The region’s local bond markets are expected to pick up pace in 2014, but no one is expecting a banner year amid elections, economic uncertainty and political turmoil in Thailand.

Calm after the storm

Source: REUTERS/Athit Perawongmetha

City workers clean a street in front of a shopping centre as anti-government protesters decamped from protest sites around the capital and regrouped in central Lumpini Park in Bangkok.

The local currency bond markets in South-East Asia may rebound this year as corporations throughout the region refinance maturing debt and as markets recover from the tumult of the second half of last year.

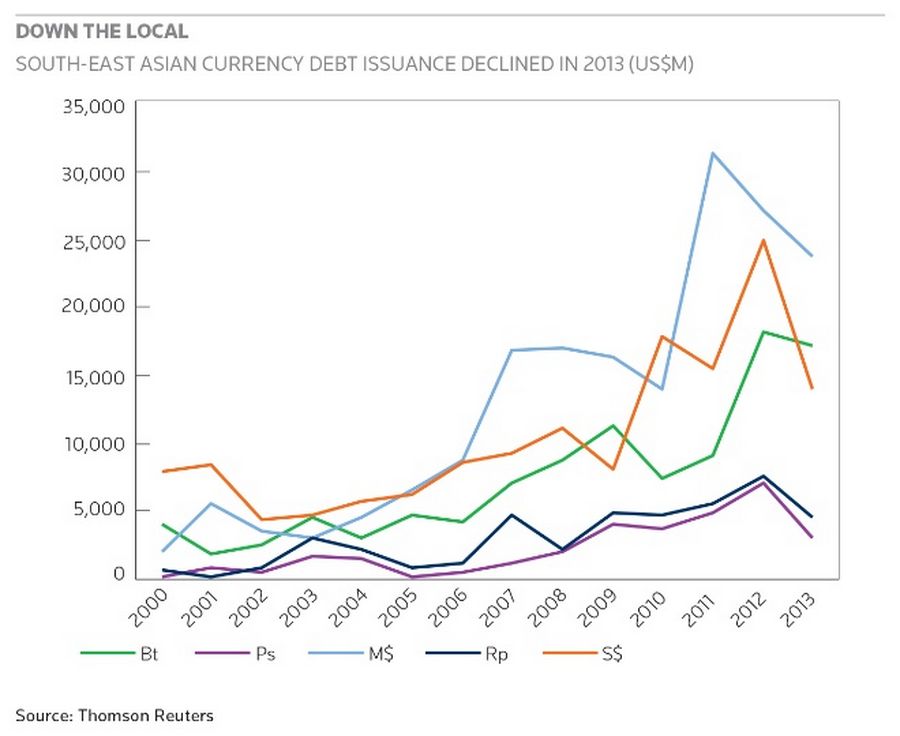

The US Federal Reserve’s plans to roll back its massive bond-buying programme triggered massive outflows from emerging markets beginning last May, wreaking havoc on local financing efforts.

The environment is stabilising this year throughout most of the region, leading DCM bankers to expect a steady supply of local currency bond issuance, but the total supply will likely be modest.

Down the local

While Indonesia’s economy is brightening, the Philippines is grappling with a declining peso and inflation threats and Thailand is in the midst of political turmoil with no end in sight.

Corporations, too, have the option of issuing bonds in international currencies if conditions are right, although bankers also do not anticipate a flood of G3 offerings this year. (see Bond Issuance Slows, Page 8).

The most noticeable turnaround story is in Indonesia, South-East Asia’s largest economy, which is showing signs of improvement. The rupiah is the best-performing currency in Asia, having gained 7% against the US dollar, compared with depreciation of as much as 21% in 2013 on the exit of foreign funds.

The local bond market is expected to pick up pace in the second half mainly because corporations have Rp36trn (US$2.8bn) in bonds maturing this year, up from Rp25trn in 2013, according to local bankers in Indonesia.

The market has not had a busy start, however, as just Rp3trn in bonds have been issued year to date compared with Rp15trn in the first quarter of last year, according to Thomson Reuters data. Issuers are waiting for parliamentary elections in April and presidential elections in July to be out of the way before launching deals, bankers say.

“Issuers preparing themselves since late last year have realised that rates are only going up and, hence, we are seeing a lot of activity in the primary market.”

Despite the political uncertainty, Indonesia’s economy is improving. Bank Indonesia expects inflation to slow to 3.5%-5.5% in 2014 from more than 8% in January and much of last year. Inflation had already eased to 7.75% in February.

As a result, the central bank is likely to keep rates stable after several hikes last year, making it easier for corporations to issue debt, DCM bankers say. Last year was a different story as the yield on Indonesia’s benchmark 10-year government bond jumped 300bp.

Lion purrs

Issuance in Singapore is also expected to rebound after a dull 2013, but bankers do not expect volumes in the Lion City to breach 2012 levels.

Local Singapore dollar bond issuance crossed the S$30bn-equivalent mark in 2012, but volumes were 35%-40% lower in 2013 because of volatile markets and the fact most major refinancing or funding exercises were done in 2012 “as per our advice,” according to Clifford Lee, managing director and head of fixed income, treasury and markets at DBS Bank in Singapore.

“For this year, we expect volumes somewhere between those of 2012 and 2013,” Lee said.

Many of the bonds in 2014 were likely to come from small- and medium-sized enterprises after DBS brought the first to the market last year, he added.

At one time, Singapore investors were interested only in buying bonds from high-grade issuers, or large corporate credits. Now, persistently low rates have encouraged them to go farther afield in search of higher yields and longer durations.

Bankers see this trend continuing and expect a number of foreign issuers to tap the market for funds this year, as well. For instance, Dutch multinational commodity trading company Trafigura raised S$200m last month through a non-call five year perpetual security.

The Philippines is also expecting a bump up in corporate bond volumes this year as issuers try to get ahead of a potential increase in policy rates. They may already be too late, however. Foreign investor sentiment towards the economy seems to be souring. The peso has been volatile this year after posting a 7.5% drop in 2013.

The currency’s weakness, on top of an uptick in food and utility prices, was likely to prompt the nation’s central bank to raise rates, analysts said.

“Issuers preparing themselves since late last year have realised that rates are only going up and, hence, we are seeing a lot of activity in the primary market,” said a Manila-based DCM banker.

Companies in the Philippines already have sold Ps23bn in bonds year to date, compared with Ps14.5bn in the first quarter of 2013 and bankers are confident of breaching the total issuance of Ps126bn achieved in the whole of last year.

This will partly be attributable to surge of refinancing deals. A burst of issuance in 2009, totalling Ps174bn, included several five-year issues coming due this year, bankers said.

Political risk threatens growth

Corporate bond issuance in Thailand was a relatively robust Bt420bn last year, but political unrest in the country is understandably pushing issuers to the sidelines now. Prolonged protests aimed at ousting Prime Minister Yingluck Shinawatra are making issuers and investors wary, and have the potential to drag down economic growth in South-East Asia’s second biggest economy.

“The pipeline is building, but the volumes will be lower than last year,” said a Bangkok-based DCM banker. “Issuers are revising funding estimates on expectations of slower economic growth.”

Nevertheless, many companies will need to come to market. A total Bt297.8bn in bonds are due to mature this year, according to Thomson Reuters data. PTT Chemical, PTT Exploration and Production, and petrochemical producer IRPC are among companies with bonds needing to be either refinanced or redeemed.

Another spate of issuance is also expected from banks. Thailand’s Securities and Exchange Commission is preparing amended regulations related to Basel III-compliant subordinated bond issues, and banks are expected to follow with deals.

Despite the protests, and their potential to harm Thailand’s economy, ratings agency Fitch recently affirmed the country’s BBB+ rating. Thailand has a strong external position and a credible monetary policy framework, Fitch said, adding that its key public finance ratios still compare well with peers.

Thailand’s strengths, in fact, helped it buffer the regional turbulence arising from the Fed’s tapering plans last year, and against the heightened political tensions, which first re-emerged early last November.

Fitch forecasts Thailand’s real GDP to grow 2.5% and 3.7% in 2014 and 2015 respectively, compared with 2.9% in 2013.

Off to busy start

Malaysia appears to be a bright spot, although it does not promise a gangbuster year either. After a quiet 2013, the number of bond deals began to pick up earlier this year and DCM bankers expect total issuance to top M$60bn (US$18bn) in 2014.

Issuance volumes dropped to M$66bn in 2013 from M$74bn in 2012 as some issuers stepped to the sidelines in the wake of general elections. Bankers in the region said government spending on infrastructure projects would be the main theme for this year.

“I expect issuance to be related to infrastructure projects and also to issuers that were on the sidelines because of elections last year coming this time around,” said a Kuala Lumpur-based DCM banker.

The infrastructure spending also is expected to boost economic growth.

Malaysia’s economic growth picked up pace in the December quarter to expand to 4.7% in 2013, albeit down from a 5.6% expansion in 2012. Analysts expect the pace to pick up to 5.0%–5.5% this year. The downside is that stronger growth is likely to spur inflation, which may raise funding costs for Malaysian borrowers.

While local markets are not completely shielded from global market moves, many South-East Asia nations should be well positioned for a relatively brisk year of issuance, although it may not be one for setting records.

To see the digital version of this report, please click here.