IFR ASIA: Welcome everyone to our discussion on how the debt capital markets can support long-term development in South and South-East Asia. Neeraj, how far have we come, and how attractive are these markets to a global investor?

NEERAJ SETH, BLACKROCK: We obviously have seen a significant growth in the capital markets in the region from where we were, let’s say, 10 or 20 years ago. But the fact is, the capital markets are still very far from where they need to be. From a longer term perspective, you would see a very strong correlation between deep, functioning capital markets and economic growth.

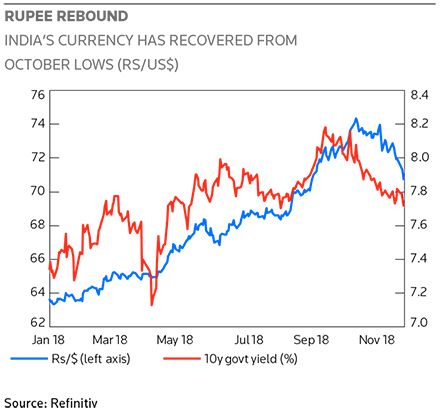

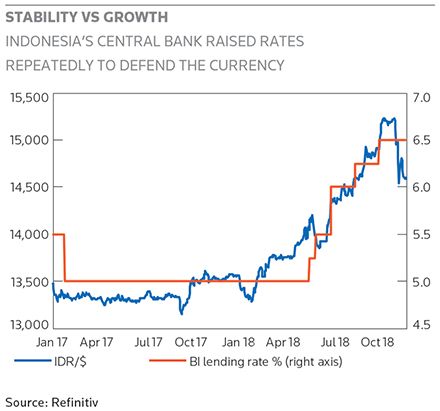

Now, at this juncture, everybody is worrying about what’s happening in terms of market volatility – the move in the Indonesian rupiah, Indian rupee, or any other currency in a broader EM complex. It does get pauses from a lot of international investors. It also has changed the course on the policy side, with five hikes from Bank Indonesia over the last six months, up 150bp, and some outflows from the region.

I would argue, from a longer term perspective, the fundamentals of the region and a lot of these countries are still actually very strong. It does still warrant, if anything, more of a focus from global investors. But there’s still a lot to be done – and I’m sure we’ll discuss as we go through the panel – from the government, from the regulators, to help develop these markets.

I don’t think there are major concerns. Yes, we are going through some noise because of the macro factors, which we can talk about, and obviously changes in the US policy, trade tensions and oil price are causing some concerns. But fundamentally, I would remain positive on a lot of these economies, and I do think there’s a case for longer-term growth of these markets.

IFR ASIA: Christian, when you look at governments in this part of the world, where have we come since, say, the Asian crisis 20 years ago? How much more resilient are we today?

CHRISTIAN DE GUZMAN, MOODY’S: There are certain ways we can look at Asian ratings today versus 20 years ago. There has been a sort of divergence as a few of the countries in the region haven’t actually recovered to their pre-Asian financial crisis rating levels, in particular Thailand and Malaysia. But then there are those who have actually surpassed their pre-crisis rating levels, including the Philippines and Korea.

By and large, over the past 10 years, what we have seen amongst all these, with the exception of Thailand and Malaysia, is a general increase in their actual sovereign ratings. That reflects a number of things, as Neeraj was mentioning. The fundamentals have improved, whether that means moving to an economic growth model with more value-added activities; whether it’s in terms of access to funding, or a lower reliance on external financing.

The institutions are also very important. We’ve acknowledged that with regards to Indonesia and India, more recently. Last December we upgraded India, and earlier this year, we upgraded Indonesia. We knew that a lot of the pressures we are seeing in these two countries today were there – they didn’t just pop up this year. But Moody’s had expressed greater confidence that the institutions have been set up to withstand a lot of these pressures when they do come, and certainly that firefighting that Neeraj mentioned has made a big difference in the case of Indonesia.

Perhaps in 2013, we saw the institutions here in Indonesia as a little more growth-oriented, but in the current context, we saw a pre-empting of some of these pressures with Bank Indonesia hiking in advance, and acknowledging that the global environment was shifting.

This is a bit of a sea change that is reflected in our view of the fundamentals in the region.

IFR ASIA: What does all that mean for corporate credit, and access to capital? Augusto, I’m going to come to you on that.

AUGUSTO KING, MUFG: I think one critical change in the region is really the growth of the domestic market. One could argue that the domestic market is deep enough now to allow the vast majority of credits to be sold domestically, so as a result, you can see in the region that corporates do have the choice – at least the better ones have the choice – of either looking internationally, or looking domestically.

Of course, the challenge for the lesser-known corporate credits is that maybe the domestic market is not ready for them yet, but for the better credits – some state-owned enterprises, for example, or in the case of India, some of the PSU – do have access to both the international market and the domestic market. That is one significant change we have seen over the last 15, 20 years in Asia. People have a much greater choice.

Of course, one would want to investigate to see how we can actually deepen the respective domestic markets. Again, for some of the very good credits, they do have an option to look internationally or domestically.

IFR ASIA: Soufat, specifically on Indonesia, how confident are you, as a fund manager here, about some of these risks and tensions that the market is facing?

SOUFAT HARTAWAN, SCHRODERS: In Indonesia the rupiah bond market has become one of the most active local markets in the world, ever since the Indonesian banks were recapitalised nearly 20 years ago. Along the way, the search for higher yield has revealed that Indonesia is improving fundamentally, and is on the right path of reform.

As a local emerging market, we have some weaknesses. A lot of foreign involvement makes this market more vulnerable to capital inflow or outflow. Currently we have nearly 40% of foreign concentration in the rupiah market. That is roughly US$50bn. Now, if you compare that with our reserves at slightly above US$100bn, this can create a potential instability should there be a major outflow from foreign investors.

Of course, our fundamentals speak for themselves. We’ve seen three major events in the last five years. The first one was probably during the Asian taper tantrum back in 2013. The second one in 2015 during the China devaluation, and probably the recent one is this year, the EM market rout. But, I think we’ve learned a lot from those crises. The government policy has been quickly addressed to stabilise the market, and the policy that has been made is always to avoid the worst market expectation.

For example, this year, we know that the currency will have to depreciate to be in line with other EM currency. Now, we are almost in line with India, and probably other emerging market currencies. So, if that’s the level that the market wants, then we have to follow that in order to maintain the confidence.

The crisis that we’re seeing this year – probably a mini-crisis – is slightly different from 2013 and 2015, because this is where the global central banks are starting to normalise interest rates. The market has its own mechanism to adjust by itself. The Indonesian bond yield has been rising by more than 200bp. That is probably what the market expects where the tightening should be.

If you look from the foreign perspective, the real rate differential in holding the Indonesian government bond is one of the most attractive in the world; currently, about 500bp. It’s very difficult to find such a real differential anywhere in the world! Even with the recent opening up of the China local bond market, we think the impact will be marginal, because we are still carrying one of the highest-yielding currencies that is the most attractive for carry trade.

But, of course, the key is the FX volatility. With the recent volatility, it is hard for a global investor, such as Neeraj, to see the entry point on when we should invest in the Indonesian bond market. My observation reveals that as long as the hedging costs, the FX swap premium, are either in line or below the bond yield, that’s the time when markets start to see positive intervention.

What we need to see going forward is whether the FX market stabilises a bit further, and that’s when we will see the real positive relationship in the eye of the investors.

IFR ASIA: Yes. I’m interested in what the rest of the panellists think about Indonesia at the moment. Christian, with 37.6% of Indonesian government bonds owned by foreign investors, is that a weakness from a rating agency point of view?

CHRISTIAN DE GUZMAN, MOODY’S: I would say that is one of the key weaknesses for Indonesia.

I think the 37.6% maybe understates the risk. I believe that’s the proportion of local currency government bonds that are owned by foreigners, but then let’s not forget that 40% of the government’s debt stock is also denominated in foreign currency. You can pretty much assume, given shallow capital markets onshore, that most of that – if not all of it – is non-resident debt. We understand that some of that are indeed concessional exposures, to the World Bank, the ADB, but by and large, a lot of that is just market debt.

For example, Indonesia is a key pillar in the Islamic financing market, where they are the largest US dollar sukuk issuer in the world, and I think many Islamic investors do look to that steady supply every year from the Indonesian government.

There’s a strength there in terms of the diversification of funding sources, but mirroring that is the weakness, in terms of the continued reliance on overseas debt.

Going forward – perhaps piggybacking on what Augusto was mentioning – what we need in Indonesia to address this weakness is further development of the local capital markets.

It’s been present in other markets in Asia, but not necessarily in Indonesia. We don’t have a captive form of savings, like we do in the case of Malaysia, or Singapore, with large provident funds. We do have BPJS here in Indonesia, but it’s simply not big enough to help fund the government. Further development of local captive sources of savings – that could include the insurance sector, for example – could go a long way in terms of addressing these key vulnerabilities related to the reliance on external financing.

IFR ASIA: Neeraj, it’s one of these topics that comes up a lot. Foreign investors want an open market to invest in, but that’s going to create vulnerabilities when it comes to an emerging market sell-off. How do you see that playing out here?

NEERAJ SETH, BLACKROCK: When you think about any capital market, and the way capital flows around the world, it’s very much intermingled. To some extent, having your capital markets integrated in a global capital market through open channels, I do think it’s positive.

Now, yes, it comes with some risk. If you have close to 40% government bonds owned by foreigners, and you’re going through the Fed’s normalisation for the first time since the crisis, you are seeing some noise factors around it. At the same time, I don’t think those noise factors are reasons enough to not keep the markets open.

From a foreign investor’s perspective, you can take different horizons. If you’re looking with a one or three-month horizon, you would be cautious today. But if you are someone who’s looking at a three to five-year horizon – going back to all the points you heard about in Indonesia in terms of fundamentals, valuations, where they are in real rates, nominal rates – I don’t see any reason why foreign investors should not be looking into these markets.

It’s not an easy answer, and there obviously has been a lot of debate. You have on one hand Indonesia, the government bond markets are open. I would argue in fact more needs to be done to open the corporate markets and equalise taxes, similar to government bond markets, and create more incentives for foreign investors to come in.

On the other hand, you have markets like India where there is still a quota – a maximum cap on holdings of government bonds. That’s surprising, because a lot of it is very much predicated on the perception that foreign investors bring volatility. Well, the fact is, it does, but more importantly, the key for a deep capital market is to have a broad base of institutional investors and retail investors, leverage the capital markets as channels for local savings, and have a proper allocation of capital for long-term growth. I think that’s the key objective.

If that’s what you’re trying to achieve, I think opening up of the markets is inevitable in today’s environment.

IFR ASIA: From my research, assets under management in insurance and pension funds total about 125% of GDP in Singapore. In Malaysia it’s about 80% of GDP. India about 22%. If you go to Indonesia, it’s about 6%. There’s certainly quite a bit of room for growth there.

On these local sources of demand, Augusto, what’s your experience been in connecting Asian issuers and Asian investors?

AUGUSTO KING, MUFG: Both Indonesia and India have been actively promoting offshore financings in their own currencies, what they call Komodo bonds here, and Masala bonds in India. We’re lucky enough to be involved in a number of those transactions. If you look at Indonesia there have been two Komodo bonds; one from Jasa Marga, and one from WIKA, and we were involved in WIKA.

It’s an interesting situation. When we’re trying to promote and sell these to international investors, there is always the question as to whether this is a rates product, a credit product, or a combo. I don’t think there’s a lack of interest but, again, there is certainly a lack of understanding in terms of how to make it work.

So when we talk about this particular topic, I think the key is really what we can do to actually enhance and develop the local capital markets. If you look at India and Indonesia per se, the lack of non-bank FIs is one critical hindrance for further development. Again, if you look at ASEAN as a whole – at least from a capital markets perspective – each of the markets is still relatively small. Any initiative in terms of creating some kind of common identity, or common platform within ASEAN, would certainly help as well. It’s been talked about for a long time. Again, I don’t think that has actually taken a lot of steps forward.

IFR ASIA: Soufat, I know you’ve looked at Komodo bonds as well. How big can that market get? Is it something that people in Indonesia should be quite excited about?

SOUFAT HARTAWAN, SCHRODERS: Certainly, this Komodo bond has been a major breakthrough for the Indonesian capital market. We have always had an issue around how we can access as many investors as possible. But we also have not many insurers in the Indonesian market that can manage the FX mismatch. Komodo bonds can be the solution for that; whereby Indonesian companies can issue in local currency to the offshore market, where the investor base is far greater.

As you mentioned, the Indonesian pension fund business is only 6% of GDP. That’s very small. So, if you want to gather more interest from the government market, the capacity is just not there. We need to explore other opportunities.

The Komodo bond market is still in the early stages of development. Firstly, not many issuers understand the mechanism, and secondly, there’s some outstanding issue regarding transaction settlement, and so on. Once we settle all these issues, we probably are going to see the Komodo be a bit more attractive for investors who want a greater yield over government risk, but want to have the local currency exposure as well. I think this is going to be another asset class in the future.

IFR ASIA: Neeraj, do you think creating offshore pools in the rupee or rupiah is part of the solution to bring long-term money into this part of the world?

NEERAJ SETH, BLACKROCK: I think it’s certainly a part of the solution, but if I look back in the last few years at the Masala bond out of India, and the Komodo out of Indonesia, I would argue the success is very mixed. The simple reason for that is what you touched on: for a lot of investors, it’s still not very clearly positioned. Are you taking a rates view, or a credit view? And from that standpoint, a lot more education is required. The countries, the regulators, the governments have to do more to actually educate global investors in terms of what the instrument is, what risk you are taking, and how it works.

Typically, the way you would do it is to start with the top end of the quality curve, and establish that curve in an offshore market. A quasi-sovereign, or even the sovereign should start that process, and then you make your way down to the corporate sector, and then from investment grade to high yield. You have to have more of an established instrument and curve, and then you can take it from there and use it for the corporate sector. So, it certainly is a part of the toolkit.

I would argue that the development of the domestic capital market remains the primary part of the solution. Other ways of diversifying the funding sources can add on top, but they will not be able to substitute for a big part of the missing capital markets in these countries.

IFR ASIA: Market liquidity often comes up as another obstacle for investors. Augusto, when you look around Asian markets, how has that evolved?

AUGUSTO KING, MUFG: Broadly speaking, over the last maybe seven, 10 years, if you look at any international bond issue, the Asian bid is very significant. I’ve been in this business for more than 20 years, and in my early days of my career, we always had to look into the US market for US dollar liquidity, but now the liquidity pool within Asia can support very large US dollar transactions, and even euro transactions for that matter. We are seeing these pockets of money not just from Singapore, or Hong Kong; we are seeing that from Korean, Chinese investors. Also recently, a lot more Japanese investors are looking beyond their normal zone and into South-East Asia for US dollar products. Asian liquidity in that sense has grown significantly.

Then we take a step back and look beyond the G3 currencies. What about liquidity in the local markets? It’s really a matter of whether those countries have put in any initiatives to direct liquidity into the capital markets. In Singapore and Malaysia, for example, vis-à-vis what we are seeing in India and Indonesia, there is a difference in terms of non-bank, non-FI liquidity. Is there enough to support a domestic currency trade? Again, that is the interesting part of capital markets development in the region. From the cross-border perspective, we see a lot more liquidity, but when you go into each country, it seems that it is not deep enough.

Certainly, there are a lot of structural constraints, and it varies from country to country. How can we actually have more sustainable capital markets in the region? It’s really about being able to develop domestic market access for issuers in their own countries, and maybe one day allow cross-border, or cross-regional issuance as well.

NEERAJ SETH, BLACKROCK: If I may add, just to put some numbers in perspective. If I look at our credit business in Asia ex-Japan, leaving aside local currency government bonds and the macro business, we manage about US$12bn in credit. About 90% of that is in US dollar credit, and it’s been 90%-plus at any given point over the last 10 years. That number hasn’t moved a lot since I joined the firm in 2009.

If you look at the dollar credit markets in Asia, they have grown from about US$200bn in 2009 to about US$900bn today. You do have liquidity in that market. You can issue with proper size anywhere between three and 30 years, and you do get liquidity across the curve.

When it comes to the local markets, and specifically the moment you go beyond government bonds and into the corporate segment, in any South-East Asian country, there are very few places where you will find liquidity. Malaysia and Singapore have some, yes. But in India it’s low. Indonesia, very low. That, obviously, is where the solution has to start from. It comes back to the point about creating a more institutional framework, with more, larger insurance, pension, other investors, getting more of the global asset managers to come onshore.

The last point I would make is in relation to creating the right infrastructure and the right institutional framework, with transparency and the rule of law. The creditor protection framework has to be fixed. When you get into corporate credit, the question is always “What happened in the last 5, 10, 20 years? What’s the history?” And if there are question marks anywhere in that history, foreign investors will hesitate to go beyond the government bond markets.

IFR ASIA: When you think about the 10% that you do allocate into local currencies, what’s really holding that back? Is it price? Is it credit risk? Is it liquidity?

NEERAJ SETH, BLACKROCK: It’s a combination of factors. It’s valuation, and it’s liquidity.

Now, in terms of valuation, if you think of your underlying base currency in dollars, which is the case for a lot of these pools of capital for us, you have to think of your returns in dollar terms. That means that if the hedging cost is too high, or if you are looking at it unhedged and the currency volatility is high, it affects the net dollar return you are going to make. Obviously, that’s more valid for the government bonds, but as you go down the corporate curve and you look at corporate credit, the underlying fundamentals and the creditor protection framework play a role.

Some of that does get reflected in the ratings, but even ratings will not be able to capture all of the risk, and that’s where it becomes an idiosyncratic risk that you are trying to underwrite. In a lot of these cases, you will have to have a very strong view. So, yes, that liquidity waterfall goes from government bonds to SOEs, or quasi-sovereigns, and to some good quality corporate, and it sort of stops there.

IFR ASIA: Christian, you mentioned this divergence between sovereign credits since the Asian financial crisis. How much of that is down to frameworks and policies, rather than economic growth?

CHRISTIAN DE GUZMAN, MOODY’S: One of the reasons we think why this time is a bit different from 20 years ago is indeed the institutional framework.

We’ve changed from the nearly universal presence of fixed exchange rate regimes, which led to the currency mismatches that led to crisis conditions all around the region, to more flexible exchange rate policies, and increased reserve buffers. Some countries that were literally counting reserves in days’ worth of import payments are now looking at months and months – hundreds of billions of dollars in some cases.

I think what’s underappreciated, other than these mitigants on the external side, are the domestic policy frameworks. In the wake of the Asian financial crisis, a lot of countries in the region implemented, or started to implement, inflation-targeting frameworks. Now, some of those countries were more successful than others in actually anchoring inflation, but I think that these frameworks have promoted macroeconomic stability, which is fundamental to creating the conditions for developing local bond markets. In particular, when you see how inflation has behaved in Thailand – which was the key source of contagion 20 years ago – their success in anchoring macro conditions has arguably been a source of comparative strength this time around.

IFR ASIA: Thinking about Indonesia, specifically, what more can the policymakers do here to promote the local market?

SOUFAT HARTAWAN, SCHRODERS: I think the government has made a lot of progress in promoting Indonesian government bonds, through regular issuance, and then by appointing about 12 primary dealers who constantly give investors proper quotations and valuations. There is also a continuous roadshow effort by government officials offshore to discuss with foreign investors. In terms of promoting the government bonds, Indonesia has done quite a lot.

This is happening in other emerging markets as well, whereby our liquidity is not constant. In a normal market, you can see a very decent volume in the secondary market, but during very difficult times, such as today, you will see a very, very illiquid market, concentrated in certain maturities. Very often you see that the yield curve becomes inefficient. This is basically not because of investor preferences, but it’s just because of liquidity factors.

Now, this creates a mispricing in the bond market, often during periods of volatility – like this time. What we need to see is that either the central bank as the macro stabiliser, or the government, can have a look at this issue. We need to see a stable, smooth yield curve that makes this market more credible.

I think a lot has to be done in this area. The Indonesian repo market is not as liquid as other markets. We do have a repo market, but it’s still in very early development. It’s not enough to support the secondary bond market.

In other areas, such as the local credit market, the size of the Indonesian corporate bond market is still very low, by comparison to the government bond market; at a size of one fifth of the government bond market.

The issue with the Indonesian credit market is, first, there is not much diversification. Around 70% of the credit market is basically issued by the financial sector. So, if I’m a fund manager looking to diversify into the credit market, then it’s a bit challenging because there’s not much diversification you can get from this market.

Secondly, the Indonesian credit market is basically dominated by pension funds and insurers. These are typically asset and liability investors. They are not active in the secondary market. They are just buying and holding for their balance sheet. We need to attract more active investors in this market to make the market more liquid.

Then, the last point, is probably the major issue within the Indonesian credit market, and why the Indonesian credit market is less liquid than the government bond market, is the absence of the market makers. There are about 12 market makers in the government who constantly provide prices to their clients, but you find a different case in the credit markets. You have to find a counterparty and insist on the price. It’s becoming less liquid. Going forward, it’s important to appoint a market maker in the credit market to make price discovery more reliable.

IFR ASIA: Is that a job for the regulators, do you think, or is it something that has to grow organically?

SOUFAT HARTAWAN, SCHRODERS: In the government bond market, the market makers are appointed by the Ministry of Finance, but it’s a different case in the local credit market. Maybe it’s not a direct appointment by the authority, or OJK, but I think it has to be appointed by the interdealer market association. We have to sit down together and try to find a way to make this market more liquid by appointing some of their members to become market makers. Maybe two or three as a start, and then we can gradually increase.

CHRISTIAN DE GUZMAN, MOODY’S: I would just like to add a macro perspective. In the current context where we’re looking at capital flow volatility, we’ve all acknowledged that domestic capital market depth can be a mitigant to those volatile external flows. In the case of India, the government has been able to withstand the capital flow volatility because there is captive demand, in the form of statutory liquidity requirements for the banks. Despite the wide deficit and the Indian government’s high debt, you have that captive source of financing because the regulators had said so.

In the case of Indonesia, they are not quite there. But a few years ago, the regulators said that the non-bank financial institutions have to hold a certain proportion of their balance sheet in government bonds, thereby deepening the domestic government bond market.

To your point, it didn’t grow organically, but the government is taking steps. It is signalling the commitment to deepening that onshore pool of investable funds. There is a role there for policy.

IFR ASIA: You mentioned India, which is a really interesting example at the moment, because the local bond market is growing very fast, but it’s mainly because the banks are in such trouble. Is that what’s forcing the regulators to act?

NEERAJ SETH, BLACKROCK: It’s actually quite interesting that if you take a longer horizon, let’s say a five to 10-year view, it’s absolutely clear that the banks in India will continue to lose market share and the capital markets will develop further. In fact, beyond the capital markets, it’s also the alternate sources of credit – private credit or the NBFCs – that will keep taking market share from the banks. In some ways it has more to do with the fact that the banks are in such a bad shape, still at a point where the NPLs are north of 10%, and it will take a long time to resolve that problem.

When we look back 10 years down the road, one of the things I would argue that has been a very important reform in India is the new bankruptcy code – if the country manages to implement the new bankruptcy code well. There are signs that it’s already in process. There have been some teething issues, which you always would expect, but there is commitment to it. If that bankruptcy code gets implemented properly, that will be a very significant shift in, again, the creditor protection framework.

Now, there are other aspects which the country hasn’t done. In the case of India, the debt markets across government bonds and corporate credit are still not fully open to foreign investors. That part is yet to happen. I think that will take longer, given there has been some resistance to opening the market to foreign capital flows. But there is more and more onshore development with the mutual funds, the asset management industry, insurance, pension funds, and the banks which have their SLR requirements, and you are seeing a deepening of the markets on the debt side across government bonds, and more so even in credit. There are a lot of things happening.

Obviously it all looks very noisy from the outside, but when you dig deeper, it’s an unbelievable opportunity as a credit investor, and if you think from a longer term, the market share of the banks going down is going to be positive for the country.

IFR ASIA: Let’s open this discussion to the floor.

AUDIENCE: I’m with CalPERS. We’re a pension fund in the United States. In the panel’s opinion, why do South-East Asian finance ministries seem so hostile to foreign capital? They don’t do the simple and easy things that would attract significantly more portfolio investment from people like us.

For example, this 36.5% of foreign investors in the Indonesian bond market, that’s a myth. Half of that is Asian reserve managers who don’t hedge, and don’t have any tax issues. For private investors like us it’s less than 20% of the Indonesian bond market.

India, is like the poster child for hostility to foreign capital. And when you speak to policymakers, they have no interest in changing the tax, the Euroclear ability, the repo markets. Nothing. Why is that? Why is this region so resistant to doing these small things that would make it much easier for us to invest?

IFR ASIA: Excellent question. Christian, you know, you look at policy around Asia. What’s your take?

CHRISTIAN DE GUZMAN, MOODY’S: Well, I wouldn’t necessarily say that they’re hostile to all sorts of foreign capital. I think what you’re seeing, in many cases, is that some of the policymakers were on the front lines 20 years ago. I don’t know if hostility is the right word, but they have been burned several times. So, perhaps there is a wariness.

But they’re also quite open to the stickier types of capital flows and FDI. Even then, of course, there is an argument that perhaps they can be a little more business-friendly, but I think these are the kinds of flows that they have been trying to attract.

I take your point that, in terms of the easy things, the more technical things, they haven’t been able to deliver in terms of greasing the wheels of finance, if you will. But I think, once again, you would probably have to chalk that up to experience.

They know that an open capital market is a two-way street, having been burned 20 years ago; in the case of Indonesia in 2015 and 2013 more recently.

NEERAJ SETH, BLACKROCK: I would just add one practical point. Rightly or wrongly, a lot of the governments in this part of the world are running a deficit. They have to fund themselves. Now, if you have to fund your deficit from these markets, you do want to have some level of control on who owns your debt. That’s not a justification, it’s just a thought process, and we debate this with a lot of regulators in the region. India, as you said, is a classic case. Potentially there’s demand, but there’s a lot of resistance in opening up the market completely just because of the risk of volatility that foreign flows bring.

Now, interestingly, in the case of India, there’s no restriction on equities. They’re fine with volatility in equities, but the regulators and the government are always more concerned about the volatility in the bond market.

Now, one can argue that the deepening of the bond market, if it happens through a combination of domestic and foreign investors, is a good thing for the government. Deepening the market will help you better allocate capital, reduce your funding costs over a longer horizon. Yes, there will be points where it creates volatility, but that’s fine. It’s not an issue.

But, yes, specifically when it comes to debt, it’s a slower process, when you think about a lot of the financial sector liberalisation, in some of these countries.

AUDIENCE: I was just wondering what you think about the development of Green bonds, and whether there is any idea to have sustainable bonds, not only for environmental uses.

AUGUSTO KING, MUFG: Green bonds and sustainability is a very hot topic in the region. We speak to a lot of clients on the issuing side, and there is certainly a strong government-led initiative to consider issuing in the green format.

One common response when we have tried to promote the issuance of green bonds is “How does it really benefit the issuer?” Certainly a lot of them see the additional work they need to do, but they’re not seeing the pricing benefit for doing a green bond. It’s not unique to us in Asia; when we speak to our colleagues in Europe, for example, they will have a similar comment.

When we look at green bond or sustainability issuance, it’s really a signal of being friendly to the environment. As an organisation, we have a lot of internal guidelines around how we should be promoting our sustainability, and it is part of our day-to-day interactions with potential issuers across the region. There is certainly a lot of awareness and, hopefully, it can develop further.

IFR ASIA: My question on green bonds is always whether these are bringing in additional funding, versus relabeling projects that would have happened anyway.

NEERAJ SETH, BLACKROCK: I would actually argue that this is going to change very quickly, much faster than a lot of market participants expect today. In the coming years we will see an exponential increase in terms of the capital flows dictating the focus on not just green bonds, but on the whole ESG concept.

I completely agree as an investor that if you look at it today, there’s no difference – the Asian green bond pays the same as non-green – and I think there’s also not as much of a discussion about ESG. Going forward, global investors and Asian investors are going to look more at ESG as an important component of investing, it’s going to change the cost of capital. The issuers who are smart are going to move towards it faster and eventually, the difference will be the cost of capital, and the valuation of the businesses.

I don’t think today anyone is thinking about it long-term. It’s more about: “If I issue a green bond, do I get 10bp cheaper financing?” That’s the wrong way to look at it. It’s not going to be just cheaper, it’s going to be the quantum of financing available.

Obviously, every sector has some constraints. If you’re in coal, you still can have a lot of ESG considerations, because coal is not just going to go away suddenly. But not having that awareness is going to be a big problem for issuers down the road, as the channelizing of capital changes in the world. I would argue it’s one of the most important things happening right now, from a debt investor’s perspective.

AUGUSTO KING, MUFG: I agree 100% with what Neeraj has said. It sounds like my pitch, as well! It’s really a matter of profiling, getting yourself ready, because we think eventually investors will be demanding the same. Certainly, we do tell our issuer clients that you should really start to get ready for it, because the pricing dynamics, and demand from the investors will come.

From our Japanese heritage perspective, we do see a lot more Japanese investors now asking us to show them green bonds. That awareness has actually moved much faster in Japan, and we believe that will also happen elsewhere in Asia.

CHRISTIAN DE GUZMAN, MOODY’S: The pricing issue is perhaps a technical concern. We do agree that ESG has the potential to change the capital markets. In Moody’s, as a firm, we are striving to integrate more ESG types of risks more explicitly into our credit analysis.

We’ve always been aware of the issues regarding the environment, regarding for example the use of coal, and how they pertain to our corporate ratings, but we’re making it more explicit that these ESG risks should be considered in a more material way in our ratings.

Having said that, perhaps I can turn it around. We haven’t talked about the role of international financial institutions in developing capital markets in Asia. Here, the Asian Development Bank, for example, has taken a lead bird role. We’ve talked about Dim Sum bonds; the ADB was the first AAA rated Dim Sum bond issuer. They have established issuance programmes in a lot of the local currencies, just to get interest started from international investors.

Similarly, in the ESG space, the Asian Development Bank has been one of the most active – if not the most active – issuer of green bonds in the region, and then they’ve even gone further. They’ve actually sold social bonds, speaking to the S in ESG, with one particular bond going towards gender equality and women empowerment. Certainly, there is a role there for the multilateral development banks, the international financial institutions, to help in this space.

IFR ASIA: To Neeraj’s point, there is a big shift in global capital allocation because of ESG considerations. Is that the same in Asia, and in Asia’s local markets?

SOUFAT HARTAWAN, SCHRODERS: That’s a completely new concept for the Indonesian bond market. There’s been an effort from the government – there was one issuance from Indonesia relating to green bonds – but I think the concept of the green bond itself is still very new in the eye of local investors.

Indonesia has been in the spotlight of the global warming issue, as well. So, I think there’s going to be the need for Indonesia to finance more renewable energy in the future, and also for the improvement of the environment.

So, I think, should the government see exponential growth in this market, this is going to be a new frontier for Indonesia. Today, Indonesia is still regarded as an old economy, but I think within five to 10 years, there’s going to be a shift towards a more sustainable economy, and that includes the environment.

Although this is still a very, very new concept for Indonesia, should demand for green bonds increase, then Indonesia is going to be one of the biggest potential issuers in the green bond market, because we have a lot of programmes to finance in terms of sustainability and environmental friendly projects.

IFR ASIA: Going back to the macro picture, what does China’s big outgoing Belt and Road Initiative mean for South, South-East Asia’s markets?

CHRISTIAN DE GUZMAN, MOODY’S: I think it’s been more of a political issue in most of South-East Asia than an actual funding vulnerability issue. When you think about what has happened in the cases of, say, Sri Lanka, or Maldives, or Pakistan; we’re not actually seeing the same sort of situation in South-East Asia. So, it really is more political.

Of course, we’ve heard about the cancellation of certain projects in Malaysia. I would argue that a lot of these projects were actually mooted outside of the Belt and Road Initiative, but then were sort of eventually included in terms of public perception. This speaks of the challenge of perhaps defining what Belt and Road actually is.

In the case of the Philippines, even before they’ve accessed Chinese financing for a lot of their infrastructure projects, there’s already been a lot of political backlash because a lot of citizens have seen what’s been happening in other countries, and they’re already wary about some of the issues related to China, vis-à-vis the South China Sea, for example.

AUGUSTO KING, MUFG: On the financing side, at least in the capital markets, we don’t really see that having any impact in what we do on a daily basis. There are a few exceptions where we are doing transactions for Chinese issuers where they specifically will be using the funding that they get for projects along the Belt and Road corridors. Chinese issuers contribute a big amount of Asian issuance and some are raising funding for particular projects as part of the One Belt One Road Initiative. But it doesn’t really have a meaningful impact in terms of what we do and what we pitch.

IFR ASIA: As China opens up, will we get more Chinese capital coming into Asian infrastructure, through things like Panda bonds, for instance?

AUGUSTO KING, MUFG: There was a recent policy announcement regarding changes to Panda bond issuance. It is certainly a very interesting market. It is a very big market, but unfortunately, there is a lot of restriction on foreign participation. As an organisation, we are watching very carefully because it is such a big market that if you do open up the inbound and outbound flows, it is going to be very significant.

NEERAJ SETH, BLACKROCK: The market is opening up. Across equities and debt markets in China, you have more access channels now. In fact, the Bloomberg Barclays index inclusion for renminbi bonds starts in April next year. It happens over a 20-month period. It’s just a question of time when the inclusion for other indices will happen on the debt side.

It’s very clearly changing the market structure. When you think about emerging markets, global fixed income, or credit, it is going to change the market structure over the next five, 10 years, with China becoming a meaningful part of the global fixed income market.

On the other hand, from the funding standpoint, as you look at China’s demographics and savings rate, the fact is as the outbound pipes open you will see China becoming also an exporter of capital to the rest of the world. If you look at Japan, for example, it is a very significant exporter of capital to literally everywhere in the world. That need for income, coupled with the demographics, is also going to get more profound in China.

IFR ASIA: Augusto, you mentioned Japan earlier on. Is that a meaningful source of capital for South and South-East Asia?

AUGUSTO KING, MUFG: Well, we’re hoping that it will be, given where we are and what we do. I do think it’s interesting. Over the last 12, 18 months, we’ve found that Japanese investors are certainly a lot more receptive to investing outside of Japan, and outside of their usual focus – the very high-grade, non-Asian names. We did a couple of investor events in Tokyo last year. We did an India day. We also took some investors out from Japan to Indonesia. The reception has been very, very good.

What we have also noticed is that when we try to sell a US dollar issuance out of India, for example, these days, we see 10% to 15% of the demand coming out of Japan. Bear in mind we are talking about India being a BBB– country. That shows that Japanese investors are taking a more proactive approach, looking beyond what they have been comfortable with in the past.

We put a lot of emphasis on trying to develop that access to the Japanese investor base. It is a little slower than we would like, but I think this is changing. The input we have got is that Japanese investors are a lot more comfortable with South-East Asia and India, but less so towards China. That could potentially change, given the improvement from a political perspective, but at this moment they are a lot more positive on South-East Asia.

NEERAJ SETH, BLACKROCK: If you think about the ratings discussion we had earlier, you’re seeing developed countries start from AAA and come down. If you’re an emerging country, you are probably starting with a junk rating and you’re going up. There’s some convergence going on in the world, over a very long horizon.

From an Asian perspective, countries like India, Indonesia, if the governments are able to provide the world, the markets, with a combination of political stability, macroeconomic stability and structural reforms, they do have the demographics to keep pulling up their ratings. Over time, that in itself actually pulls in a lot more capital.

Now, going back to the earlier question, if you are a North American pension fund and you are looking for longer duration, good quality assets capable of generating cash flow, this is the part of the world where you can find those. Then it’s a question of comfort around the overall stability of the currency and the regimes that you are investing in.

There is clearly a lot of potential to pull more global capital into this part of the world, as long as the governments stay the course and provide stability.

AUDIENCE: On monetary policy, do you think Bank Indonesia is doing enough, or do you think there is going to be more tightening to come? Secondary to that question is how should we look at the currency swap that was signed a couple of days ago with Singapore for US$10bn?

SOUFAT HARTAWAN, SCHRODERS: First of all, I think Indonesia wishes to have a stable currency, going forward. But I think in the Indonesian environment it is very difficult for them to maintain the current level. In recent weeks, they have begun to let the currency depreciate, because there is no option. We need to be in line with other EM currencies.

The problem is that we don’t have a liquid hedging market onshore. That’s why in every situation, in every crisis, we always see a foreign investor hedging the position offshore. In the last month, we are seeing hedging costs up to more than 20% in the NDF market. This is clearly not helping, because we will see a very steep difference between the spot and NDF price. Creating an onshore NDF market is a good starting point to make the FX market a bit more stable, and more controllable in the eye of the central bank.

I think a combination of raising the interest rate and a tweak in the FX market will gradually stabilise the market.

CHRISTIAN DE GUZMAN, MOODY’S: To your point, are we going to see more increases in policy rates, I think this reflects that shift that I mentioned earlier, that there is this need to maintain macroeconomic stability.

So, in the case of Bank Indonesia, we have seen this pronounced shift over the last five years towards an emphasis on stability over growth. Previously, Bank Indonesia arguably went the other way. They had emphasised growth at the expense of stability.

Some people in the market may argue they’ve gone a little too far, given that they are well under the growth target of, let’s say, 6%, and they are tightening monetary policy even further when inflation is actually doing fairly well. This shows the market that they are serious about macroeconomic stability, and that perhaps lends some stability to the rupiah.

Now, with regards to the currency swap agreement, this is nothing new. Bank Indonesia has several other currency swap arrangements, and it is considered a second line of defence; the first line of defence includes their large reserve buffers already. I think the recently announced swap arrangements are more of a signalling mechanism; that the Indonesian authorities are ready, and they are continuing to bolster the defences in light of the capital flow volatility that we’ve seen.

SOUFAT HARTAWAN, SCHRODERS: Over the last six months, Bank Indonesia has been spending at least US$15bn to stabilise the currency, and it’s still not working very well. I think they need to refocus on other policies that might be more effective instead of intervening in the currency too much. This means probably a combination of raising interest rates, in line with the US Federal Reserve, and, secondly, promoting a more credible FX market by allowing the currency to depreciate further, gradually, and then to provide investors and the business community with a liquid hedging market.

IFR ASIA: Ladies and gentlemen, thank you very much for your attention.

To see the digital version of this roundtable, please click here

To purchase printed copies or a PDF of this report, please email gloria.balbastro@refinitiv.com