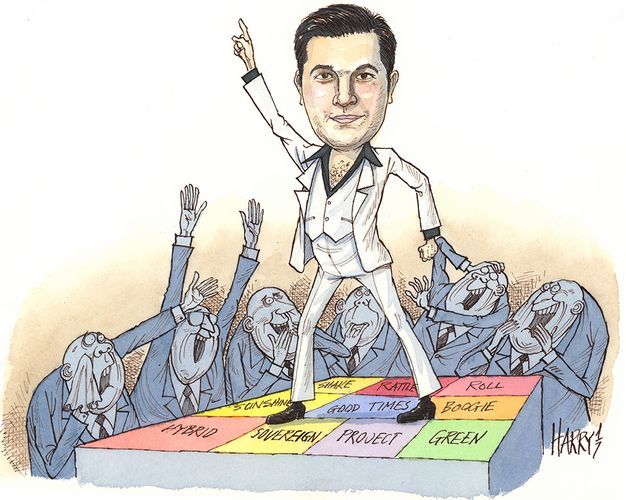

In another competitive year, and with financing volumes reaching new heights, one house capitalised on conditions to bring the broadest range of issuers to market. For spotting the trends and excelling across the capital structure, HSBC is IFR Asia’s Bond House of the Year.

HSBC dominated G3 issuance in Asia again in 2017, leading the deals that set the trend for the rest of the market and helping issuers around the region make the most of supportive conditions.

It was quick to spot changes in investor sentiment through the year, helping financial issuers from Australia to South Korea access regulatory capital and allowing corporate clients to bolster their balance sheets with low-cost or perpetual funding.

HSBC took a leading role in the Additional Tier 1 market with a debut issue for Industrial Bank of Korea, a swiftly executed SEC-registered trade for Australia’s Westpac, and a tightly priced benchmark for Singapore’s United Overseas Bank, which came at the tightest reoffer spread for an AT1 in dollars.

It was also on the top line of Postal Savings Bank of China’s US$7.25bn capital raising, the largest single-tranche Asian US dollar issuance to date. Not only was it the biggest AT1 issue from a Chinese bank, but it also priced at one of the tightest yields.

HSBC extended that expertise to corporate issuers, bringing a wave of hybrids to the market to meet investors’ desire for yield. That enabled companies like Cheung Kong Properties and the Philippines’ Ayala Corp to print daring fixed-for-life perpetuals – an unlikely achievement in a rising rate environment.

HSBC leveraged its distribution strengths to bring issuers like China National Chemical Corp, Motherson Sumi Systems and UOB to the euro market, the latter with a bold dual-currency covered bond that paid virtually no new issue premium.

It won roles on significant sovereign issues, whether it was China’s rapturously received return to the US dollar market, Indonesia’s issue of the largest South-East Asian sukuk, South Korea’s successful 10-year print following its president’s impeachment, or Sri Lanka’s latest professionally executed dollar trade.

In Indonesia, HSBC was one of two global coordinators on Paiton Energy’s US$2bn dual-tranche project bond, the first such issue in Asia for many years, demonstrating that the bond market could be a viable financing avenue for infrastructure if deals were structured to meet investor needs.

It was equally comfortable arranging bond issues related to mergers and acquisitions, bringing trades in dollars and euros, respectively, for Sunac China Holdings and Bright Food Group.

Sunac was just one of the dozens of high-yield issuers to rely on HSBC to bring it to the offshore market. As Asian high-yield enjoyed a resurgence, the bank won repeat mandates as well as leading debut trades for issuers like Pan Brothers from Indonesia and the private equity vehicle Marble II in India.

Liability management became an important trend for issuers either addressing changes in their corporate structures or simply taking advantage of market conditions to cut their funding costs, and HSBC remained at the forefront. It helped Malaysia’s Sime Darby buy back and exchange its sukuk as part of a reorganisation into three companies, and allowed Tianjin Binhai New Area to address a potential technical default via a consent solicitation.

It showed commitment to Green and socially responsible bonds, a growing trend in Asia, working on ICBC’s dual-currency trade, the first from China to obtain both Chinese and international Green certification, as well as debut Green issues from DBS and Korea Development Bank. HSBC was sole strategic adviser when Hong Kong’s Castle Peak Power launched “energy transition bonds” to help fund its move away from coal to cleaner gas-fired generation.

On top of that, it comfortably topped the league table, booking US$33.8bn of league table credit for Asia ex-Japan from well over 200 deals and growing its total volume by 31% from a year earlier. It maintained clear water between itself and its rivals, despite growing competition, to achieve an 8.9% market share.

To see the digital version of this report, please click here