IFR ASIA: Good afternoon, ladies and gentlemen, and welcome to the fourth annual IFR Asia Green Finance Roundtable. No doubt, you’ve heard plenty about Green bonds and loans over the last few years.

It’s an asset class that’s booming. It’s come from nothing, and now we’ve had the first sovereign Green bond from Indonesia. We’ve had the first corporate Green bond in Singapore from City Developments, who I’m glad to announce are on the panel, and we’ve had Green securitisations in Australia, China. We’ve had Japanese insurers showing a greater commitment to increasing the amount of Green assets on their balance sheets. So it’s definitely an asset class on the rise, and we’ve got a great panel here to talk to us today.

On my left, we’ve got Katharine Tapley, head of sustainable finance at ANZ, Anna-Marie Slot, practice group lead, high yield debt at Ashurst. Jonathan Drew, managing director, infrastructure and real estate group in the global banking and markets team at HSBC. Lim Whee Kong, head of treasury at City Developments and Sanaa Mehra, senior associate, Green and social bond origination at Citigroup.

So to get things started on a positive note, I’d like to ask Katharine, what are the opportunities for Green finance in Asia? Are there are any particular industries or countries or sectors that could drive issuance?

Katharine Tapley, ANZ: In Australia and New Zealand we’re seeing plenty of opportunity, and I think, probably much like other markets, the obvious sectors for Green bond issuance are commercial property, infrastructure and also renewable energy. So in our context, that means solar, wind, as well as geothermal and “run of river” hydro in New Zealand, noting that we are watching carefully how acceptance of hydro and criteria develop.

I think helpfully in both countries, we’re also seeing signs of regulatory support emerging. I think that’s going to be crucial and helpful for the future growth. So, for example, in New Zealand with the change in government to Prime Minister Jacinda Ardern, you’re seeing the government make very rapid moves towards things like a zero carbon act for New Zealand and the creation of a Green fund that’s going to put US$100bn into Green investments in New Zealand.

In Australia, there are some promising signs coming from some of our regulators. We’ve had APRA, who is the regulator for the financial services industry, making it very clear in statements to the industry that they see climate risk as a financial risk. We’ve most recently seen ASIC make comments around similar issues, including that they are reviewing the top 300 listed companies in Australia around their adherence to the Taskforce for Climate-related Financial Disclosure and in particular the use of scenario analysis to determine companies’ advancements towards dealing with climate change.

We’ve also had a senior barrister talk about Corporations Act breach of fiduciary duty by directors if they’re not taking into account climate risk.

So in summary, the opportunities for Green bonds are being generated through a combination of industry level action, as well as some regulatory signalling.

IFR ASIA: Jonathan, you’re based in Hong Kong. What’s the view like from Hong Kong?

Jonathan Drew, HSBC: Well, I think, Daniel, broadly to your question, in every country and for every sector there’s a huge need for what we might more broadly call sustainable financing, i.e. the need to bring finance to create assets that will decarbonise and depollute the entire economic activity that we currently undertake. Because I think when you look at the science of the Green part, the environmental part, I think we have to recognise that the timeframes in which we need to take very significant action are very urgent indeed.

So there isn’t, in my opinion, a market or a sector or, for us as a bank, a client who isn’t impacted by and who hasn’t got a very material role to play in this whole process of making our economic activity sustainable.

Obviously with respect to your question around Hong Kong specifically, then if you just look at who the actors and who the players are in the Hong Kong market, obviously you’ve got a big financial services sector. We’ve seen a lot of activity from commercial banks raising Green funding or raising sustainable bonds or broadening it to the Green plus social component in order to on-lend to their clients who are making exactly those eligible Green or eligible social projects.

I think now that’s why it’s particularly exciting that we’ve not only got the Green bond product, but we’ve also got the Green loan product. So commercial banks or banks generally with sort of one hand can be aggressively writing Green loans, and with the other hand they can be raising their Green and sustainable bonds to finance that lending activity. So clearly banks and the financial services industry in Hong Kong have a huge role to play and all the banks there are potential Green and sustainable capital issuers.

You’ve got an important transportation sector in Hong Kong. Hong Kong has through the MTR - a bit like Singapore - a very efficient mass transit system. And of course they have already very successfully raised capital in Green format multiple times, and that’s given them an opportunity to really talk about the business that they’re running.

Mass transit itself is fundamentally sustainable because it’s about moving people from A to B in a low carbon manner, taking them out of high carbon alternatives, whether it’s a car or a bus. But also investing in the operation of that system, so whether that’s, for example, major investment in managing their air conditioning bill through screen doors or more advanced technologies which again I think you have in the MTR system here.

Such as regenerative power, so that when trains are coming into a station, the kinetic energy is converted into electrical energy and that can then be stored and then used to power other trains to pull out of the station in other parts of the system. So all of these investments are hugely important across the transportation sector.

Interestingly, MTR in terms of the power of raising a Green bond, they actually appeared last year in the Fortune 50 ‘Change the World’ list. And I know the CFO said to me, “Well, how did that happen?” You know, they provide very reliable service, so very low incidents of delays on the system, and a very affordable service in Hong Kong, obviously in part driven by their ability to bring revenues from the real estate business in to support the transport component.

But the CFO said to me, “But we always have done that.” What actually made the difference in 2017 was the fact that in 2016 they’d raised a Green bond, so they got an extra mark for financial innovation.

I think that for those sort of corporates and other institutions who are thinking about issuance, that talks to again another of the huge benefits of looking at raising your capital in Green format because it really does bring a whole new level of attention to the type of business you’re engaged in, how you’re running that and why yours is a business for the future. You’re positioning yourself as a winner and not a loser as we go through this massive transition process.

So the transport sector, and of course, as you said in the outset and Katharine reiterated, the real estate sector again as well. Hong Kong is a big city, a massive built environment, and a huge investment is required in that built environment to decarbonise it.

IFR ASIA: And Sanaa, you’re based in London. Perhaps Europe is a little more advanced than Asia when it comes to Green finance, so where do you see the opportunities for us here?

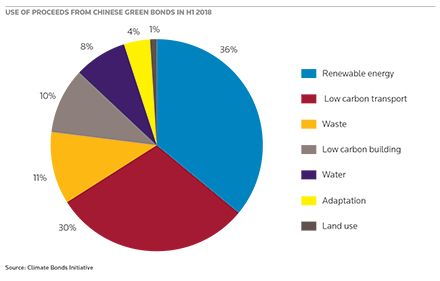

Sanaa Mehra, Citigroup: Experts estimate that we need something like $50trn of investment in sustainable infrastructure by 2050 to reach a two-degree world. The majority of this investment needs to be done in emerging markets. So there are huge opportunities for Green Finance across Asia, particularly in the larger economies of China, India, and Indonesia, where we saw the first Asian sovereign Green bond.

In terms of industry, to reach a two-degree world by 2050 is not just about renewable energy, but about every industry. Every sector has a role to play in the transition to a sustainable way of operating, and what’s holding the market and certain industries back from green issuance at the moment is the lack of definitions for what counts as an eligible Green asset across different sectors of the economy. For example we need to see Green Taxonomies for shipping, for aviation, for the consumer business, etc.

And I think what the Green bond market has done so far is to put these issues at the front of mind for many of the key stakeholders, and there are numerous technical working groups looking at different industries & thinking about how Green Finance can apply across different industries. What’s the most sustainable way of operating in my industry? Industry experts are now working with the scientific community and once we have more definitions across different industries, which will help this market flourish with greater diversification of issuers, not just in Asia but globally.

So I think we’re headed in the right direction in terms of industry. In the longer term, the majority of issuance has to come from emerging market countries, given the tremendous infrastructure needs.

IFR ASIA: Now I’d like to turn to Whee Kong because you’re the first and so far only corporate issuer of Green bonds in Singapore. So how difficult and time-consuming was the process of bringing that deal to market?

Lim Whee Kong, City Developments: Well, I guess all you are quite aware CDL is the leading Green developer in Singapore. We started our Green journey in 1995, led by the late Mr Kwek Leng Joo, the deputy chairman.

In view of this Green DNA, I think when the Green bond was first being introduced by some banks, I think including HSBC here, we thought that, yes, clearly we could embrace this concept of Green bonds because we had started our Green journey much earlier. It made it much easier for us to understand what are the Green Bond Principles and what they entail.

In fact, we took quite a short period of time. I mean, to our surprise actually, just basically from the time we wanted to start seriously looking at the green bond to the time we came up with the Green Bond Principles to the time that we got a second opinion provider and plus KPMG as assurer for the pre- and post-issuance, that took almost in all only about two months. I think the bankers here could probably vouch, that’s quite a short period of time.

But we found difficulty on the investors’ side because at that time when we were looking at it in 2016, I think not many SRI investors were keen in Sing dollar denominated bonds. So clearly when we look at that situation then, even though MAS and SGX were promoting Green bonds, we were realistic that maybe we couldn’t get the SRI investors interested in our Green bonds.

So we had to settle with just the Sing dollar investors, and to make them understand. We actually used our CDL properties, the secured MTN programme to issue the Green bonds. So based on our funding needs at that time, we did a two-year bond at 1.98%.

So on the investors’ side, I remain not quite convinced that the SRI investors are keen on Sing dollar. I’ve got to emphasise this applies to a Sing dollar issue.

IFR ASIA: Anna-Marie, how much time and effort would you say goes into the debut Green issue, and does it get easier and less onerous after the first issue? And where are the bottle-necks?

Anna-Marie Slot, Ashurst: I think it is an extra wrinkle to an offering process. It probably shouldn’t actually add that much extra to the process.

A debut issuer always has to contend with getting used to the idea of doing a bond which is of itself a little bit more complicated than doing a bank loan because you do have to go through a diligence process. You have to put together an offering memorandum. I think in fact doing a Green bond at the same time for a debut issuer is just sort of another wrinkle on the way and shouldn’t really be seen as a detriment to them, because at that time they’re actually dealing with the whole process as an initial process.

You have to collect all the contracts. You know, it’s Asia. Everybody is chronically understaffed so you have to find the contracts. You have to find the signed contracts. All the lawyers are asking you crazy questions like, “Can we have the contracts in the originals and all the addendums on them?”

So all that description and all of that diligence when combined with the Green aspect, I don’t think the Green adds a lot. I think issuers get scared that it will, but it doesn’t really in my experience. I mean, we’ve done a number of debut issuers in in fact the sub-investment grade space who are also taking advantage of the Green, because they’re all renewables companies.

As long as you’ve got the right teams helping you put together the bond, it shouldn’t be a game stopper for any issuer because the banks know what they’re doing. They’ve got- you know, the second opinion people, like KPMG, does a really good job, as well as all the accounting firms. You have companies like Sustainalytics and other companies like that who are used to coming in and evaluating eligible projects.

Now actually I think it’s quite a nice period. When we sat on panels years ago, it was kind of a question of, what does Green mean? What do we mean by green? I think now with the Green Bond Principles, with Green Loan Principles, with the ASEAN announcements around the principles, which are all quite similar, it gives issuers more certainty about what we’re talking about when we say Green, and then you can point them to things and that actually makes the process a lot easier, having those out there.

Jonathan Drew, HSBC: Daniel, if I might just add, to sort of reinforce Anna-Marie’s point - Sanaa mentioned the Republic of Indonesia transaction, which was the first Green sovereign this year. In terms of complexity of putting or structuring a Green bond, in other words building a framework, looking at use of proceeds, and getting an external review, sovereigns are pretty much as complex as it can get because you’re dealing with all sorts of issues, including restrictions around procurement processes.

But the Republic of Indonesia, they effectively Greened their transaction in line with their standard transaction timetable. So from the RFP process, which was a standard RFP, they really just bolted the Green on.

We know it was a huge scramble to work with them to support them to develop that framework to assess the use of proceeds, particularly around areas such as pillars two and three, which gets into the sort of internal mechanics of government process on how they review and assess and how they track proceeds through their internal accounting system. But the message is it was all done within the same standard timeframe, so however complex it can be, it can be done. So it’s really no excuse for an issuer to say it’s too difficult or too time-consuming.

IFR ASIA: Katharine, are we getting closer to Green finance providing a cost saving for issuers? If we’re not, are there any other tangible or intangible benefits that make it worth doing?

Katharine Tapley, ANZ: There are data points that seem to show that there are cost-saving benefits, but we’re not fully there yet. My view, is that if you’re in this market merely for a price benefit, it’s probably the wrong market to be in. It’s the intangible benefits that tend to generate the value for issuers, and that will probably drive better pricing in the longer term.

So what I’m talking about here is the so-called halo effect of issuing Green or Sustainability bonds – for example aligning to an issuer’s strategy around corporate social responsibility. A second example is bringing an issuer’s business closer to the fixed income investor group and giving them the opportunity to engage in a way that has largely been the domain of equity investors

A third example is greater staff engagement – a corporate pride in accessing the responsible investment markets to fund responsible activity - we’ve seen that in our own issuances, and clients will repeatedly say this to us as well

These benefits have to be taken into account alongside pricing. And to be really clear - there is no pricing disadvantage. Fundamentally these bonds will price on an issuer’s curve, tending towards the lower end of indicative launch ranges on launch, sometimes underneath. They certainly will mark in the secondary curve almost immediately tighter as well.

I’m not sure that we may ever get to a point where Green bonds will issue more cheaply for borrowers. My personal view is that those who are not issuing Green bonds or who need to fund activity that’s not associated with transitioning to a low-carbon world will eventually encounter problems with accessing capital and they’ll be paying more for it.

IFR ASIA: And is that how you see it, Jonathan? That maybe the pricing benefit isn’t in the actual Green financing, but that polluting companies are going to have to pay more for their financing?

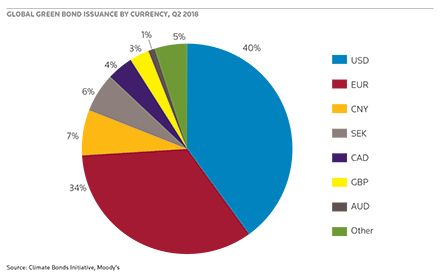

Jonathan Drew, HSBC: Yes, I think that’s absolutely right. I completely agree with Katharine’s comments. And I know if you compare an issue as Green versus the non-Green - let’s leave aside the on-shore China market for the moment - in the rest of the world, you can see very small differences in terms of better pricing for the Green versus the non-Green, but it’s small.

So because you’ve got this sort of huge, as it were, aspirational demand to buy Green paper, very much for the points you made at the beginning Daniel, because so much institutional money is day-by-day more and more embedding ESG criteria into their investment approach and portfolio management structures. So there’s a big demand for them, but it’s still fundamentally an assessment of credit risk. You will see investors coming in, perhaps with slightly bigger ticket sizes and they might be slightly more aggressive on the pricing.

So in primary, you can see transactions either closed slightly below perhaps the issuer’s target price range. Or, again as Katharine alluded to, you might see the issuer achieving their target price but then being able to upsize their transaction because of that quantum of demand.

But I think in the medium term, we will start to see a very significant shift in capital moving away from companies that haven’t got their sustainability act together, if I can put it that way, to companies who are addressing these issues, who are fronting up to this and who are leaders. Because these are in the very near term going to become real financial impacts, whether it’s stranded assets or whether it’s fines and penalties as you alluded to.

So I think probably at the moment we’re going to see some very significant shifts in the valuation of financial assets as people suddenly start or as people increasingly start to realise exactly what is going on and exactly what needs to happen. The Green bond is a great label for investors to say, well, you’ve got a pretty good opportunity of improved alpha and improved beta if you follow this label. It’s not the end of the story, but it’s a pretty good indicator I’d suggest.

IFR ASIA: And what would you say to that, Sanaa, in terms of benefits for issuers?

Sanaa Mehra, Citigroup: Well, I completely agree with Katharine and Jonathan. I’d reiterate there’s a very modest pricing advantage at the moment, and it’s purely driven by the demand and supply dynamics. In Europe, where the growth of investor demand for these products is tremendous we do see a pricing tension in primary order books, resulting in Green bonds pricing with a lower new issue concession or at the tighter range of pricing.

It’s not a question about, does a Green bond of the same issuer price tighter than non-Green? But it’s a question about future market access, and an issuer with a coherent sustainable strategy will achieve better market access over time and a better pricing over their entire funding curve than a company that is lagging in terms of its strategy for the transition to a low carbon economy.

If you look at the Green loan market, we’re already seeing a marginal pricing advantage. We’ve seen green loans that are linked to a company’s ESG score, where if their company’s ESG score goes up, the margin on the loan will decrease and vice versa. Banks are already recognising that ESG considerations are an increasingly important component of credit analysis.

There is a pricing advantage in the loan market, and I think it will soon translate into the bond market as credit rating companies such as Moody’s and S&P more explicitly take into account ESG risks in their published credit ratings.

IFR ASIA: Okay. Whee Kong, as the issuer on the panel, Were there cost benefits, and if there weren’t then was the process worth it for the reputational boost and the marketing benefits?

Lim Whee Kong, City Developments: I can only speak from CDL’s experience, from issuing the first green bond. As the bankers have all here elaborated, clearly your profile increases, especially your Green profile. You get invited to many, many of these forums to speak of your Green journey, the launch of the Green bond journey, etc.

From day one already, all the banks we spoke with really emphasised the point that you’re not going to get any pricing advantage if you do the Green bond, so that we register.

Clearly, there’s a lot of preparatory work. You have to collect and verify your ESG data. I speak from the first Green bond, about Republic Plaza. You had to show proof of the savings, in dollar terms, in water, electricity, etc. All this has to be verified by KPMG, in this case, the assurer.

We have started collecting all this data many, many years ago, Republic Plaza was awarded the BCA Platinum Green Mark in 2012. We have been collecting data to show proof that for every enhancement, every improvement that we make to the buildings, there are in turn savings in monetary terms. So I think that helped actually in getting our Green bonds launched pretty quickly, as I previously mentioned.

I’m looking at the moment at Green loans, but again I’m comparing the green loan versus the conventional loan, and the pricing again. There isn’t that pricing advantage. In fact, I may end up to pay more actually because again if you want to be the first to do certain things in the sustainability field, maybe you may have to pay a bit of so-called school fees.

So I certainly hope that day will come where we’re able to command some savings when we embark on a Green-linked loan or bond.

IFR ASIA: One question that comes up all the time is, is there a need for greater standardisation in the Green bond market? So Anna-Marie, what are your thoughts on that?

Anna-Marie Slot, Ashurst: Yes, as I mentioned earlier, a couple of years ago this was a huge topic. What does Green mean? And what do we all mean by Green?

I think it for me has been quite fascinating to watch the markets evolve in different places across the world, and I think we’ve gotten to a place where the Green Bond Principles and now the Green Loan Principles, which in many ways mirror taking into account the difference of the structure of those two products, I think those are kind of settling in as a standard or at least something that people can use as a comparison mark, sort of, “We have IFRS, but we have IFRS with our own country bits on the end of it.” So I think it is kind of circling around that.

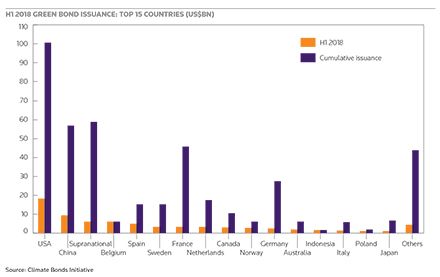

You do have obviously China, as we alluded to earlier. Jonathan mentioned China was the largest issuer in 2016, I think, just inched out in 2017, so is now in number two. The China standards are obviously different. People spend a lot of time talking about those standards being slightly different.

The one that always gets mentioned if you’re not in the Green circle is China has this concept of clean coal. Most of the sustainable investors across the world don’t buy into clean coal. That’s not on the top of the list for the green funds, “Let me invest in coal today.” So there is that, but China’s point is they’re saying they’re at a different point in their life cycle, and cleaner coal is better than not clean coal. And you can see the arguments, really.

So I do think those standards are kind of fleshing out and settling down so that people can then get to the edges, which is where we’re going now. When you talk about a Green project and a Green eligible project, within each sector what does that mean? And then on the back of that, where are you going with the ESG? So how do you reduce carbon in all sectors, as Jonathan mentioned at the beginning? How do you make every sector more sustainable for the long term?

IFR ASIA: Katharine, do you see a need for greater standardisation?

Katharine Tapley, ANZ: I think it’s really important. I completely agree with everything that Anna-Marie has said.

We have the right basis in the Green Bond and Loan Principles and the Sustainability Bond Guidelines

I think it’s really important to recognise that every country is different. What is “Green” in Vietnam might be very different to what’s “Green” in Singapore, for example. Definitions of “Green” need to be built accordingly.

IFR ASIA: Jonathan, what do you think?

Jonathan Drew, HSBC: I think there are a couple of points, Daniel. The first is when we talk about definition of Green, I mean, why are we trying to define Green? And I think people don’t really stop to think about that enough. To me, there are two possibilities. There’s one to think Green is ultimately the label we want for everything in terms of climate impact that we can do that fits within a two-degree centigrade scenario.

But at the moment I think in the market we have a definition of Green that’s much narrower than that because it really focuses on most of those things that are sort of 2050 ready or zero carbon. Although it does include some what you might call sort of energy efficiency projects which are more transition type investments, energy efficiency Green buildings, where those can be green even though they aren’t zero carbon. Because of course, again as Sanaa said, we have to get to zero carbon before we get to 450 parts per million or in CO2 concentration in the atmosphere or consume the carbon budget.

I think that’s the first point, and you can’t really talk about definitions of Green unless you understand what you’re trying to define.

I think the other point around Green and Green bonds is to remember what the Green Bond Principles define: what is a Green bond? The Green Bond Principles do not define and explicitly say they do not define what is Green, and that’s I think an important distinction.

So the Green Bond Principles, it’s the four pillars. It’s about having to disclose your use of proceeds. You’ve got to disclose your evaluation metrics and your standards. You’ve got to disclose how you track proceeds or you’ve got to set up a process to track proceeds, and then you’ve got to disclose what you’ve done with the money and you’ve got to disclose on a best efforts basis your estimate of beneficial impact. That’s what makes a Green bond, and I think that definition is robust and I think it’s sufficient.

The question then comes around when all issuers and investors are looking at sort of pillars one and two. What then is the sort of investment that they should be supporting? And conversely, what is the sort of investment that they should be walking away from, to think a little bit about what, for example, the Europeans and the EIB has been doing with the PBoC in China in trying to come up ultimately with a definition.

Again here I think there are two key steps, which people often overlook. The first is to create the taxonomy, and the taxonomy is the classification system. The taxonomy itself doesn’t define what you should or shouldn’t do, so that’s sort of the Linnaean approach to classification of the natural world. So that’s what the taxonomy is trying to do, look at human activity and then human activity and its impact on sort of the five key potential areas of environmental impact that we need to be aware of, whether it’s adaptation, mitigation, natural resource protection and pollution and biodiversity.

So that’s the taxonomy, and then to come to making decisions about what you do or don’t do you then have to create standards and then apply those standards to say whether you should or shouldn’t do something. And this is where I think Katharine is absolutely right. Those standards are not necessarily the same in every market. So your standard about whether you should purchase diesel engines to drive trains, you may come up with a different answer to whether that’s the right thing to do or not the right thing to do depending upon which market that you’re looking at that investment in.

And it’s the same as Anna-Marie said in the area of clean coal. I mean, if you as a country, if you’ve got no renewable resources and your alternative route to energy is burning high sulphur or low quality heavy fuel oil, then you might be better to generate power by bringing high calorific coal from Australia, burning it in state-of-the-art IGCC technology from Japan. That might be your best environmental solution along a given development pathway.

I think this is where China has got to, because China has done both steps. I’m not sure they recognise they’ve done the two steps, but they’ve categorised and they’ve decided what they will and won’t do by saying it’s either in the Green catalogue or not. So in that sense China is ahead because they’ve actually done the analysis and made the determination. Europe is behind because they haven’t done the taxonomy yet, and they certainly haven’t got to the standards and applying them.

IFR ASIA: Sanaa, what are your thoughts on standardisation and also the different certifications and ratings that are available?

Sanaa Mehra, Citigroup: I agree the Green Bond Principles are the benchmark guideline for capital markets issuance. If you want to use the Green bond label, the GBP explains the process you need to follow as an issuer. And I think in terms of standardisation, the Green Bond Principles are now globally recognised by all investors. It’s the first question we get when we roadshow with investors, they ask us if the green bond is aligned with the Green Bond Principles.

If you look at the different standards, the ASEAN standards, SEBI in India, for example, they all very closely follow the Green Bond Principles and most often they’re put together in close collaboration with the ICMA GBP. Therefore I think in terms of standardisation of the process, we’re there. But again the GBP, as Jonathan says, does not define what’s Green, and that’s where you can have a Greener bond from issuer to another and from one country to another.

Europe is leading the way with the EU’s action plan on sustainable finance where they are working on a sustainable taxonomies which will help issuers identify eligible green projects. I think the UN Sustainable Development Goals are another useful, globally recognised framework which can be used for classifying sustainable investments.

Global asset managers are looking to map their investments to the UN SDGs, and issuers are starting to map their own balance sheets to the SDGs, so we also start to see some form of standardization here. However, I agree again that there remains a lack of definition and clarity about what constitutes Green across different industries and geographies. What’s Green in one geography could be not Green in another. I don’t think we’ll have a standard definition of what’s Green in the near future given the complexities, but with initiatives such as the sustainable taxonomy framework which the EU is working on, and the good work done by others such as Climate Bond Initiative, we have a good starting point to give more guidance to issuers and the market globally.

IFR ASIA: Whee Kong, when you were getting the first Green bond issue ready, how did you decide which standards you wanted to use or which certifications?

Lim Whee Kong, City Developments: In Singapore, the government Building and Construction Authority, for many years has laid down certain standards, at least for completed projects, office buildings, and commercial buildings.

A platinum is of course the highest category. Then that’s follow by a gold, and I think there’s a gold plus. There’s already that benchmark for you to comply, and to ensure you comply you will get the various so-called standards. The certification is given to you, and this certification has to be renewed every three or four years.

On the development side, every CDL project is also a platinum whenever possible, meaning for every development project that we do we will make sure that there’s adequate Green features being introduced into the development to ensure that we obtain the Green Mark certification.

So at least in Singapore, I think it’s much easier because - at least for a real estate player - there are already clear-cut rules and guidelines for real estate developers to stay guided to.

IFR ASIA: Katharine, looking at the buy side, are investors in Asia perhaps lagging behind the rest of the world a bit when it comes to adopting Green principles or having discrete pools of Green assets?

Katharine Tapley, ANZ: My perception is that it has been lagging but I think it’s coming on more quickly. In Australia and New Zealand, certainly the pace is quickening on the buy side down there. It’s very rare that we have a meeting with an investor where ESG is not a component of the conversation. And it seems that with every roadshow we go on, someone else has popped up with a specific mandate or has introduced ESG as an investment overlay into their processes.

The other thing that I find really heartening is that investors are increasingly talking about ESG analysis being part of their risk analysis. By way of example, two weeks ago we led the first domestic green bond issuer to the market in New Zealand, the Auckland Council. Going into the deal, we were pretty confident that there was latent green bond demand there - we just didn’t know how much.

Analysis of the investor base in the transaction shows that over 70% were light or dark Green investors We found that pretty remarkable for a “first ever” transaction both for the issuer and the market, and it points to growing appetite for the Green format.

IFR ASIA: What about you, Jonathan? Are you seeing greater interest in Green assets from Asian investors?

Jonathan Drew, HSBC: Well, yes and no. I mean, I think if you look at the survey results, they show that clearly Asian portfolio managers’ awareness and focus on ESG issues is increasing.

I think the last one we did, we found there were only 9% who didn’t consider it at all. The survey then went looking at the detail which their analysis went into. The 91% who did consider ESG scored quite low.

But I just wonder whether we’re perhaps all not measuring the right thing, because I think any investor today when they’re looking at credit and evaluations, if you’re looking at the energy sector, how can you possibly ignore that renewable energy can now be produced more cheaply than energy from burning fossil fuels in many, many markets across the region?

I mean, the latest round of tariffs for Taiwanese offshore wind were at 50%. The tariffs bid were 50% of the tariffs that were bid 12 months ago. If you look at the transportation sector and you’re putting money to play at work in the transport sector, how can you ignore the fundamental changes that are ongoing in the way we move around? And I’m not just talking about e-vehicles but mobility more fundamentally, and with artificial intelligence it’s radically changing the way we do things. Those are all sustainability considerations.

Look at the real estate sector. I mean, who today who’s a thoughtful real estate developer develops anything other than a Green building? Because when you’re looking for anchor tenants amongst corporates or institutions, that’s what they want. So this is about business and business considerations and how sustainability is clearly driving that.

You look at the whole digital revolution and taking carbon out of the way we trade and what we trade and what we consume, so low-carbon goods and services. It’s all being driven by those same underlying themes, and I think capital is responding. So it might be a bit misleading just to sort of measure and survey who calls that assessment ESG, because I don’t think Asian money in any sense is foolish, and Asian money I think is looking at these things.

Look at on the consumption side. I mean, the surveys that we’ve seen show that the Asian millennial as a consumer is far more sensitive to the sustainability qualifications, as it were, of the brands that they buy into, far more sensitive to that than their European counterparts. So I don’t think we should be dismissive in any sense of what’s happening here in Asia.

IFR ASIA: Sanaa. Most of the big global asset managers have got green strategies in place. But one thing that I wonder is whether they’re being successful in relaying those strategies to their fund managers in Asia and emerging markets.

Sanaa Mehra, Citigroup: Yes. I think it’s true that majority ESG specialists at global asset management firms tend to sit in, say, their global headquarters, be it Europe, be it in Paris, New York, London, etc. but I think it’s really important to understand that the Green bond market is still very young and ESG analysis and investment is not yet fully developed. ESG investment is becoming mainstream, and will be increasingly ingrained in credit analysis. It will then be very hard for any portfolio manager to ignore ESG risk, and it will become more deeply embedded in investment decision-making globally.

In terms of Asian investors in particular, there are a significant number of Asian investors who are signed up to the UN PRI. Citi estimates that there are about $25trn of assets under management globally are now managed according to an ESG screen, and we see this growing year on year at a rate of about 12%. I think it’s important to note that multilateral investment banks play a big role too. Initiatives like the IFC-Amundi fund which looks to invest in Green bonds from emerging market countries, are boosting demand and encouraging green issuance. And then you also have initiatives like the World Bank Group and the recent study with the GPIF of Japan, the largest pension fund in the world, looking to incorporate ESG analysis in its fixed income investments.

There is definitely a shifting attitude from investors globally, thinking about how to incorporate ESG factors into their funds and all decision making processes. Do they have a specific Green fund, or do they incorporate ESG risk in their overall credit analysis? Or do they have some form of, say, negative screen where they don’t invest in certain industries such as; coal or nuclear, etc.? There is room for different approaches. A lack of ESG data availability is a key challenge, but it’s clear that as the market develops further, ESG risks will become fully imbedded in all investment decision making processes.

IFR ASIA: Whee Kong, as an issuer, are investors in Singapore or Asia lagging behind the rest of the world, or are they asking the right questions when you bring a Green bond?

Lim Whee Kong, City Developments: We only have done one Green bond, but maybe partly because CDL is still principally a Sing dollar bond issuer - because clearly we are locally based - up until now, to us it makes sense to still issue in Sing dollar. Clearly in other currencies, the hedging costs and all that may potentially sometimes cause some bottom-line issues.

So we’d rather continue to issue in Sing dollar, and based on the conversation I had with banks and the issue managers, I’m not so sure yet whether we’re getting that attention. I mean, the share price or CDL shares are being looked at now more increasingly with interest from the responsible and SRI investors. But on the bonds side, I’m not quite sure whether we’re getting the attention from the SRI and responsible investors.

IFR ASIA: Anna-Marie, once investors have made a Green investment, what kind of headaches have they got in monitoring it and tracking to ensure that the issuers spent the money in a way that adheres to Green principles?

Anna-Marie Slot, Ashurst: Obviously the tracking is important to avoid what people call greenwashing, which is money that’s been raised for Green purposes and is not used for green purposes. It ends up building a toll road, hypothetically speaking, not that that ever happened.

But I think something that all of the panellists have alluded to so far and something that comes out with the ongoing reporting aspects of it and the reason why I think the Green bond market has done well is it’s quite disclosure-driven, and it is the principle of telling people what you’re doing and being upfront about that, and then they’re making their decision about whether to invest in you or not.

And having a company go through that process, that takes a certain type of company. It takes a company that is committed to disclosure. It is not good to have a company that’s out in the bond market who’s not committed to disclosure because they will end up in a bad place.

But it also has, not only the halo effect that you were talking about earlier, but also the halo effect that if you are running a company where you are forced to disclose on an ongoing basis, you are putting in place internal structures within your company that are going to allow you to do that reporting. And by putting those structures in place, and there are studies that are tracking this at the moment, companies who commit to Green issuances will have stronger internal controls.

Once you have those stronger internal controls, you have companies that do better in the long term because they’re more focused on how they’re running themselves, and they are seeing these things at a board level as strategic priorities in a way that other companies aren’t.

So I think the headache is probably putting the process in place, but I think once that process is in place the company actually benefits in lots of other ways, not necessarily Green ways but lots of ways of having those communication channels where they know what their subsidiaries are doing. They know what this company is doing in this part of the world.

Particularly in Asia when your companies are across lots of different places, they have lots of different regulations and companies are run very lean, that is a challenge for companies to be able to keep a tab on what’s happening everywhere in their structure. And that reporting is conducive to better corporate governance overall.

Katharine Tapley, ANZ: My team is responsible for ANZ’s reporting on our own issuances so I can vouch for “use of proceeds” reporting really not being that hard. Once you establish the process, the reporting metrics and a frequency of reporting that works for investors and works for you.

I would say that “impact” reporting does take more time and effort. It took us two years to do the first impact report on our Green bond. Part of the challenge for us is that weare not the owner of the underlying assets that our Green bond is financing – this means that access to information can be a hurdle. The second part of the challenge was working out the actual impact metrics themselves - we undertook quite a bit of research, leveraged our internal sustainability analyst and also worked with a group of investors, to understand what a meaningful set of impact metrics looked like.

I agree with Anna-Marie that this process generates good governance. I would also say it generates greater engagement internally with business units as they look to understand what assets they are writing might qualify for Green bond funding, and as they realise Green bonds create a point of difference in a customer conversation.

IFR ASIA: Katharine, as a bank, are you being asked to prove your ESG credentials throughout the organisation when you’re pitching for financings? I guess if you’ve issued Green bonds, then that shows part of it.

Katharine Tapley, ANZ: Yes, we are. And it’s actually becoming more and more prevalent as well. We see this happening when we are re-pitching or responding to clients on RFPs on general banking services, as well as RFPs specifically on Green or sustainability financing. We also see it when we talk to our own debt and equity investors. We find ourselves being asked for our transactional as well as our organisational CSR credentials.

IFR ASIA: In terms of developing the market, Whee Kong, how important do you think government subsidies or regulatory efforts are going to be to encourage Green financing?

Lim Whee Kong, City Developments: We did it in April 2017, but before that, when we first started this Green bond journey, we had met with SGX as well as MAS. I think that was in the second half of 2016. They were very keen to promote Green bonds and they were hoping that we would be doing one. This is their ambition to make Singapore the original Green bond or sustainability financial centre.

So we did our part and we did the first Green bond in April, and the incentive came in June or July. There are certain criteria that you have to meet. One, you have to have it listed on SGX. And secondly, the issue size has to be a minimum of S$200m and the minimum tenure is three years. You are allowed to use up to S$100,000 for payment of financial services and opinion providers.

Since that incentive was introduced, I believe DBS Bank came out with the first Green bond in 2017, but I have not seen many Green bonds since then. So clearly, how effective is that incentive in pushing issuers into wanting to do more Green bonds?

IFR ASIA: So who does need to drive the push towards Green finance in Asia? Is it going to be regulators, government issuers or investors, or all of them, or none of them? Anna-Marie, what do you think?

Anna-Marie Slot, Ashurst: I am a lawyer, but don’t take this the wrong way. I would follow the money. I think the more the investors push it, the more everyone else will respond. I think especially in Asia, it’s very helpful to have regulators involved in it because a lot of times you’ll have issuer companies asking why they have to do something. So it was quite helpful to actually have a framework that you can point to to show them conceptually what you’re talking about.

But I think at the end of the day, if you can show that there’s money there, then people are practical and they will respond.

IFR ASIA: Katharine, what do you think?

Katharine Tapley, ANZ: Well, I think when you look at the magnitude of the issues that are facing us globally, whether they’re environmental issues or social issues, I think it’s actually a collective responsibility. I completely agree with Anna-Marie on her “follow the money” comment, but I think everyone has a role to play in this.

For example, what we’re seeing in Australia is that big business really understands where we need to be with regards to low carbon transition and is driving forward the agenda.

IFR ASIA: Okay, and over to you, Jonathan.

Jonathan Drew, HSBC: Well, Daniel, maybe people won’t be surprised by this answer but I think everybody. It’s the responsibility of everybody to play their part in driving capital and somehow facilitating and supporting this fundamental requirement for decarbonising, depolluting economic activity. And clearly, as others have said, we have to do that to give future generations their opportunity.

To see the digital version of this roundtable, please click here

To purchase printed copies or a PDF of this report, please email gloria.balbastro@tr.com