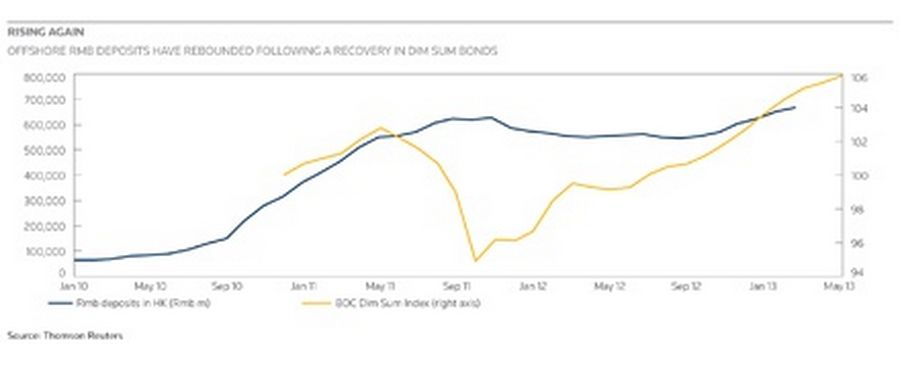

A rebound in offshore renminbi bond issues has signalled a rise in confidence among investors. Falling yields are again making the product more attractive versus onshore rates, but is the increased interest here to stay?

Despite some mild setbacks in 2012, the offshore renminbi bond market has had a robust start to this year. Overseas enthusiasm for the Chinese currency has surged in recent months on signs that the authorities have loosened their grip on the exchange rate. At the same time, the Dim Sum, or CNH, bond market has also proven to be more resilient and less volatile than many of its international counterparts.

It is also a growing market. The volume of new offshore renminbi bonds, excluding tenors shorter than one year, reached a new high of around Rmb80bn (US$12.7bn) in the first five months of 2013, a 27% jump from Rmb63bn in the same period last year. Analysts expect the yearly total to cross the Rmb200bn line from the Rmb159bn in 2012.

Although the Dim Sum market cannot realise its full potential until China is willing to open up its capital account, observers remain confident that the offshore debt capital market will keep developing in tandem with the currency’s gradual liberalisation.

Since July 2010, an growing number of Chinese and overseas banks and corporations have raised renminbi funding in the international markets, bringing the total outstanding Dim Sum bonds to nearly Rmb356bn, including short-term and long-term issues, as of May 20 2013.

CNH bonds now provide choices in terms of issuer types with a wide spectrum of investment-grade ratings and tenors amid improved secondary liquidity.

Meanwhile, Hong Kong renminbi deposits in March rose another 2.5% to Rmb668bn. Total renminbi remittance for cross-border trade settlement in Hong Kong grew to Rmb832bn in the first quarter of the year, already 31.6% of the Rmb2,633bn total for all of 2012.

While Hong Kong deposits represent a major part of CNH liquidity, trade settlement, corporate holdings, foreign inflows and hedging flows have helped to deepen the offshore renminbi pool.

HKMA’s helping hand

The removal of some major restrictions on the renminbi business in Hong Kong in April provided a huge boost to the CNH bond market. The Hong Kong Monetary Authority’s move levels the playing field with other would-be trading hubs elsewhere in the world, allowing Hong Kong to make the most of its home advantage.

The HKMA and the Treasury Markets Association announced a set of new measures on April 25, including removals of the net open position limit on banks’ renminbi positions and the 25% renminbi liquidity ratio requirement, as well as the launch of CNH Hong Kong Interbank Offered Rate fixing.

The relaxation of the regulations will allow banks to release more liquidity into the market, which, in turn, would support the CNH bond market and help pave the way for renminbi lending.

In particular, the development of CNH Hibor is seen as critical in the development of offshore derivatives, such as interest rate swaps, as well as floating-rate CNH bonds and bank loans. Analysts expect the availability of hedging tools to encourage more investors to hold CNH paper.

“(CNH Hibor fixing) should help improve liquidity and hedging options in the offshore currency market, encouraging further use for trade settlement. Trade settlement in renminbi should, in principle, help reduce the relentless increase in Chinese reserves, as foreigners become more willing to hold renminbi,” according to a Stratton Street report.

Rising interest

Despite the emergence of other renminbi-denominated products, such as ETFs, insurance and structured products, the CNH bond market remains the top parking place for offshore renminbi investors.

Liquidity has built up in various renminbi centres around the globe. Apart from Hong Kong, cities like London, Taiwan, Singapore, Paris, Frankfort and Sydney have also accumulated substantial renminbi pools. There has been evidence that some of the funds from those cities have flowed into the CNH market. For example, Taiwanese insurers were major supporters of China Development Bank’s 15-year CNH bonds.

While maintaining a low profile, a growing number of central banks and sovereign wealth funds have shifted assets to include renminbi-denominated paper in their reserves, at least, in part, a response to uncertain outlooks for the euro and US dollar.

“We have noticed rising CNH liquidity from a broader base of international investors who are looking opportunities to diversify their portfolios in terms of currencies and credits,” said Jon Pratt, head of Asia Pacific debt capital markets at Barclays.

Dim Sum bonds have attracted average weekly inflows of US$73m so far this year, according to HSBC.

“In April, offshore renminbi bonds continued to attract firm fund flows and beat Asian US dollar counterparts on total return,” said HSBC analysts in a research report. “FX contributed to around 60% of the former’s gain. However, we expect the FX contribution to moderate in the coming months.”

Expectations of currency gains remain an important factor, but much less so than in the first few years of CNH bond market.

Bank of America Merrill Lynch expects CNH to appreciate gradually against the US dollar, gaining 6.05% by year’s end. Barclays puts the 2013 number at 6%.

More corporate issuers, fewer foreigners

One recent phenomenon is the dominance of Chinese corporate issuers in this year’s roster of new issues. This year, 16 have come to the CNH market, double the number in the same period last year. Among them, a rising number of property developers have found the Dim Sum market an attractive source of funding, supplementing their limited access to onshore funds and offering a relatively cheaper alternative to the US dollar market.

Even large state-owned enterprises have found a better reception for their CNH bonds. This is a sign that overseas investors are becoming more comfortable with SOE structures than they were last year. State relationships have played a big part in both rated and unrated deals, as more investors come to view solid government connections as more important to doing businesses in China.

However, only two foreign issuers – both financial institutions – have visited the CNH market this year. The major culprit is the one-sided cross-currency swap market, where three-year rates have dropped sharply from the high of 2.5% last year to a low of 1.5% for the same tenor in the first quarter of this year.

That move has eliminated the benefits of issuing in CNH for many issuers seeking to swap the proceeds into another currency, pushing many potential foreign issuers to the sidelines.

“Most multinationals in China are usually well capitalised. So, unless the swap position changes dramatically, there will not be many high-grade foreign issuers tapping CNH and then swapping to other currencies,” said a banker familiar with foreign issuers.

Still, the CNH market is unlikely to be short of issuers. Sovereign issuers, including China’s Ministry of Finance, global emerging-market names, Asian corporate issuers and Chinese industrial companies, are all heard to be working on new deals, while China is poised to agree on new quotas for big SOEs looking to issue CNH paper in Hong Kong.

To add to that, more than Rmb89bn of CNH bonds, including short-term and long-term paper, will mature before the end of 2013, and another Rmb136.7bn falls due in 2014. Refinancing alone will provide a steady supply of new Dim Sums in the next two years.

New RQFII

Market watchers, however, are especially upbeat about the Dim Sum market’s prospects following a May 2 revision to China’s renminbi qualified foreign institutional investor, or RQFII, programme. After a pause in RQFII approvals, the measures made clear that investments foreign funds could make in China’s renminbi markets, and mark a further step in the PRC’s opening of its capital markets.

A week after that, three funds won a combined Rmb5bn RQFII quota, for China Asset Management (HK) (Rmb2bn), CSOP Asset Management (Rmb2bn) and E Fund Management (Rmb1bn). The market expects more RQFII quotas to be released shortly. China raised RQFII quotas to a total of Rmb200bn in November from Rmb70bn for the previous pilot scheme.

As RQFII quotas increase the flow of capital across China’s borders and allow investors to buy both onshore and offshore assets, CNH bond market players are excited that new money may be on the way.

However, the RQFII scheme can be a double-edged sword. When the onshore interest rates go up, the RQFII managers may move their money onshore in search of higher yields, selling offshore holdings in the process. That brings a risk that CNH liquidity may be drained and offshore yields move closer to their onshore equivalents.

Most market players, however, seem unconcerned at the moment. The initial RQFII scheme was not very well received because most related funds offer moderate yields, but high transaction fees, which deterred investors to some extent.

To see the digital version of this report, please click here.