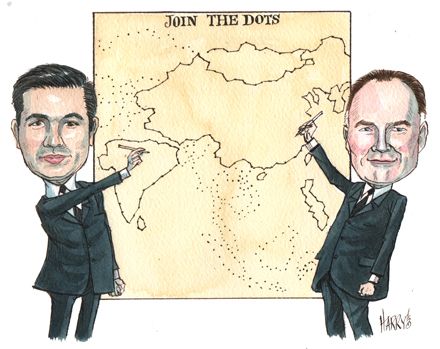

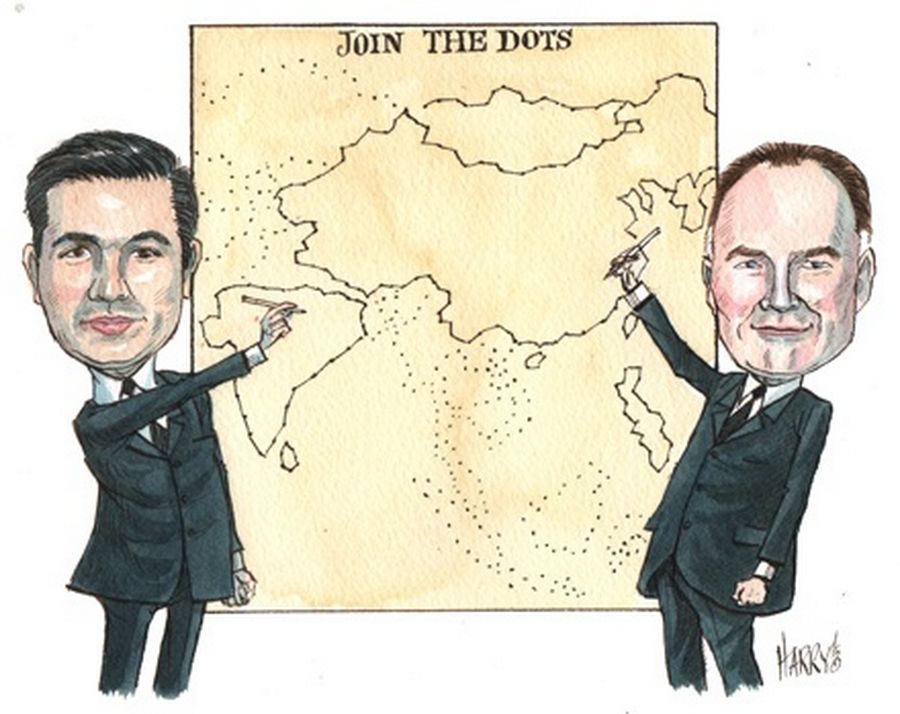

A pan-Asian footprint proved important in a year of extreme volatility in many local bond markets in the region and one bank’s focus on cross-border deal-making stood out. For bringing down boundaries and driving innovation, HSBC is IFR Asia’s Domestic Bond House of the Year.

Domestic Bond House

HSBC’s bond business saw an outstanding year across Asia, leading several innovative offerings and bringing more Asian issuers across borders than any of its rivals.

The bank topped the domestic currency league tables for the region, leading almost US$20bn in deals in onshore markets in Asia-Pacific, a 10% share of the market if Chinese onshore deals are excluded. That was an improvement on its second place in 2012, thanks to a stronger showing in several key markets, including the Philippines and Australia.

Deal volumes aside, HSBC worked hard to deepen Asia’s domestic debt markets in convincing issuers and investors to look beyond their home markets. As well as offering lucrative returns from swap-related business, the ability to complete cross-border financings without relying on US dollar investors helped Asian issuers weather the summer storm in the global markets.

HSBC brought Export-Import Bank of Korea to the Thai baht market for a Bt2bn 12-year bond – its longest baht offering to date – in July, at a time when Asian issuers were having difficulty getting competitive funding in the US dollar market.

“Local currency markets offered valuable alternative funding sources for domestic and international issuers, especially when the US dollar market was struggling,” said James Fielder, head of local currency syndicate for Asia.

The bank brought Korean issuers to Australia, a Russian bank to the renminbi market, and an Indian lender to Singapore. It led the first Hong Kong dollar deal for an Australian developer, GPT Group, and Abu Dhabi’s first ringgit-denominated Tier 2 sukuk.

In Thailand, HSBC signalled its determination to deepen the intra-Asian market with the lead role on the first deal to use the Asian Development Bank’s Credit Guarantee and Investment Facility.

The Bt2.85bn three-year offering for commodity trader Noble Group proved that the credit-enhancement platform could encourage local investors to look at overseas credits, while it also provided a vehicle for low investment-grade issuers to access an alternative to US dollar funding.

HSBC also excelled at bringing its global market knowledge to local currency transactions. That dynamic was evident in its role in helping structure the first Basel III-compliant Tier 1 bond to be issued in Asia. United Overseas Bank’s S$850m (US$674m) perpetual non-call five notes were priced at par to yield 4.9% in July.

As well as introducing an essential capital instrument to the region, the transaction showed that Asia’s local markets could offer better terms for issuers than the far bigger international arena.

HSBC remained the arranger of choice for inflation-linked government bonds. It was one of three bookrunners on New Zealand’s second and longest inflation-linked bond in over a decade, a NZ$2.5bn (US$2.06bn) offering due in 2030 issued in early October.

The bank was also present on Thailand’s longest-dated local currency inflation linker, a 15-year Bt40bn (US$1.25bn) transaction sold in March through a bookbuilding process. HSBC also claimed all three of the Hong Kong Government’s inflation-linkers, firmly establishing its expertise in the structure.

HSBC was also the only foreign bank to lead a local currency securitisation for Courts Asia, a Singapore-listed retailer. The offering marked the first time an issuer had sold asset-backed notes in both Malaysian ringgit and Singapore dollars off the same medium-term note programme.

In Singapore, HSBC was active in helping small-cap firms access the city state’s bond market for the first time, leading five deals. In doing so, it was at the forefront of a development that was among the most important in the Singapore dollar market this year.

HSBC also continued to dominate the offshore renminbi market. The bank ended the review period at the top of the league table for offshore renminbi bonds, having led some of the most high-profile deals of the year.

To see the digital version of this report, please click here.