IFR ASIA: Good morning, ladies and gentlemen. Let’s start off this discussion with a look at how the green bond market has developed in this part of the world. Katharine, can you tell us how you see it?

Katharine Tapley, ANZ: Including Australia as part of the Asia Pacific region, the market is developing well, and there’s been an acceleration in the first six months of this year. Like the European market, Australia started with SSA issuance and has moved through to the banks. All four of the major Australian banks have now issued their own green bonds and it’s now starting to carry through to the semi-governments with Victoria and Queensland issuing bonds. We’re now seeing interest from the corporate market as well, particularly in the property sector and through into the energy sector as well.

There’s certainly demand in Australia and in New Zealand on the investor side. This is a demand-driven market, where investors really can’t get enough of green bond issuance. They’re very oversubscribed, they’re pricing at the low end of the range, and there’s significant interest in the sustainability aspects of these deals.

In terms of the supplyside, it’s really about issuers getting used to the tool as an instrument for raising funds, and it’s also important that an issuer has the ingrained sense of sustainability as part of its overall strategy. I think that really assists in the thinking around using the green bond as a financing tool.

IFR ASIA: That leads us nicely on into a look at Asia. Ko-Wei, what’s your experience been in green bonds? Where did this market start, and how did it develop?

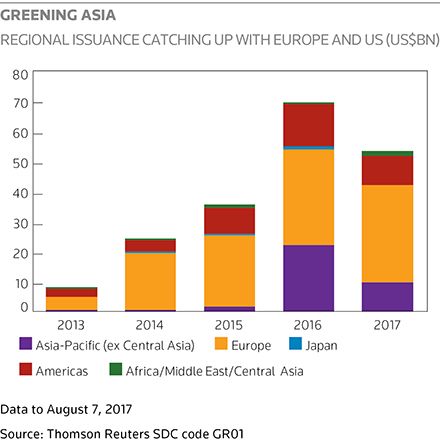

Ko-Wei Hsiung, HSBC: The first green bond in Asia came from Kexim in 2013. Shortly after that, in 2014, Advanced Semiconductor Engineering from Taiwan became the first corporate green bond issuer from Asia.

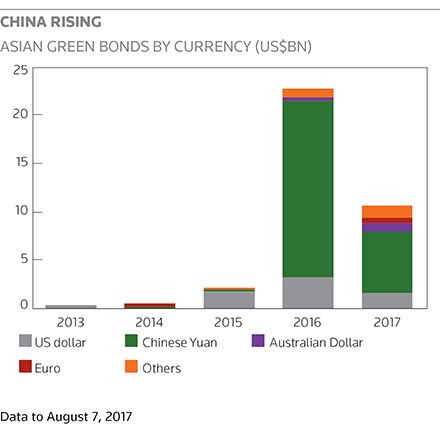

The market went a bit quiet after that, but more recently China is picking up a lot. The PBoC issued the first guidelines in 2015, and then we saw huge growth in that market in 2016. Chinese green bonds made up nearly a third of all global issuance last year, at close to US$35bn. That’s been a phenomenal growth trend right there.

We’ve seen the market growing again in 2017. You’re seeing a strong willingness from the regulators, and more issuers are looking to be part of this global phenomenon.

IFR ASIA: Thank you. You did mention regulators there, so this might be a good opportunity to ask Mark about your discussions with regulators. What’s the attitude been like?

Mark Austen, ASIFMA: I think that the attitude has obviously been very positive. As we’ve already heard, one third of overall global green bond issuance is now Chinese, and that’s been very much driven by the PBoC. That’s been a very, very positive development. You can also look at India, which came out with its own standards in 2016. There’s an increased awareness around green energy in India, so we expect that market to really develop going forward as well.

Regulators in general have been very, very supportive in trying to move this along, and globally we’ve also had standards coming out of the FSB on disclosures. I think we’re going to talk later on how regulators can incentivise green bond issuance, because I think at this stage the demand side is really only driving issuance in those markets that have have a stronger environmental awareness. If you don’t have that awareness, you need to incentivise users to actually buy these instruments. I think that’s where the regulators probably need to play a more active role than they have in the past.

IFR ASIA: Just to round off on the recent developments, John, let me ask you what are the growth areas that you see in green finance at the moment?

John Wade, Mizuho: Thanks, Steve. First of all, from our perspective at Mizuho, we have a lot of issuers who want to come to the capital markets and green, or sustainable, finance has now become a product that we need to be very conversant in. I can remember the morning when that first Kexim trade happened. Nobody knew what it was. There was a lot of education that everyone needed to go through before we could really start talking to other potential issuers. For example, if I talk to David, he’s going to say, “What do I need to do to issue a green bond?”

There are three basic components I think we need to develop the market. One is a willing issuer base, and generally that means finding an issuer where a transaction will suit their sustainability needs, suit their financing needs, and come at the proper price. But we also need investors. Initially we thought the market was going to have every single investor in the world want to buy green or sustainable bonds. Well, that’s still developing. If you go to Europe and show an investor a green bond, a dedicated green might be happy to put some money towards that, but we also need investors that don’t have a dedicated green portfolio to buy something that is fairly priced.

We need to keep working on investor education, and also on the framework, making it easy for people to understand. That’s one of the things I think we’ll need to develop.

IFR ASIA: I want to touch on some of the challenges there, but first it might be interesting to hear some of the individual experiences that we’ve got on the panel. David, what did you take away from your experience?

David Pang, MTR: We issued a public bond, a US dollar 10-year green bond, last October. Before that, we spent quite a lot of time studying the market. I think this is something that lots of corporates will have to go through if they are considering a green bond. What are the obligations that we have to follow? What is the extra work that we need to do?

Luckily, we have a sustainability department in the company which has been looking after these aspects for many years, so we have the help internally to go through our projects to see whether they are really green enough.

The good news is that we are in an industry that is really green, we are in metro transportation. I remember seeing one statistic: a single MTR train can replace 25 buses and 1,500 cars. You can see how that reduces carbon dioxide emissions and roadside pollution.

Then we looked at what we needed to do. First, we had to establish a green bond framework. That at first looked complicated, but once we studied the ICMA green bond principles, it became quite straightforward as we have enough green projects. Then we had to get a second opinion, which took us about six weeks. I regard that as quite an achievement because some banks told us to allow at least two and a half to three months!

Once we got that, then the issuing procedure would be no different from a normal conventional bond except that in this particular case we spent a week doing the roadshow. For a conventional bond we probably don’t need a roadshow because we are, I think, an established name in the market.

We were very happy with the deal. First, it was our first green bond; second, it was priced right before the US election, before Treasury yields went up, so it was a good experience all round. Once we established the framework we were able to do a private placement a couple of weeks ago with the help of my friend John on my left, and we were also very happy with that because of the swift execution. We didn’t need to do a roadshow because it was a private placement, and the pricing was also very competitive. It was an Aussie dollar issue so the final pricing in Hong Kong dollars also depends on the cross-currency swap rate, but, yes, our experience in the green issue was very good.

IFR ASIA: Vivian, let me come to you for a quick recap on where the rating agencies see the green market. Does this have an impact on credit and what’s the role of a rating agency here?

Vivian Tsang, Moody’s: Last year we published a report on how a rating agency will look at climate risk, and in this report we actually mention four risks we now incorporate into our rating analysis. Regulatory and political risk; that’s the first one. The second is the demand risk from consumers’ changing preferences. There’s also the direct financial impact from climate risk, and the fourth one that we look at is technological shock.

Any of our credit ratings take into account the business profile, financial leverage, and also profitability and efficacy, so it’s essentially built into the existing framework, but we focus a bit more effort now on incorporating climate risk into our rating.

In this report we highlighted 13 sectors out of 86 that will face high or very high climate risk. The top three are the coal industry, coal terminals, and the unregulated power industry. You can see in the unregulated US market that wholesale power prices have come down and renewable energy supply has gone up, so the dynamics are changing in certain markets.

We also highlighted for the other sectors what we think the impact will be in the next three to five years and in the medium term, but it’d be more immediate for the coal terminals as well as the unregulated industries.

IFR ASIA: Did you have to revise any credit ratings as a result?

Vivian Tsang, Moody’s: No, I think it’s an ongoing thing. We look at our ratings constantly and we’d definitely do some adjustments if it actually moved the needle. Even in the regulated power industry, which I actually cover, one of the considerations is the fuel mix and diversification. Clearly if you’re a pure coal-fired generator, your score would be lower than a power company with a mix of coal and wind and solar. It’s a constant process, and we consciously try to build that into our framework.

IFR ASIA: Arthur, on the buyside, what does your experience look like so far in green finance? What issues have you come across?

Arthur Lau, PineBridge: The green market in Asia has just started to emerge over the past few years. Now we’re past the awareness stage. People know that it is a growing market, with growing demand. But as an investor, honestly, we are driven primarily by our clients’ requests or by commercial sense.

When we look at green bonds for our general, non-green mandates, then of course it has to make commercial sense for us to participate. As a firm, we also have so-called ESG mandates from European and US clients, so they actually want to come to Asia to diversify their investments. I would think that the growing Asian universe actually will make green bonds a little bit more competitive here, given we have fewer issuers to choose from.

Of course, we see some challenges in identifying green bonds. All these are labelled as green bonds but it’s very hard to really ascertain the use of proceeds. For one thing, the market infrastructure is not standardised. Look at the index companies: they have different versions of a green index for onshore China versus the international market. Even the criteria to include those companies into the index is different.

Back to Vivian’s point, we haven’t seen any indication of a ratings benefit from a green project. In theory, a greener company in the medium term should perform better to those other companies that are not concerned about environmental issues, because of capex requirements or because of potential environmental risk.

As an investor, we’re happy to see the market continue to grow and we’d also like to participate in some of these green projects, not just for our clients’ requirements but also we believe that these companies should survive much better in the medium to long term. But we need some infrastructure to help us: it’s not just about the index but also about the mechanism of monitoring that a company stays green.

IFR ASIA: You mentioned a lot of the hot topics there. Has there been any example of a green bond pricing at a premium to non-green?

David Pang, MTR: We did not see any significant difference in the pricing of our green bond or green MTN, but what we definitely see is we have an expanded investor base. In this sense, we are confident that our green bond would not be priced worse than a conventional bond simply because an expanded investor base will create more price tension.

We are hoping that as more investors are engaged in green investments, as the investor base enlarges, they may create better pricing for green issuers.

IFR ASIA: Have you seen any movement in prices, John?

John Wade, Mizuho: I wish I could answer that question! If I’m speaking to Arthur I’m going to tell him this is the best thing he could buy because there’s more liquidity. For David, I have to tell him not to expect a premium. In my position I have to please all the various constituents, and you know the outcome there!

What’s quite important, I think, is on the investor side. If we go to Arthur with a Kexim bond, he knows what portfolio that goes in. He has nothing else to do except for analyse the credit and see the pricing. But if we tell him it’s a green sustainable bond, he has to look at his ESG mandate: where can this go, does it suit? What index does it go in?

That’s something for everybody in the room to think about. Having very clear guidelines for investors and issuers will help us ultimately get to the point where we can price bonds tighter. There’s a lot of work to do, but that’s the endgame.

Vivian Tsang, Moody’s: One of our rated issuers, China Three Gorges, just recently priced a 650m green bond in Europe to refinance the acquisition of a wind farm last year. According to some articles I read, the pricing was pretty much the same as their existing bonds but with a slightly longer tenor. Maybe that’s a small pricing premium.

Ko-Wei Hsiung, HSBC: If you look at this in a simpler way, there’s never going to be an investor who says “Hey, this is a green bond; I’m not going to invest in it.” When you launch a green bond you’re going to have the conventional investors coming in and you’re going to have the benefit of an expanded universe of green bond investors, who can perhaps only invest in green securities. That’s a really simple breakdown of what we’re seeing, but it should never be pricing wider than a conventional bond.

IFR ASIA: What about the procedures that issuers need to go through? Is there a point where it just becomes too much work?

Katharine Tapley, ANZ: That’s a conversation I have with treasury teams frequently and I’ve had it with my own treasury team actually. With the right support, nothing is impossible, and I think it’s key to partner with the right organisations to take you through the process. Find a bank that can assist you with your framework and has the expertise of having done their own issuances themselves – there’s a few of us sitting on this panel.

I would also always encourage an issuer to supplement their framework with an opinion of some form – whether that’s in the form of an assurance or a certification for example from the Climate Bonds Initiative. Ensure that you’re engaging an opinion provider who has really deep understanding of the market and really good experience in the space.

IFR ASIA: Let’s just explain that. You’re talking about a third-party verification, a stamp of approval for these deals?

Katharine Tapley, ANZ: Well, CBI certification is one form of a second-party opinion or third-party verification. The key point is that investors – and Arthur will correct me if I’m wrong – are really keen on seeing some sort of independent view of an issuer’s green bond framework. There are various ways you can do that, and CBI certification is one option that is emerging as standard practice in the Australian market.

Treasury teams – and we’ve talked about it a couple of times already – really need to work with their sustainability teams because the reality is that the data about the underlying asset base will exist in your organisation. The treasury team will not be starting from scratch. The key to it is engagement with the sustainability team.

Mark Austen, ASIFMA: This is one area where governments and regulators can help. We’ve already heard on the panel that investors are driven primarily by yield, even if you think that sustainable instruments are probably more viable than unsustainable ones in the long term. Investors still look at yield, so what is the incentive for issuers to issue in that space, especially if they’ve got other additional burdens?

There’s one scheme that MAS has set up in Singapore which allows an offset of 100% of the expenses attributable to obtaining an external review for green bonds up to a cap of S$100,000 (US$73,720). It’s not a huge amount of money but it’s one way governments can help incentivise issuers by helping them get over that initial hurdle so that they can actually start issuing green bonds.

If governments and regulators want to support green bond issuance for the benefit of society as a whole – and that’s really what we’re talking about here – then really they should put their money where their mouth is.

IFR ASIA: David, what about the ongoing costs? Do you see any hurdles there for companies that need to keep updating investors throughout the life of the securities?

David Pang, MTR: It is always good to have some incentive from the government to encourage the issue of green bonds or green finance, but the actual cost of, for example, the third-party second opinion, is not that much compared with the cost of issuing a bond.

You asked earlier about companies that do not have a sustainability team in place. I think in that case it could be quite a lot of work. For us in the treasury department, for example, we seldom pay attention to the amount of environmental benefits generated from a particular project. So if you have to start from scratch, it could be quite tough. First you have to understand the project and then you have to quantify the benefit.

Even in our company we found many interesting projects, but nobody was quantifying the associated environmental benefit. As a result of this green bond we are now trying to quantify the benefit so that a third party could verify it.

To go back to your question on how much ongoing work needs to be done, it’s all voluntary. The green bond framework doesn’t require you to report the amount of environmental benefits, for example. It encourages you to give an estimate, but we tried to take it one step further, so we quantified it, set up a methodology and asked the third party to verify it. It required a bit more work, but again it is all voluntary. If you don’t want to do it, you don’t have to do it. That’s the beauty of the present green bond principles, actually, they do not force you to do anything you don’t want to.

Basically, you have to have a framework which aligns with the GBP, and then you have to verify the use of funds. Basically, that’s it. There is some work but that is not overly onerous. Once you have fully allocated the proceeds, estimated the environmental benefits, then the annual report becomes a static one, so every year it’ll be the same. I would say that’s not too much of a burden.

Vivian Tsang, Moody’s: In China they take a slightly different approach. If you issue a bond under PBoC guidelines, you’re actually required to do quarterly reporting on the carbon reduction. So in the context of issuing bonds in China, you’re faced with a bit more ongoing work.

IFR ASIA: Does somebody need to verify that report as well?

Vivian Tsang, Moody’s: There’s no strict requirement in China for a third-party review, but the unspoken indication is that the regulators want you to do it, even though it’s not on their guidelines.

IFR ASIA: Arthur, this goes back to your point about the use of proceeds. How do you feel hearing that it’s a voluntary commitment rather than anything legally binding?

Arthur Lau, PineBridge: It raises the concern that we always talk about on how we can monitor the green proceeds on an ongoing basis. As an investor I don’t think I’m qualified to say I am an expert in assessing green projects, so I need to rely on other opinions for that. Internally the challenge we have is how to ensure a green bond issuer will continue to be green, and we don’t have a mechanism at the moment for that. We understand the bond proceeds are fungible; they can move around. But there’s no such thing as a rating downgrade, for example, or a way of reclassifying the green bond issuer as non-green if they are not complying with all these requirements.

In addition to that, we have found that even in searching for an ESG certification partner there is no standardised process. Many different consultants may have a different approach in terms of how to define ESG, and we have our own version. That is part of the challenge I mentioned earlier about the market infrastructure: who is going to do the monitoring, who is qualified to do this monitoring, and can there be a system to punish bond issuers that are not complying with the guidelines?

IFR ASIA: Would you like to see some kind of penalty in the written documents? Say if a company is raising money to build a solar plant and then builds a coal station instead, should that be an event of default? Should investors have a put option? How would that work?

David Pang, MTR: Just to clarify, the use of proceeds is not voluntary; it is governed by the list of eligible projects on your green bond framework. What is voluntary is whether you quantify the environmental benefits or not.

Arthur Lau, PineBridge: It’s certainly helpful when some conventional bonds have compensation for a rating downgrade or a put option, like if there is a change of control. As I said, we have passed the awareness stage for green bonds, and we’re now looking at actual investment. We have seen demand from non-Asian investors, but we do need to answer those questions for our ESG or green mandates. As an agent for our clients, how can we make sure the investments comply with their requirements? We can’t do that without the infrastructure to help us.

Maybe for MTRC it’s quite clear cut, but we do see that the certification process is not standardised. We do see, for example in China, that some of the PBoC indices for so-called green bonds do not require the use of proceeds to be 100% in green projects. There is a challenge for us to identify which bonds are greener than the other.

Mark Austen, ASIFMA: I believe strongly in standardisation, and standardisation definitely needs to play a role here, but I think we have to realise that this is a very new, growing industry and we need to give it some time to allow these standards to develop. We’ve mentioned the ICMA green bond principles already a few times and certainly we see that as a starting point to develop international standards in this area.

We’ve already mentioned the fact that China has different standards. Going forward how do those standards get reconciled with the international norms? PBoC claims that 90% of the bond issuance under the China standards would be compliant with international standards. One of the big stumbling blocks there is clean coal. Under the China standards you can actually issue for clean coal where under the international standards it is very difficult.

I think we’ve got to let the industry develop and reach some agreement on what those international standards are. If you look back at other areas of development, it can take years to get there. I think we’re moving in the right direction, it’s just going to take a little bit of time.

To view all special report articles please click here and to see the digital version of this report please click here.

To purchase printed copies or a PDF of this report, please email gloria.balbastro@thomsonreuters.com.