The record listing of the Bangkok SkyTrain infrastructure trust has underlined Thailand’s potential to become one of the region’s most active equity capital markets. Demand for yield-based instruments remains strong despite a change in global sentiment.

Source: Reuters/Sukree Sukplang

A Bangkok Mass Transit System (BTS) skytrain station is pictured under construction on the outskirts of Bangkok.

An increase in IPOs from infrastructure and property funds is expected to spice up Thailand’s equity capital markets as major companies expand their businesses and investors prefer yield instruments.

“There was pent-up supply in the market after the 2011 floods reduced capital market activity. Companies are now looking to implement their expansion plans,” said Vorada Thangsurbkul, executive vice president and head of investment banking at Siam Commercial Bank.

The numbers speak for themselves. Equity issuance from Thailand totalled Bt80bn (US$2.6bn) in the first four months of 2013, compared with Bt51bn in all of 2012. The Thai stock market was one of the best performing markets in Asia in 2013, before recent stock-market volatility wiped out all those gains.

Investor demand for yield instruments has encouraged telecom, transportation and power companies to consider infrastructure fund IPOs, and real estate companies to launch property funds.

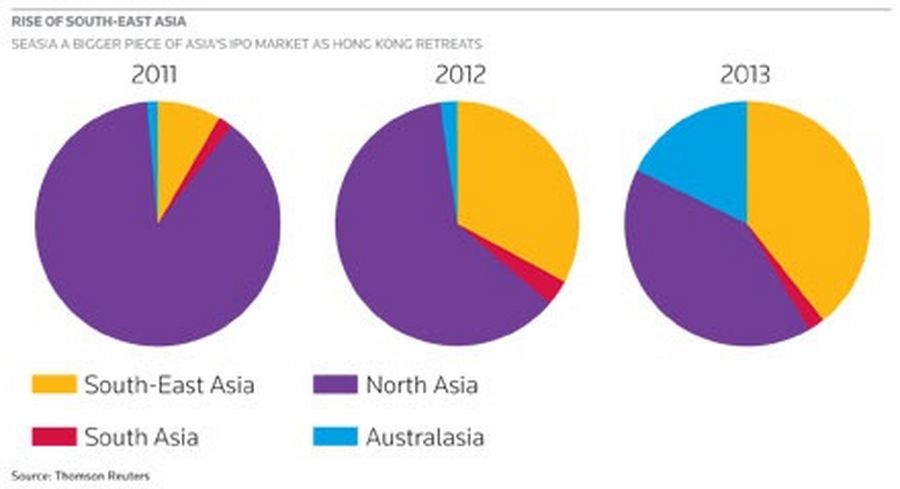

“Many South-East Asian countries want to emulate the success of Singapore in deepening its stock market with the listings of business trust and real estate investment trusts,” a source said.

Companies are also able to price trust issues at a premium because, at present, they are very popular.

Raising capital through trust structures has other advantages for issuers. For example, BTS Group, which listed Thailand’s first infrastructure fund earlier this year, said the fund was the better option because “debt financing will significantly increase the company leverage, while an equity offering will significantly dilute the control and economic benefit of existing shareholders”.

In March, BTSGIF’s 3.86bn-share IPO raised Bt41.7bn, excluding the sponsor tranche, after pricing at Bt10.80 per unit. The final price implied a yield of 5.8%.

International demand for the offer, the largest Thai IPO ever, was strong with 19 cornerstone investors buying 2.33bn units. The cornerstone investors included Capital Research, AIA Group, JF Asset Management and Morgan Stanley Investment.

Morgan Stanley, Phatra Securities and UBS were the bankers for the IPO.

Telecom operator True Corp is planning an up to US$1bn IPO in late 2013 or early 2014. It has mandated Credit Suisse and UBS as the bankers. Power developers Amata B Grimm and SPCG are also planning infrastructure fund IPOs of up to Bt6bn and Bt5bn, respectively. The IPOs are likely to be launched towards the end of 2013.

Crystal Retail Growth Property Fund recently sold 390m units at Bt10.6 each, totalling Bt4.1bn. The offer price implied a 7% yield for 2014.

Another property fund, Sri Panwa Freehold Property Fund, plans to sell 200m units at Bt10 each, amounting to Bt2bn at a 7% yield. Subscription is likely to open in the first week of July. Siam Commercial Bank is the sole bookrunner on these property fund IPOs.

Bankers are confident that the northward move in interest rates will not derail the IPO pipeline. SCB’s Vorada said the yields have moved up for securities at 10 years and beyond, but not much in the one-year to five-year bracket, indicating that trust and property funds do not have to pay much more then they had in the recent past.

Vorada said SCB is confident of meeting its target of launching equity offerings totalling US$1.5bn in 2013. So far the bank has launched deals totalling US$360m.

Funds are not the only IPO issuers.

Power company CK Power is expected to launch its up to Bt4bn IPO in the last week of June; Amata VN’s Bt5bn 139.8m-share IPO is being readied for a July launch and Bangkok Airways’ up to US$300m IPO is scheduled for the second half.

Asia Plus, Bualuang Securities, KT Zmico and Siam Commercial Bank are the joint lead managers of the CK Power IPO while SCB and OSK Securities are the bankers to the Amata VN IPO. Citigroup, Credit Suisse and DBS are involved in the Bangkok Airways IPO.

To see the digital version of this report, please click here.