kind of adjustment in emerging market countries and many other places around the world.

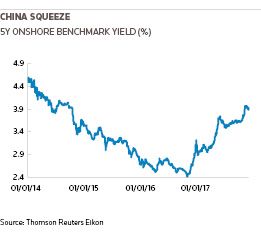

I would suggest, looking forward, the bigger picture here is that the global monetary policy cycle among the major central banks is converging towards the Fed rather than diverging. The ECB is in the process of getting ready to taper and then will probably eventually start to raise rates. The Eurozone is growing above trend. China’s major central bank operates behind capital controls, but it’s already been tightening. The BOJ faces an economy that’s growing well above trend, although like many other places, inflation is still missing in action.

As long as there aren’t any surprises, or let’s say significant shifts, in fiscal policy in the US, the bigger picture is that the monetary policy differential between the Fed and the other central banks is closing, and the dollar, if anything, is expensive – not cheap.

The dollar tends to behave in multi-year cycles, so we’re probably likely to see a weaker dollar rather than a stronger dollar, which should be conducive to continued interest and inflows into emerging markets. Especially in this global macro sweet spot, where growth is reasonably strong, inflation reasonably weak in most places, and financial conditions extremely easy. So, it should be very conducive for more change and more interest in Asian local markets, and other parts of emerging markets as well.

IFR Asia: Do we think, then, that opening up Asian markets provides some kind of protection from global capital flows, or does it leave Asian countries more exposed? Bill, maybe I’ll throw that to you. I know you’ve looked at these questions in particular regard to India.

BILL FOSTER, MOODY’S: Sure. The Indian market is quite closed when you look at it on a relative basis. Foreigners hold only around 4% or so of outstanding government securities. By 2018, the expectation is it will go up about 5% or so, but foreign investors are very limited in terms of their potential exposure. The corporate bond market in India is very under-developed as well. It’s only about 5% of GDP in total. There’s really not a lot of opportunity for foreign investors of scale to really participate as much as they would like, I would say.

The Masala bond market in particular, which is an exciting new potential opportunity, is a very nascent market, and we’ve seen some kind of fits and starts recently in terms of its development. In particular, very few issuers are eligible for that market - only the highest quality of issuers, like the HDFCs of the world and certain state-owned enterprises. More recently, the government has decided to set more limitations, basically, on who can use that window. They’ve shifted the restrictions towards the external commercial borrowing window, which places certain tenor and price restrictions on the issuers.

So, when you look at India in particular, it’s really in the early stages. The reason that this is happening is, I think, because the domestic market itself is still in the early stages of development. The RBI and SEBI, the securities market regulator, are very much focused now on continuing domestic market development, providing more depth, more liquidity. Still, the majority of corporate issuances, for example, are really private placements. It’s going to take time, and some of the analysis behind this is it’s a bank-driven lending model still driving the economy. This is what’s led to significant issues with regard to infrastructure projects and high NPLs in the banking system, because of the maturity mismatch.

So, the incentives are very much there for the authorities to continue to develop that local market. They’ll be focused on that over the next few years, but it will take time for foreigners to be able to participate at scale because of these issues that we’re dealing with.

IFR Asia: Monish, perhaps we can ask you for the official sector view. How crucial is it to open up and develop capital markets from a development perspective?

MONISH MAHURKAR, IFC: From IFC’s perspective, we have observed over many years that there are recurring lessons from various crises. Certainly the Asian crisis was caused by excessive foreign currency imbalances between assets and liabilities. That was a lesson well-learned in Asia, and that’s the time when the development of local bond markets started in all seriousness.

In our own case, while our primary lending currency is the US dollar, which offers the maximum liquidity for us to finance our clients, we have seen a growing demand from many of our clients to finance in their own currency. It is quite logical because, unless a client has export revenues in foreign currency, all others who have domestic revenue streams should be appropriately borrowing in their own currency.

The challenge, of course, is that in many markets where inflation rates are high, nominal interest rates are high as well. When you compare nominal double-digit or high single-digit rates with a very low nominal one in dollars, the temptation is to take the lower one. It’s only in hindsight, or after a major currency devaluation or correction that you realise how expensive that tempting low dollar coupon actually was.

Over the years, we’ve been pushing the development of many domestic markets. Where sometimes domestic markets don’t provide the right opportunity, we try and find these bridge products, like the Masala bonds that were created in late 2013, early 2014.

Eventually, these offshore markets are only as good as the domestic markets, because there is an inevitable concern among regulators and policy makers that you can never say that money coming from the outside will only be one way. Every time it comes to a sudden halt, it creates a lot of disruption and volatility and has a serious impact on the real economy.

So, while we would like to see one-way growth, less restriction on foreign capital inflows and instruments that allow foreign capital to flow in – including through Masala bonds, for example – there is some understanding among policy makers, and certainly amongst ourselves, that there are some real issues out there. Right now, we are financing about 25% to 30% of our total client financing globally in local currencies.

Asia is, on balance, less challenging than sub-Saharan Africa or other less developed markets. In India, for instance, to pick up on your point on the Masala bonds, since we were able to access that instrument, our India programme literally doubled within the last two years, because that’s where the gap and the need was.

To push this forward from here, what we have done recently in the World Bank Group is to establish a group-wide programme called JCAP, short for the Joint Capital Markets Development Programme. Partly this is meant to complement the work that we do from the treasury side to actually then follow through to policy work and regulatory work to make sure that it is embedded in longer term, more stable policies, and that the markets continue to grow.

I think it’s an exciting area. It’s still growing, as you said, and there are still a lot of challenges ahead.

IFR Asia: Is that programme available to any country?

MONISH MAHURKAR, IFC: Given, of course, there’s always the challenge of resources, the aspiration is to take it to as many markets as possible, but the reality is that we have to begin by focusing on a few select markets. We have picked a mix of the least developed and some semi-developed markets to focus on initially, but eventually we hope to get it across to as many markets as possible.

IFR Asia: Eddy, let’s bring you in on this one. What is it like from a foreign investor’s point of view when you look at Asian emerging markets? You have to make a choice between hard currency, local currency, offshore and onshore. How do you go about doing that?

EDDY STERNBERG, LOOMIS SAYLES: That’s an excellent question, because we do actually invest both in hard currency and in local currency, through different strategies. Sometimes we mix them, but it’s seldom. Both markets have had their challenges lately.

On the hard currency market, you mentioned US$250bn in issuance for this year, a lot of it coming from China, with a large investor base in the region. We’re about 12 hours apart from most of the Asian region here in the eastern United States. When we go to bed, they wake up, they go to work. Here comes a company that decides to issue a bond with the help of the capital markets people. They find lots of investors who are willing to pay very little for this debt. We wake up, we say, “Oh, they’re issuing, we want to participate.” They say, “So sorry, but we already placed the bond.” So, everyone there is already invested and we’re left out.

How do you resolve that? You have local offices. In our case it’s great because we have one, but it still requires a lot of coordination between, in our case, Boston and Singapore. So, that has its challenges. The investor base and the amount of savings in the region is enormous, and the willingness to pay very little is very high. I’m an old-fashioned emerging markets person, so I don’t like 3%, 4% yields!

On the local markets, they’re rather small in some countries. The two largest ones are China and India, and they’re both for the time being harder to access for foreign investors. One is rapidly moving to open itself, not without some details to resolve, and that’s where the devil appears.

Let’s take India, which is the one that’s not opening, although it sort of opened a little bit late last year, or early this year. In the past, you had to pay for the privilege of lending, which is sort of awkward. You have to pay to be able to lend to the government. Not everyone was willing to do that.

IFR Asia: You’re talking about quotas?

EDDY STERNBERG, LOOMIS SAYLES: I’m talking about quotas, yes. You have to pay to use a quota. You also had to use the quota all the time, and if you stopped using it for 45 days you lost it, and then you had to bid again and pay again. More recently, the quota has been increased and the cost came down until it reached zero. We used that opportunity, but then that night that we invested, it closed. Again, it reached the limit. So, that is a problematic market.

The Masala bond market would help us out with that. But, whether it’s Masala bonds or whether it’s the Brazilian offshore market or any other market, I’ve personally learned to dislike them because they are not available to local investors. They’re only available to foreign investors, and the foreign investors tend to move in a pack. We all buy at the same time, we all sell at the same time, and it doesn’t necessarily reflect local dynamics.

This year, for example, we had the privilege of investing in two bonds in India, because the corporate bond market is actually easier to access. By corporate bond market, I mean more the quasi-sovereign bond market. In that case, we had one Masala bond and one local domestic corporate bond. Interest rates were coming down in India, inflation was coming down, so everything was working out.

The local domestic corporate bond behaved the way we expected it to, so yields came down, so that is a capital appreciation for the investor, it was good. The Masala bond initially didn’t do anything, and it took quite a while for it to start behaving like the local bond, and it never accomplished the type of return that the domestic bond market had. So, I don’t like it.

IFR Asia: They do pay you more than 3% or 4% though, don’t they?

EDDY STERNBERG, LOOMIS SAYLES: Yes, in India you do get higher interest rates, but then the currency can depreciate. It’s not always on an appreciating trend. That happened late last week, I think.

To see the digital version of this roundtable, please click here

To purchase printed copies or a PDF of this report, please email gloria.balbastro@tr.com