IFR ASIA: Welcome. Let’s kick things off with the state of play in Asia’s banking sector. Where are we in terms of meeting global regulatory requirements, and how is that affecting lending?

ARUNDHATI BHATTACHARYA, SBI: Regarding the requirement for capital, yes, we are in a country that is a little bit capital deficient if you look at the Basel requirements. Now how do we go about raising that capital? In respect of the public sector banks, we will need a capital raise, but we also have a lot of non-core assets that we can sell or list. We are also looking at various other instruments to see whether the capital markets can help us.

We’ve been talking about perpetuals, and the fact that Additional Tier 1 capital instruments are still not available in the domestic arena. What is happening in countries like India, where the domestic market is not that developed, is that companies need to go abroad to get international investors to take on such instruments. Now this obviously poses a challenge for companies such as ours, because if the domestic market is absent then there is a premium that you need to pay to attract international investors. In India, the pension funds and the insurance funds, who should be large players in this area, are still fringe players, because the investment policies from the government and the regulator pre-empt them from taking products like perpetuals, and pre-empt them from investing in bonds that are less than Double A rated. That is a major challenge, but it is starting to change. In fact very recently the Employees Provident Fund Organisation allowed a 5% investment in equities for the first time.

We see a very clear focus on the challenges that are preventing the deepening of the capital markets. The government understands the challenges, and is trying its level best to see that we move this market ahead. The question is: is it moving fast enough? Maybe not for the investors. But for those of us who are looking from inside out, we believe that it has to be sustainable. It has to be something where all stakeholders are convinced that it is the right way to go, so a little time is necessary.

IFR ASIA: How urgent is it then that Asian banks do raise capital? Are we getting to a point where banks are capital constrained?

ARUNDHATI BHATTACHARYA, SBI: I don’t think that we are so capital constrained that we will not be able to participate in the next round of growth. In fact across the board if you look at the profitability of the banks and the kind of growth they have been generating, credit growth of around 14%–15% is still supportable. What will not be supportable is a growth of around 20%, in which case we will need to raise capital immediately. But as I said in a group like ours we have a number of very profitable units that we have not listed. We have an investment bank that is making good profits – not listed. We have a card company that is making very good profits – not listed. We have a life insurance company making good profits – not listed.

There are a lot of other things that the Indian banks can do. It’s not as though I will stop participating in the growth story if I don’t get capital tomorrow. That’s not the case. But, going forward, it is something that is required in the medium term, not the long term.

IFR ASIA: Alexi, let me ask you to follow up. The constraints facing the Asian banking sector have already been a driving force in capital markets growth, haven’t they?

ALEXI CHAN, HSBC: We’ve certainly seen some very positive dynamics in the capital markets around the kind of bank capital instruments that my co-panellist just mentioned – both Tier 2 and AT1. I would fully agree that Asian banks would in general be keen to raise these sorts of instruments both domestically, where they are available, and also internationally. For many of the banks in the region, capitalisation is actually at relatively high levels on an international comparison. But what perhaps contrasts the banks in Asia with their counterparts in Europe is that the growth of risk-weighted assets is expected to continue at significantly more rapid levels than in other, more developed parts of the world. Banks will require capital to support that growth.

The Basel III agenda was a major step for the market to digest, particularly with regards to the issuance of so-called ‘loss-absorbing’ instruments in the international credit markets. The positive news is that these sorts of instruments have been readily accepted by international investors. We have been working hard with our clients in the investment community to explain the risk features to them, and get them comfortable with the risk features in Asia relative to other parts of the world. In China we have seen very substantial volumes of AT1 products, as well as Tier 2, in the international markets, and that has been very well absorbed by the market.

We’re on a journey, and we are seeing these sorts of instruments starting to develop in some of the local markets – in Australia, in Singapore, and in the RMB market. It’s clearly not going to be a single pace, and some of the markets will take their time. In certain jurisdictions, for example in India, there has been extensive discussion around the framework for these sorts of instruments. But the international community is firmly behind this agenda, and I think the prospects for substantial amounts of capital raising – by Indian banks and by others across the region – are very positive.

IFR ASIA: Tom, what’s the link between capital markets and economic development? The banks here do need to do their part, but could a country with a deeper capital market grow faster?

TOM BYRNE, MOODY’S: In most emerging markets in Asia, growth is dependent on bank credit. For the most part, the banks are able to provide that credit – at least in banking systems where the sovereigns are rated investment grade. The challenge that we’re seeing in Asia is that some of the systems are somewhat overleveraged. China is the biggest case, where going into the global financial crisis the banking system as a whole was deleveraging as a share of GDP, and the policy stimulus quickly turned that around. The corporations – particularly SOEs – got hooked on credit, trying to provide a demand that no longer existed, both externally and domestically. That still has to be worked out of the system, and that’s probably one of the biggest challenges, even though we still think that the Chinese can find a way through it.

India has an issue with corporate leverage, but when you look at household leverage I think it is pretty well managed even in systems like Malaysia, Korea and Thailand where it’s relatively high – in Australia as well. But for various reasons that doesn’t pose a threat to the banks’ balance sheets. Non-performing loans would be most likely low even in China in an adverse scenario with a big slowdown in growth. I think one of the biggest challenges in Asia is not the state of the banking system, but because Asia is export-orientated it’s the state of the global economy.

IFR ASIA: We can touch on global risks in a second. Let’s bring in VP Lakshmi here. What’s been your experience working with the private sector? Has there been any significant change in risk appetite among the banks you deal with?

LAKSHMI VENKATACHALAM, ADB: Actually I’d really like to pick up on something Arundhati said a while ago – that there is a price to pay when you have an underdeveloped domestic debt market. As far as the ADB is concerned, we really understood this in the wake of the Asian financial crisis, when there was a very deep-seated, concerted move to address this macroeconomic issue. The ADB really got off to a very serious start under the Asian Bond Market Initiative to promote the development and integration of the local bond markets. This has been a very, very challenging exercise, since it has involved not just policy dialogue but also developing relationships with all the stakeholders and building the infrastructure needed to facilitate an active bond market. But I would say that the results are quite compelling. From 2000 to 2014 we have seen local currency bonds grow from about US$800bn to almost US$8trn, and they have also become a quite significant share of GDP.

Where we began to feel the pinch was in our twin focus – promoting infrastructure development and using the private sector as the key driver. It’s here that we really feel the drive to move from bank finance to capital markets is a very compelling story, because we all know the arguments: banks have to match their assets and liabilities, they have to manage credit exposure to single sectors and single borrowers. While banks are very well positioned to take up the initial construction risk and due diligence on a project, there has to be this subsequent movement. There’s also a compelling argument that bank finance is an inefficient way of promoting economic development. Because who do banks lend to? They don’t lend to the SMEs in the volumes they need, they lend to the large state-owned enterprises or big corporates. It’s really the SMEs that have to be developed if you want to accelerate growth: they’re the ones who create the most jobs. Once you see infrastructure assets moving away from the banks, we are going to really free up capital for this sector. I dare say while the corporate bond market has seen some progress, we are still going to face significant challenges in the development of the project bond market.

IFR ASIA: When we are talking about developing a local market, how has Azerbaijan’s experience been so far?

RUFAT ASLANLI, AZERBAIJAN: The Azerbaijani capital market is relatively young: Baku Stock Exchange started its operations just 12 years ago. But the government has a very ambitious agenda to develop this sector, and we adopted a 10-year strategy in 2011. There are three major parts to this strategy: legal, regulatory and operational improvements; second, supporting supply and demand – generally supply because we already have huge demand here; and third, capacity building for all market players. We have already seen some good results since we implemented this strategy. Market capitalisation has increased fourfold in the last four years, reaching US$17bn – approximately 22% of GDP. But we have to continue our efforts to make the market deeper.

IFR ASIA: Are there any restrictions in terms of foreign access?

RUFAT ASLANLI, AZERBAIJAN: There are no restrictions. Moreover, we are working with our Korean colleagues to bring more international actors to our market. We do believe that the first players will be from this part of the world – from Asia.

IFR ASIA: David, from an issuer’s point of view, do the capital markets offer what is needed?

DAVID RASQUINHA, INDIA EXIM: Yes indeed. We are a little bit of an odd animal here because our balance sheet is predominantly dollarised. We have more than two thirds of our loan portfolio in dollars, so for us it is perhaps the international market that is a little more important than the domestic market in rupees. Our experience has been extremely positive, and we have been tapping a variety of currencies and instruments. But our role is really to be agnostic in what is the currency or market we tap, as long as we can achieve an economic price in floating US dollars, because that is what our customers are demanding. Given that we are 100% owned by the government, we are perceived in many ways as a proxy, since the government itself does not borrow overseas. Our issues have been regularly oversubscribed by a significant margin, and we have found ourselves quite welcome in the markets.

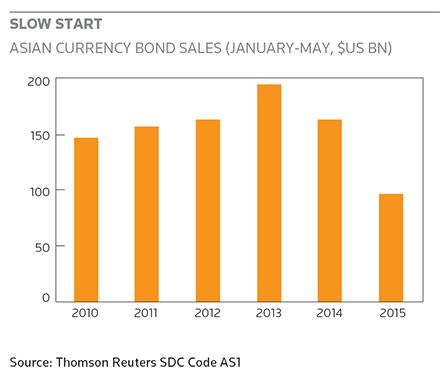

IFR ASIA: That’s a nice segue into the development of the international market. We are now looking at about US$200bn of dollar bonds sold each year from Asia, excluding Japan and Australia, versus only about US$30bn–$40bn pre-crisis. Chinese companies borrowed US$1bn in overseas bonds in 2008, and that’s gone up to US$76bn last year. The question that follows is whether Asia is exposing itself to more risks in currencies outside of its control. Should we be worried?

TOM BYRNE, MOODY’S: Chinese offshore borrowing has certainly not gone unnoticed, and we think this is a challenge for some of the corporations in China. We have about 160 cross-border ratings in China, and just as an aside, the explosion of offshore ratings has been good for our business. The biggest share is from the property developers, who are almost all in the private sector and are non-investment grade. There are some concerns about where that segment is heading in terms of cross-border risk. But the system as a whole remains well insulated, not just because the PBOC has something approaching US$4trn of reserves. The financial system as a whole is remarkably strong for an emerging market, because the net international investment position is about 15% of GDP. Now that’s been halved since the pre-crisis level, and that reflects the rise in offshore borrowing, but there’s still a large buffer. We don’t see this leading to any kind of systemic crisis; at least it would take a lot more borrowing for this to occur.

That’s the Chinese context. In contrast you have the case of Korea. We just put a positive outlook on Korea, and you can look at it versus China, which has the same rating. The Asian financial crisis always comes up, no matter how long ago it was, and it’s good for stability that policymakers remember it so well. Korean corporates leveraged up in 1996–97, and the banks were particularly highly leveraged going into the global financial crisis in 2008. That’s all stopped. The regulators have come in pretty effectively, putting a cap on loan-to-deposit ratios, and bank risk management has improved, we think. So Korea did not participate in this binge of offshore borrowing that has occurred in China and in other countries in Asia Pacific. External debt levels have remained constant.

IFR ASIA: Alexi, what do you see behind this surge in offshore bond issuance?

ALEXI CHAN, HSBC: I’d take this from a couple of perspectives. One of the lessons from the original Asian financial crisis, as my fellow panellists have already mentioned, was the risk of overreliance on bank debt and insufficient access to capital markets. So I think the growth of Asian issuance in bond markets – whether that’s in the dollar markets or in local currencies – is something to be welcomed. The markets have been deep and liquid, and they allow issuers to access long tenors, which are often not available in the bank markets. We are seeing Asian issuers shift more towards a US-style approach, with a 60/40 or 70/30 split in their debt raisings in favour of the capital markets over bank debt. Asia had probably been the opposite previously. I think the shift into the capital markets is a structural one, which is clearly to be welcomed.

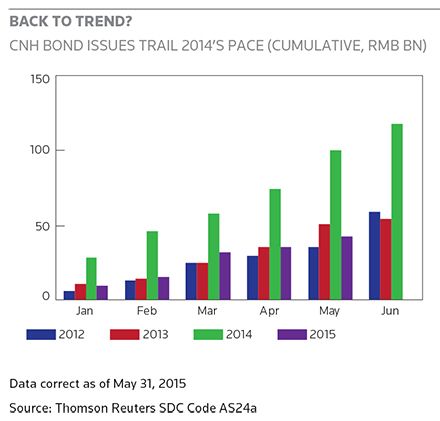

On the question of currency risks, some of the issuance we’ve seen has been to support other cross-border flows, where Asian entities have expanded overseas. It’s also important that Asia has developed better hedging mechanisms, which can allow issuers to tap a specific market and gain a pricing or liquidity advantage, using cross-currency swaps to bring the proceeds back into the currency that’s finally required. That’s another positive dynamic. We’ve also seen offshore markets develop in selected local currencies, and the most high-profile of those has been in the Chinese renminbi – the so-called Dim Sum bond market. These are all positive ways in which the offshore markets have responded to concerns over currency risks. Offshore funding is going to remain a core part of the capital markets infrastructure in Asian economies.

IFR ASIA: Azerbaijan issued its first dollar bond last year. Why does that make sense?

RUFAT ASLANLI, AZERBAIJAN: It was our first experience and the aim was to create some benchmark for our local companies, which are on the way to being listed in global markets. Before the first sovereign bond was issued our state-owned oil company, SOCAR, started issuing bonds in London, and several of our national champions are now looking to build a presence in the European capital markets.

From our perspective, from a local market perspective, we have only seven listed companies in Baku, but the number is growing very rapidly. Just three years ago we had only two. Such an experience of issuing sovereign and corporate bonds in the global markets brings a lot of good practices to the local markets. That’s why we as a local market regulator support such initiatives.

IFR ASIA: You’re importing best practices, in a way. Lakshmi, let me ask you what more can be done to stimulate this cross-border flow between Asia’s local markets? Is there a need for greater integration?

LAKSHMI VENKATACHALAM, ADB: The compelling arguments to facilitate cross-border flows come from the growth models that we are now seeking in Asia, which is much more about South-South trade and investment, and the development of these regional value chains where countries can develop manufacturing capabilities based on their comparative advantage. It’s recognising this potential that led us to set up the ASEAN+3 initiative of the Credit Guarantee and Investment Facility (CGIF), where we were able to provide a facility to allow corporates to upgrade their ratings through credit wraps from the CGIF. The green shoots have been quite encouraging, to the extent that other regions – particularly South Asia – have been exploring similar facilities.

It’s really the drive for diversification of investments that is propelling this desire for cross-border issuances, and as a multilateral bank we are trying our best to encourage this among our member governments. Of course the real challenge here is in the regulatory space, where you’ve got to have uniform standards and other constraints being addressed to ease the movement of capital.

ARUNDHATI BHATTACHARYA, SBI: I just wanted to mention that local currency borrowings are often at a much higher cost – especially in other emerging markets in Asia – so companies naturally look at borrowings outside their local market. In India two or three things are being done. One, the regulator has come out with quite a different kind of measure, that is to tell the banks they must set aside additional provisions if they are lending to a company that has a very large unhedged exposure, where the mark-to-market losses are in excess of 15% of that company’s Ebitda. So this obviously forces the corporates to assure their banks that they have adequate hedging policies in place, and that the impact of any mark-to-market losses at any time doesn’t go beyond 15%, because that means their borrowings will become more costly.

The second thing that the regulator has now done is to allow corporates to raise bonds overseas in rupees. The IFC has already done so, and it’s being termed a Masala bond in line with the Dim Sum market, but other corporates are being told they may raise their borrowings in rupees overseas, in order to mitigate this currency risk. But having said that – as I said earlier – it is the cost of the borrowings that matters most to people, especially in large infrastructure projects where you are importing capital goods. If you are getting very soft lines from the Exim banks of those countries then there will be a tendency to borrow in that currency. Therefore the only thing we can do from the financial system is insist that the borrower must have a proper hedging policy. They may not be able to hedge the whole way through, because the market is not deep enough at the long end, but they may come up with something like a rolling hedge that goes forward one year at a time. Whatever it is, we do insist that they have a proper hedging policy, so that the risk is understood, monitored and mitigated.

IFR ASIA: Are there any questions from the audience? We’ve found in previous years that the ADB audience tends to be extremely well informed and asks extremely intelligent questions. So that’s on you!

QUESTION: I’d like to ask about the perspectives on securitisation in the Asian markets. With the increase in assets and properties, what is the future of asset-backed and mortgage-backed securities in your markets?

ARUNDHATI BHATTACHARYA, SBI: Actually this is something we have been looking at, but there are certain issues, such as stamp duty and other legal regulations that need to be sorted out before this really starts making a proper impact. However, I think it is the natural state of progression. If your risk-weighted assets are growing very fast and you don’t have enough capital on your books, and if you have good opportunities to take on new projects, then you will have to get the mature assets off your books. And that is where this securitisation will really take off.

It’s a question of the markets maturing, of regulations falling into place, and also the kind of problems we have seen across the globe. For the regulators to feel comfortable that whatever they are doing will not replicate the kind of problems we had elsewhere, where people bought merely on the basis of the rating without going into the underlying risks. That has really done a disservice to the entire mortgage securitisation market. The emerging market regulators are very scared that similar kinds of stuff might creep in, so they are looking at all kinds of checks and balances. My own take on this is that this is a natural progression for any market. It’s going to come into the emerging markets as and when new projects come up, and banks are definitely going to go for securitisation to get assets off their balance sheets.

ALEXI CHAN, HSBC: From HSBC’s side we’d absolutely agree with that perspective. Securitisation and ABS became a more challenging concept after the global financial crisis, but as the capital position of banks globally has come under more scrutiny, securitisation techniques are coming back as a major development in the markets – certainly in the European markets and in the US markets, and it’s a matter of time before this comes back into play in Asia. I think there will be other sectors as well where global players will look to mimic their financing techniques in the global markets through securitisation and ABS. The auto sector, for example, is one where we see substantial ABS issuance on a global basis, and many of the established players in that sector have started issuing in Asia’s local markets – including the Chinese RMB market. And again we expect that to spread.

ARUNDHATI BHATTACHARYA, SBI: This is actually going to be a very good opportunity. If you look at India and the mortgage loans that we are making, the loans are made not on the basis of your property value, but on the basis of your capacity to repay. So even though you may have a property that is worth Rs2m, you may actually get a loan for a few thousand rupees if that is your capacity to repay. It’s a very good portfolio. Even at the height of the problems that India has had, NPLs in the personal and mortgage sector have been consistently below 1%. Not only that, in all the emerging markets these loans are often to first-time homeowners, who would do anything not to lose the roof over their heads. So it’s a very stable, well-paying portfolio, so to take it to the securitisation market where you’ll have a host of new investors coming in, I think it’s a very good thing that is just waiting to happen.

LAKSHMI VENKATACHALAM, ADB: I just want to add that as long as you are able to manage the risks with proper regulatory frameworks, securitisation can also really become a very important tool in some of the most underserved segments like the micro-enterprises, where you can estimate the reliability of the cash flows and then basically create products that you can deploy elsewhere. We have a very good example where we’re supporting a non-bank institution called IFMR Trust in India, which is actually acting as a partner and arranger for microfinance and housing finance, and also through IFMR Capital is really using securitisation mechanisms to support these micro-enterprises. We think there is a lot of potential to go down this route to serve these segments.

QUESTION: Given the NPLs that have built up in banks and financial institutions over the last five years, where do we see capital markets coming up if credit offtakes from the banks are not taking place? Most central bank governors are worried that commercial banks are not passing on the monetary easing to industry. Where do we see capital markets – Asia, worldwide, anywhere – coming up because the money has to come back somewhere?

TOM BYRNE, MOODY’S: When you get to the basics of capital market development, one of the pillars is a sound banking system. Relatively speaking India’s is not all that sound. We have a negative outlook on it, we recognise that NPLs are higher than other peers such as Indonesia; asset capital is a bit weaker than peers as well. In general, to deepen capital markets in the emerging markets you need a sound banking system because the banking system is complementary to other forms of capital market investments. So I would throw the question back to you: what is India doing to improve its banking system?

To view all special report articles please click here and to see the digital version of this report please click here .

To purchase printed copies or a PDF of this report, please email gloria.balbastro@thomsonreuters.com .