The past 12 months have been a rollercoaster ride for Asia’s credit markets. But to this seasoned operator, an end to the exuberance of recent years is no cause for alarm.

![]()

Just what was it that made 2018 so terrifying for the Asian debt markets? Perhaps it was all about rising US interest rates and their impact on the global cost of money. Perhaps it was about a slowing Chinese economy, dragged down by Donald Trump’s petulant trade war and the fear of a collapsing debt mountain. Or was it the start of a great reckoning, following the irrational exuberance of the quest for yield over the past decade or so, as central banks turn off the spigot of quantitative easing?

The year has been fractious, nervous, with a constant sense that the next storm can never be far away. But deals got done, even if primary issuance in the G3 currencies failed to add to the record-breaking pattern of the past eight years or so.

“Asian credit markets have behaved rationally against a backdrop of strong US growth and a higher end-point for US rates. In many ways it’s a case of ‘nothing to see here, move along’,” said Mark Leahy, head of fixed income at the Singapore Exchange. “Primary market volumes will be the second highest on record albeit about 20% lower than 2017’s boom year.”

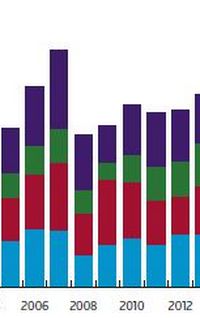

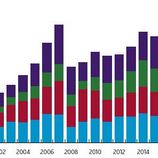

The secular growth of Asia’s G3 primary bond market over the past decade has been breathtaking in terms of volume and number of deals, and perhaps 2018, for all the background bearish noise, has not been an unmitigated disaster.

In 2010, according to Refinitiv data, a total of US$84.6bn printed from Asia (ex Australia) via 211 new issues. By 2015 the tally had more than doubled to US$179bn. The gangbusters year was 2017, when a colossal US$333bn printed via 564 deals – an all-time high.

We are off that at US$249m from 487 deals so far this year, and, barring miracles, won’t be beating that record-breaking clip when 2018 comes to a close.

But that achievement doesn’t look too shabby in a year when Treasuries commenced what many leading luminaries – including guru Bill Gross of Janus Henderson Investors – envisage to be a long-term bear market, bringing to an end the US government bond bull run that kicked off in the early 1980s.

There was even a ray of sunshine in the rebound of Japanese yen issuance, and the continuing popularity of Green finance as environmental, social and governance issues moved up institutional investors’ wish lists.

“The Asian bond market has made significant strides in recent years in assuming structural importance in the region, becoming a core avenue of funding for issuers as well as a key part of the investment strategy for insurance companies, funds, banks and private banks,” said Carla Goudge, head of debt syndicate at HSBC in Hong Kong. “We have seen market participants adjust to higher US Treasury yields, and expect markets to remain open next year.”

RATES AND REALITY

Digging further into the data shines a light on the impact of rising US rates on both issuers and investors. Emerging market Asian corporate issuance was down 28% in 2018 to US$221bn, while EM Asian sovereign issuance was down by 33% to US$14bn.

This decline reflects both the unwillingness of issuers to lock in long-term funding at higher rates and of investors to step up – in anticipation of wider spreads and higher absolute yields to come as the Federal Reserve rate-tightening cycle continues apace.

The lower reaches of the credit curve have borne the brunt of the forward-looking rate attrition, even though a flattening US Treasury yield curve has brought some relative value at the shorter end.

“Lower-quality issuers are more sensitive to higher interest rates,” said Nachu Chockalingam, senior emerging market debt portfolio manager at Hermes Investment Management in London.

“This is driven by the smaller headroom to absorb higher funding costs within free cash flows. Additionally, a bigger reliance on the front end of the curve leads to higher sensitivity to the flattening of the US dollar interest rate curve.”

Asian high-yield suffered in 2018: corporate high-yield in Asia paid an average return of 10.3% at five years as of the end of November – the highest since 2012, following a 170bp upward yield surge in October.

The first cracks began to appear in the lower reaches of the Asian credit curve late in 2017 after a record-breaking US$47bn of US dollar high-yield bonds cleared the market that year, thanks largely to the China property sector.

But given that China has been the most fertile source of high-yield paper, the cooling of its economy became the proverbial elephant in the room in 2018. There have been defaults, and Chinese companies approaching the high-yield market have had to pay up for the privilege.

A pellucidly clear example came from property developer Times China, which paid 11% for a two-year dollar trade in late November, up from 7.85% for a three-year non-call two only six months earlier. A 3%-odd repricing for a one year shorter duration demonstrates just how brutal conditions became, with Chinese property company paper trading at record lows in late November.

Nevertheless, despite a less than auspicious backdrop, the sector deluged the market with new US dollar deals as the year approached its close, albeit at significantly higher yields.

“The widening in Asia high-yield this year was primarily due to new issues continuously repricing secondary curves,” said Ed Tsui, head of Asia debt syndicate at Deutsche Bank in Singapore.

Unsurprisingly there was a notable risk-averse shift towards high-grade issuance in 2018, perhaps most clearly demonstrated by the frothy response in September to the Republic of Korea’s US$1bn dual-tranche issue, which pulled in a massive US$10bn book for its 10 and 30-year tenors.

This allowed for two iterations to price guidance – something of a standout in a year when the modus operandi in high grade has been for far slimmer contractions than has been the norm over the past five years.

And a swathe of Asian high-grade issuance managed to clear as recently as September, following a turnaround in sentiment which saw the iTraxx ex-Japan investment-grade CDS index pull in around 13bp from the wides of July. China’s policy shift in favour of monetary stimulus in the form of reduced reserve requirements for banks underpinned the risk-on mentality.

YEARNING FOR YEN

The unexpected recovery of the primary yen bond market was the joker in the pack for 2018. Despite the constrictions of a hyper-accommodative monetary policy under the Abenomics regime, which had pushed Japanese government bonds into negative yield territory and roiled swap markets, some bright spots have begun to emerge.

“We have seen a massive difference in the yen bond market of 2018 versus the previous year,” said Kazuhide Tanaka, head of funding at Rabobank in Tokyo. “We can attribute this to the recovery of the yen/dollar basis swap which has made yen issuance more economically viable for more high-grade issuers.”

Five and 10-year basis swaps contracted this year, making issuance in yen more attractive for offshore issuers looking to swap back to dollars. Another driver of issuance was a ruling by Japan’s FSA on total loss-absorbing capital (TLAC), which reduced fears of higher risk weightings for banks holding bail-in-able senior bonds and powered demand from Japanese banks.

“This has resulted in massive buying interest from Japanese financials, especially regional banks, for TLAC-eligible issues,” said Tanaka.

There were some barnstorming Samurai deals in 2018, driven by this newly unleashed demand as well as by the view that the yen was likely to appreciate over the medium to long term. Top of the list was the ¥154.2bn (US$1.38bn) three trancher from the Philippines, which priced in August and marked the biggest Samurai bond from an Asian issuer.

ESG loomed large in Asia in 2018, with climate change and corporate governance becoming part of the asset management industry’s fundamental risk analysis. Accompanying this shift was the continuing super-charged growth of the region’s Green bond market.

Asian G3 Green bond issuance, excluding Japan, was on track to top US$20bn by the end of 2018, around double the 2017 total, thanks to the need to fund sustainable infrastructure growth in the region.

The most encouraging element of the ESG market is the growth of demand for the product from Japan, where subsidies from the Ministry of Environment have teased out issuance and where demand from life insurers and regional banks looks to be here to stay – whatever direction US rates take from here.

To see the digital version of this review, please click here .

To purchase printed copies or a PDF of this review, please email gloria.balbastro@tr.com .