We are now firmly in the midst of a commodity downturn. From its peak in June 2014, the S&P Commodities Index has lost over half its value. Industrial metals and agricultural products have been bleeding slowly since 2011, but they have slid more rapidly in the past 12 to 15 months, shedding about a third of their value. Energy prices have declined by a shocking 60% in the same period.

This has affected the prices of both shares and bonds issued by commodity-related companies. Noble and Glencore have each lost about three quarters of their market capitalisation since mid-2014, while other publicly traded commodity firms have lost 18-38%. Noble’s bonds maturing in 2020 are trading at about 75 cents, yielding 1,300bp over Libor.

How did these masters of the universe fall from grace? Commodity traders used to take pride in their ability to make money, irrespective of the commodity cycle. After all, they buy commodities and sell them for a profit, and it should not matter to them whether the underlying price was going up or down. That was exactly the argument given to me by a past CFO of Noble Group several years ago.

But, on closer examination, this argument turns out to be illusory. First of all, there is the volume effect. In a downturn, trading volumes decline, leading to a corresponding decline in profits. Even if the trader manages to keep up both volumes and its percentage margin, the total dollar amount earned declines as the underlying price falls.

WITH GREATER AVAILABILITY of information over the years, generating a profit from pure trading has become increasingly difficult. After all, if a trader is just buying and selling commodities, how does he justify a fat margin? In their quest to improve their razor-thin margins, trading firms have to take on some risks: some traders enter politically difficult countries; others take on price risk over time by stocking up on inventory or entering into forward markets.

Either way, higher margins come with higher risk. Hedging may not be available for many commodities or may be very expensive. There is also the temptation to cross the line from using derivatives as hedging instruments to using them as profit generators.

In that sense, a pure trader’s business is by definition a high-volume, low-margin business. Over time, as traders grow bigger, they take on a very different kind of risk in a bid to improve profitability. They start to acquire long-term assets, instead of just trading short-term. Such assets could be related to logistics (such as warehouses) or processing plants to add value to the commodities, but still in line with the underlying trading nature of their business.

As a further step, commodity firms acquire long-term assets, which could be stakes in the source mines or advances to mines against guaranteed offtake contracts. These investments are often justified as guaranteeing access to the commodity. But that argument bears close questioning. After all, the best way to guarantee access to a liquid commodity is to be prepared to pay the market price for it.

This is the evolutionary path that Noble Group took during the 1990s and the 2000s to go from asset-light to asset-heavy.

INVESTMENT IN SUCH long-term assets changes the nature of the trader’s business significantly. Now the trader faces a different set of risks. By investing in the source mines, he has tied up a part of the costs, leaving his margins more vulnerable to a commodity price slump. He has also made his balance sheet asset-heavy and less liquid in a downturn.

Along with the asset-heavy balance sheet, the nature of financing for the trader also changes towards a greater proportion of longer-term debt, which may often be unsecured or secured by the underlying mines. In a down cycle, the long-term assets decline substantially in value, leaving the long-term lenders severely exposed. As the commodity borrowers scramble to sell assets in order to cut leverage, they are confronted with crashing valuations and liquidity for their assets.

Short-term lenders, by contrast, can count on the short-term trading inventory as security and can revalue such assets in the course of the trading cycle with greater frequency. This is not to say that short-term lending to commodity firms, secured by inventory, is free of risks – as last year’s Qingdao warehousing fraud illustrated.

High liquidity, particularly in the form of readily marketable inventory, is supposed to be another credit support for traders. In fact, rating agencies often cite liquidity in the form of such inventory and committed undrawn bank lines as support for their ratings. Therein lies the irony that the three – inventory values, bank lines and credit ratings – are linked to each other. Banks may use inventory values and ratings as inputs in deciding whether to renew the trading lines; and ratings depend on inventory values and bank lines!

In fact, one of the most difficult challenges in analysing commodity companies is to disaggregate the risks of trading versus long-term investments. As commodity firms grow, their bankers come under increasing pressure to finance all parts of their business. Often they extend loans based on “relationship” reasons or on the basis that they are secured, only to expose their vulnerability in a downturn. As Warren Buffett once said, “Only when the tide goes down do you realise who is swimming naked.”

Commodity traders facing long-term stress

*Dilip Parameswaran is founder and head of Asia Investment Advisors, an advisory firm specialising in Asian fixed income.

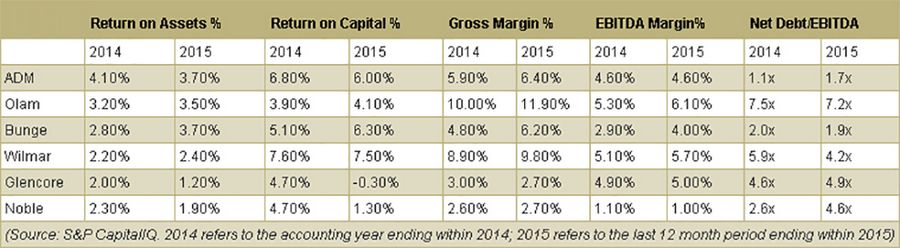

| Return on Assets % | Return on Capital % | Gross Margin % | EBITDA Margin% | Net Debt/EBITDA | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 2014 | 2015 | 2014 | 2015 | 2014 | 2015 | 2014 | 2015 | 2014 | 2015 | |

| ADM | 4.10% | 3.70% | 6.80% | 6.00% | 5.90% | 6.40% | 4.60% | 4.60% | 1.1x | 1.7x |

| Olam | 3.20% | 3.50% | 3.90% | 4.10% | 10.00% | 11.90% | 5.30% | 6.10% | 7.5x | 7.2x |

| Bunge | 2.80% | 3.70% | 5.10% | 6.30% | 4.80% | 6.20% | 2.90% | 4.00% | 2.0x | 1.9x |

| Wilmar | 2.20% | 2.40% | 7.60% | 7.50% | 8.90% | 9.80% | 5.10% | 5.70% | 5.9x | 4.2x |

| Glencore | 2.00% | 1.20% | 4.70% | -0.30% | 3.00% | 2.70% | 4.90% | 5.00% | 4.6x | 4.9x |

| Noble | 2.30% | 1.90% | 4.70% | 1.30% | 2.60% | 2.70% | 1.10% | 1.00% | 2.6x | 4.6x |

| (Source: S&P CapitalIQ. 2014 refers to the accounting year ending within 2014; 2015 refers to the last 12 month period ending within 2015) | ||||||||||